Embed presentation

Download to read offline

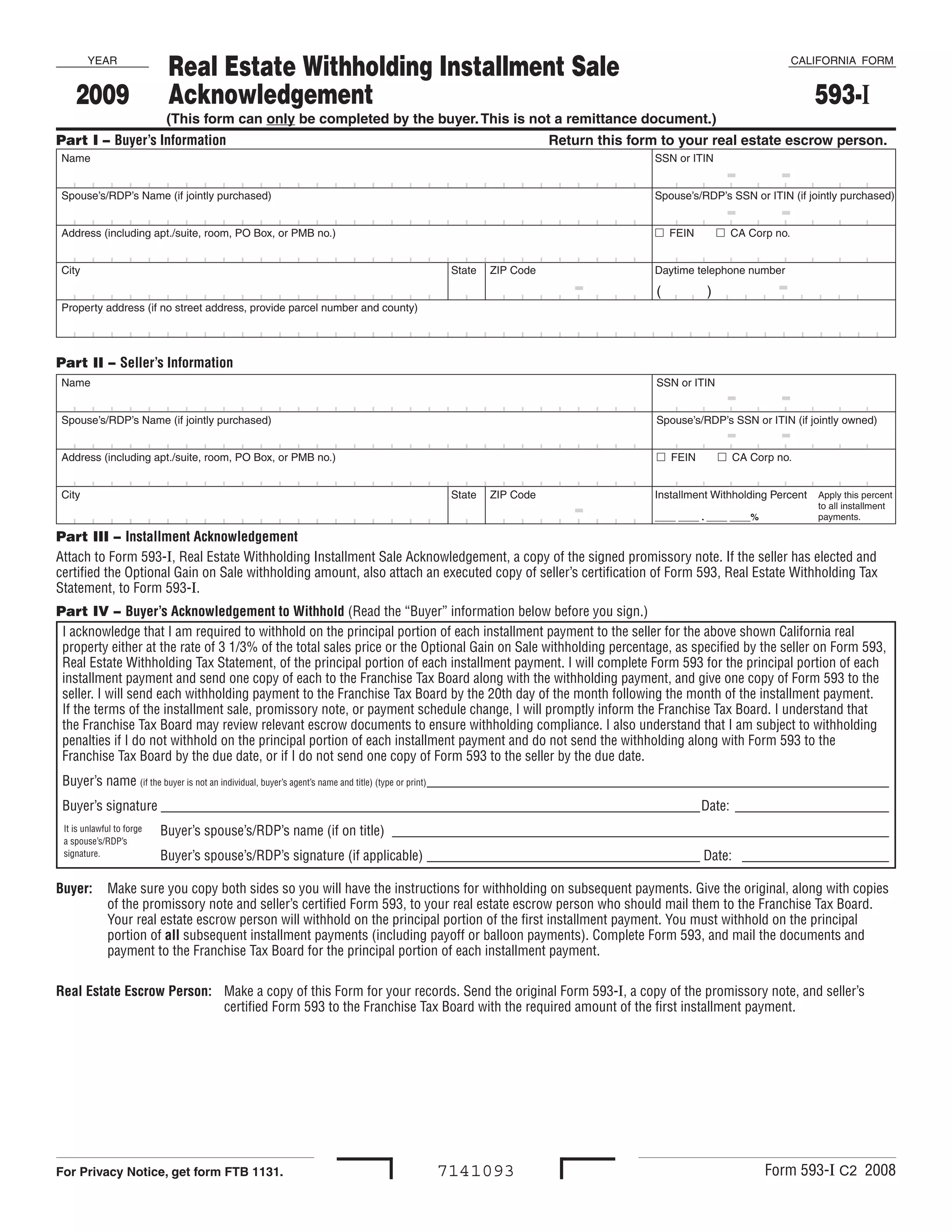

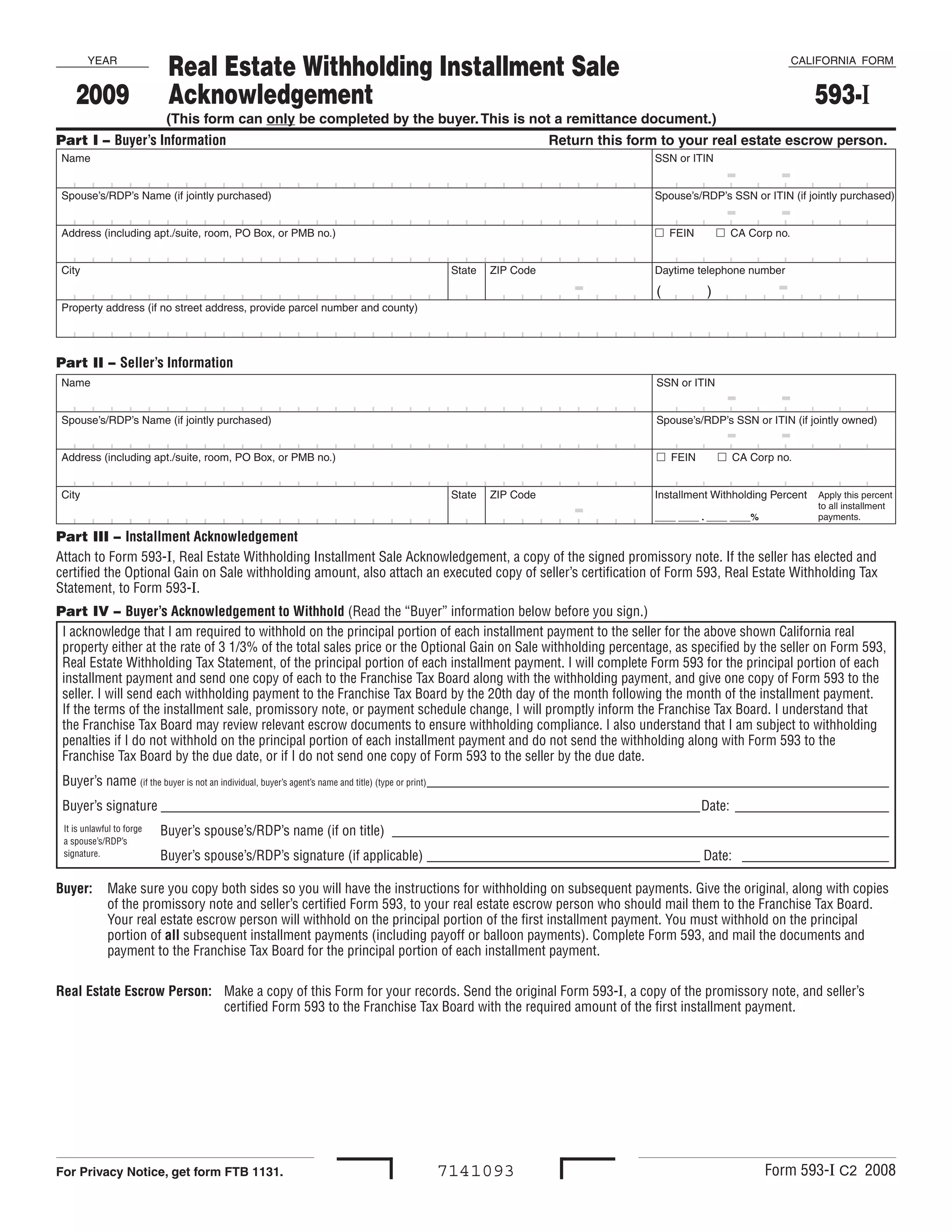

This document provides instructions for California real estate withholding on installment sales. It explains that for tax years beginning on or after January 1, 2009, the buyer is required to withhold taxes on the principal portion of each installment payment for properties sold via an installment sale. The form guides the buyer through providing their contact information, the seller's information, acknowledging the withholding requirement, and signing to indicate they understand their obligation to withhold taxes and send payments to the state. Escrow agents are instructed to send the initial withholding amount to the state and provide copies of documents to help facilitate ongoing withholding as future installment payments are made.