Embed presentation

Download to read offline

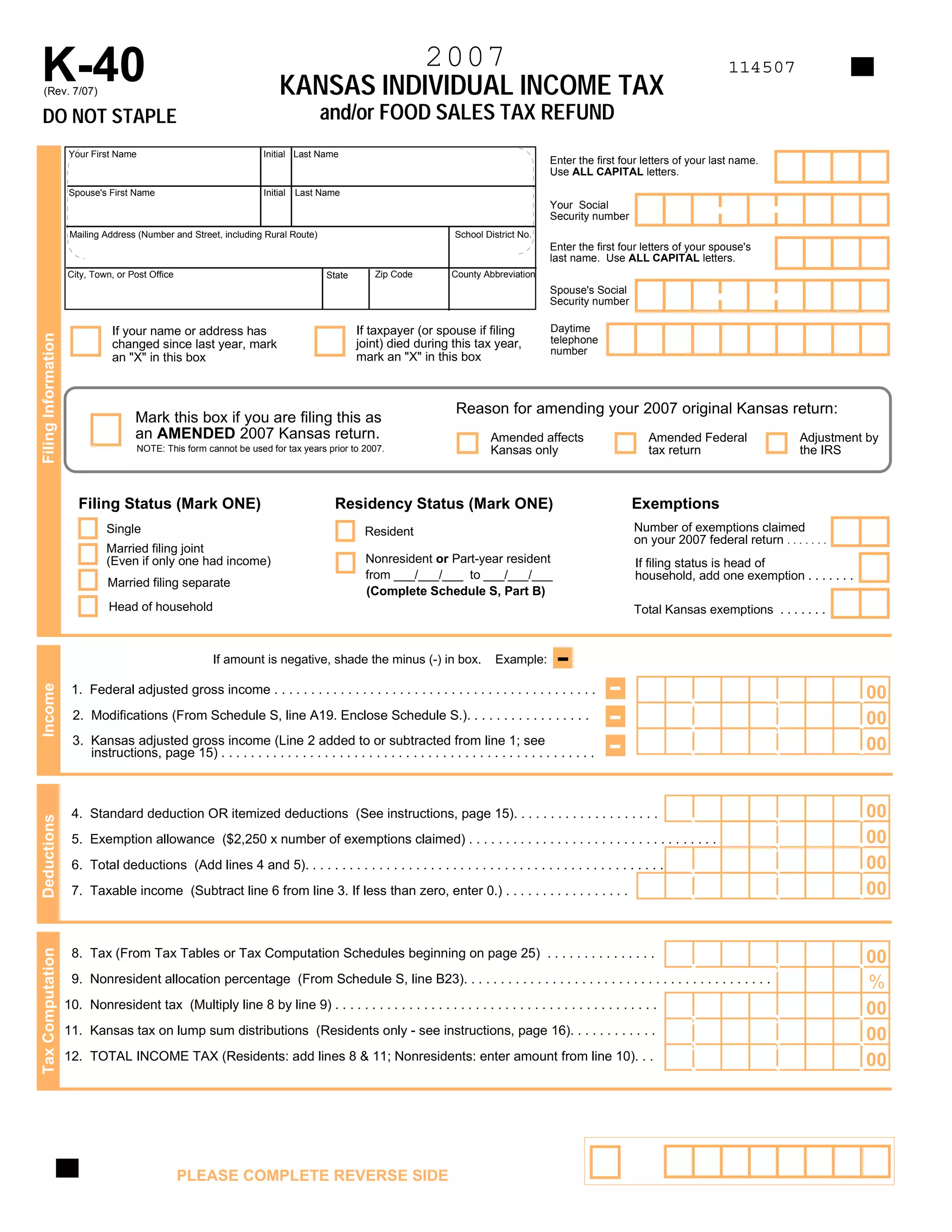

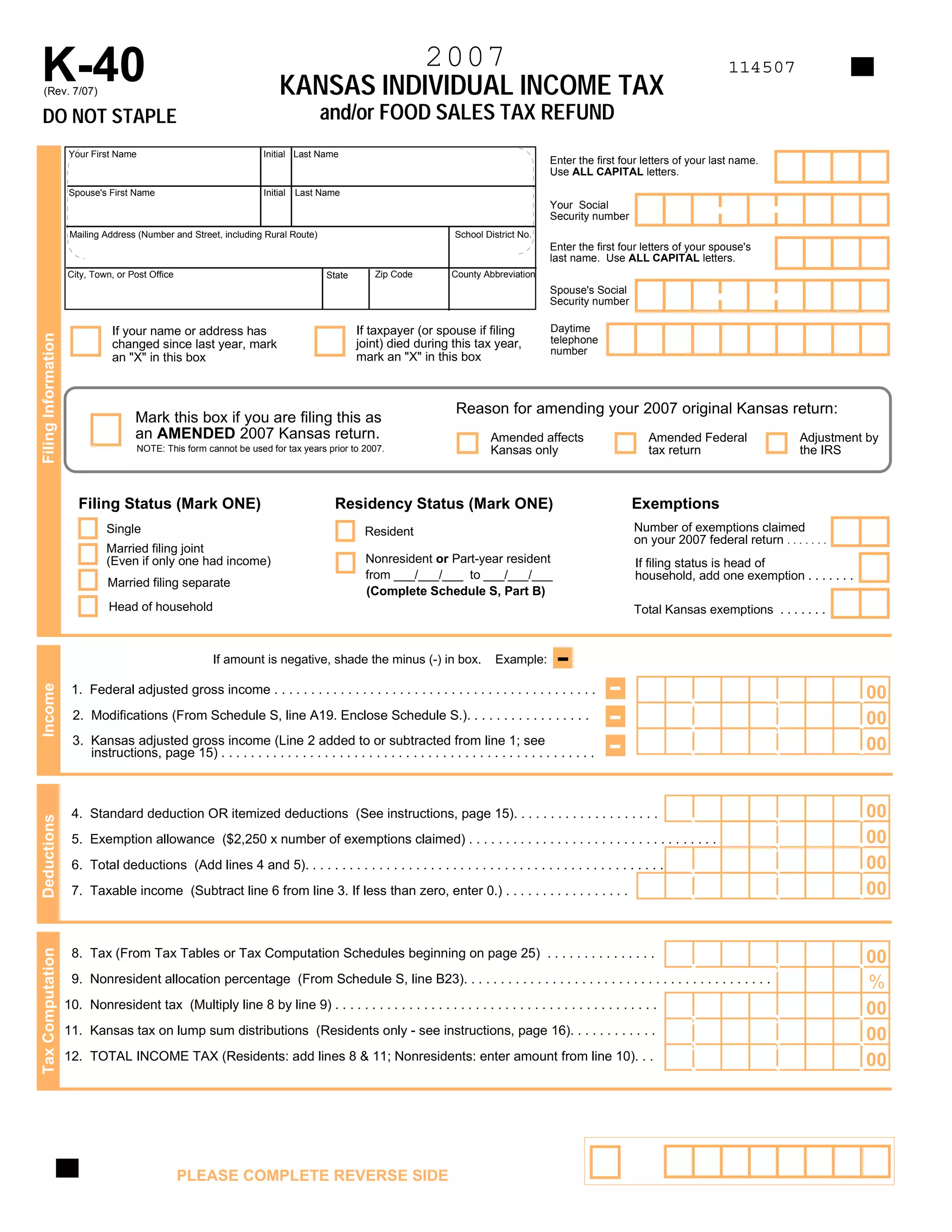

This document is a Kansas individual income tax return form for tax year 2007. It requests information such as names, addresses, filing status, income, deductions, credits, payments and the amount of refund or taxes owed. The multi-page form includes sections to report federal adjusted gross income, Kansas adjusted gross income, exemptions, tax computation, credits, withholdings and estimated payments, donations to charitable programs, and signatures.