Embed presentation

Download to read offline

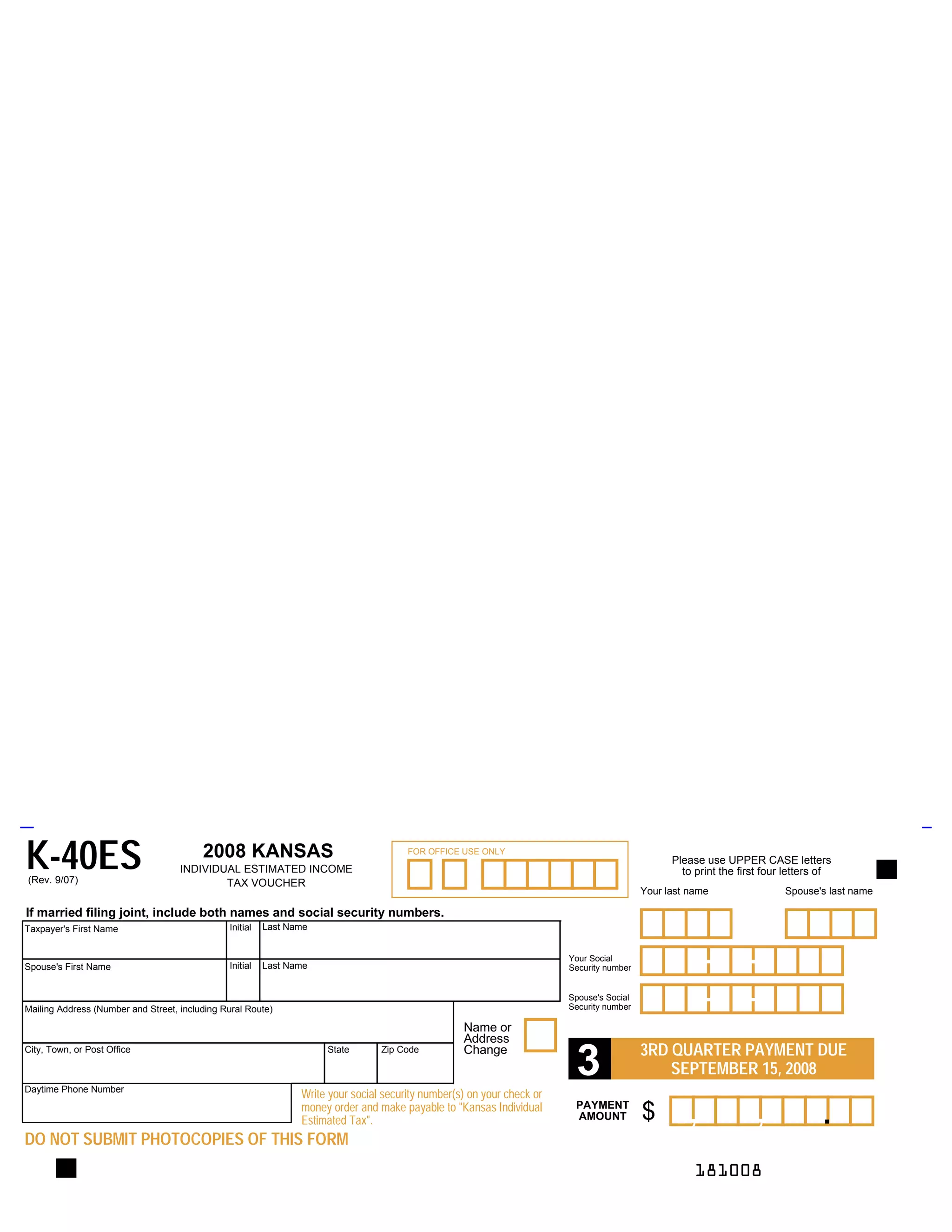

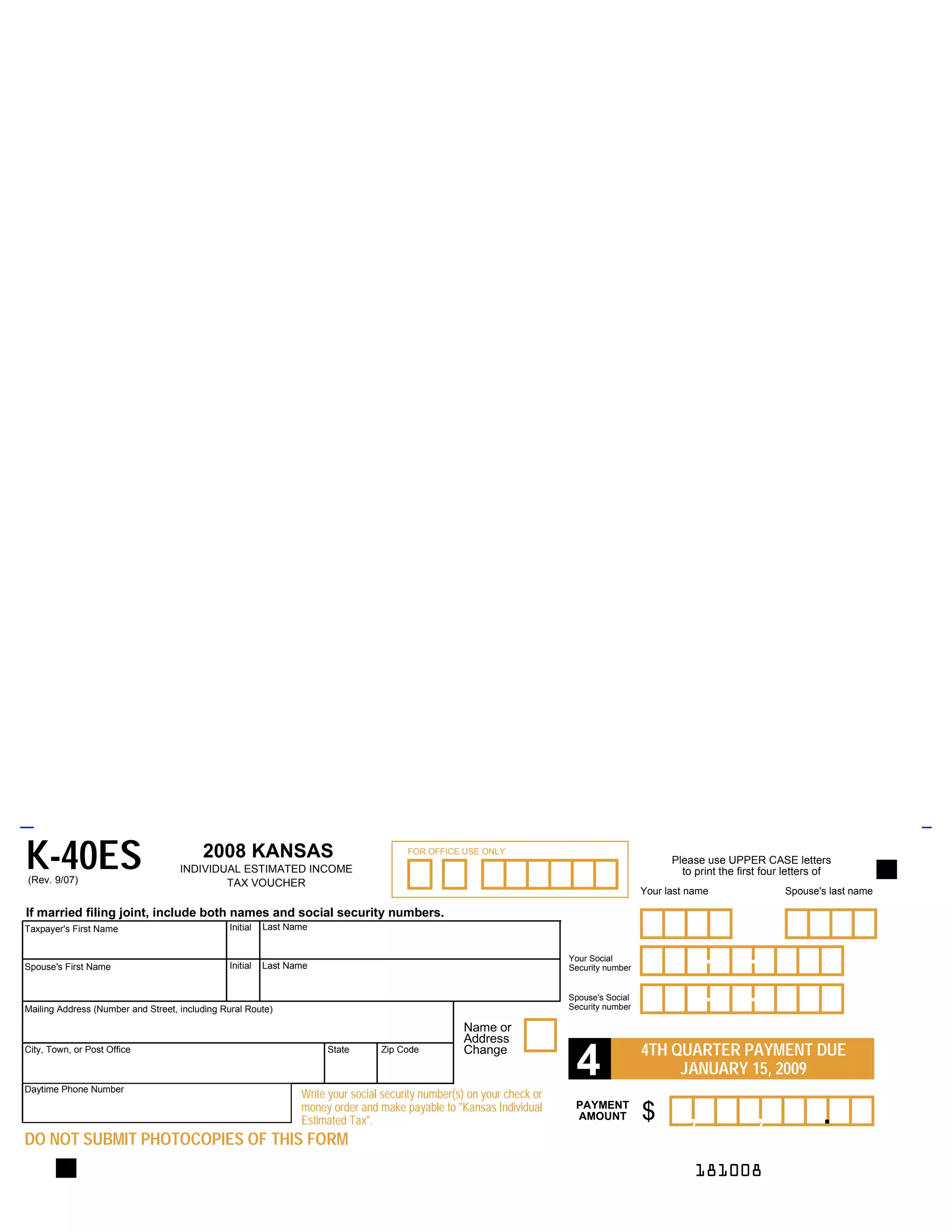

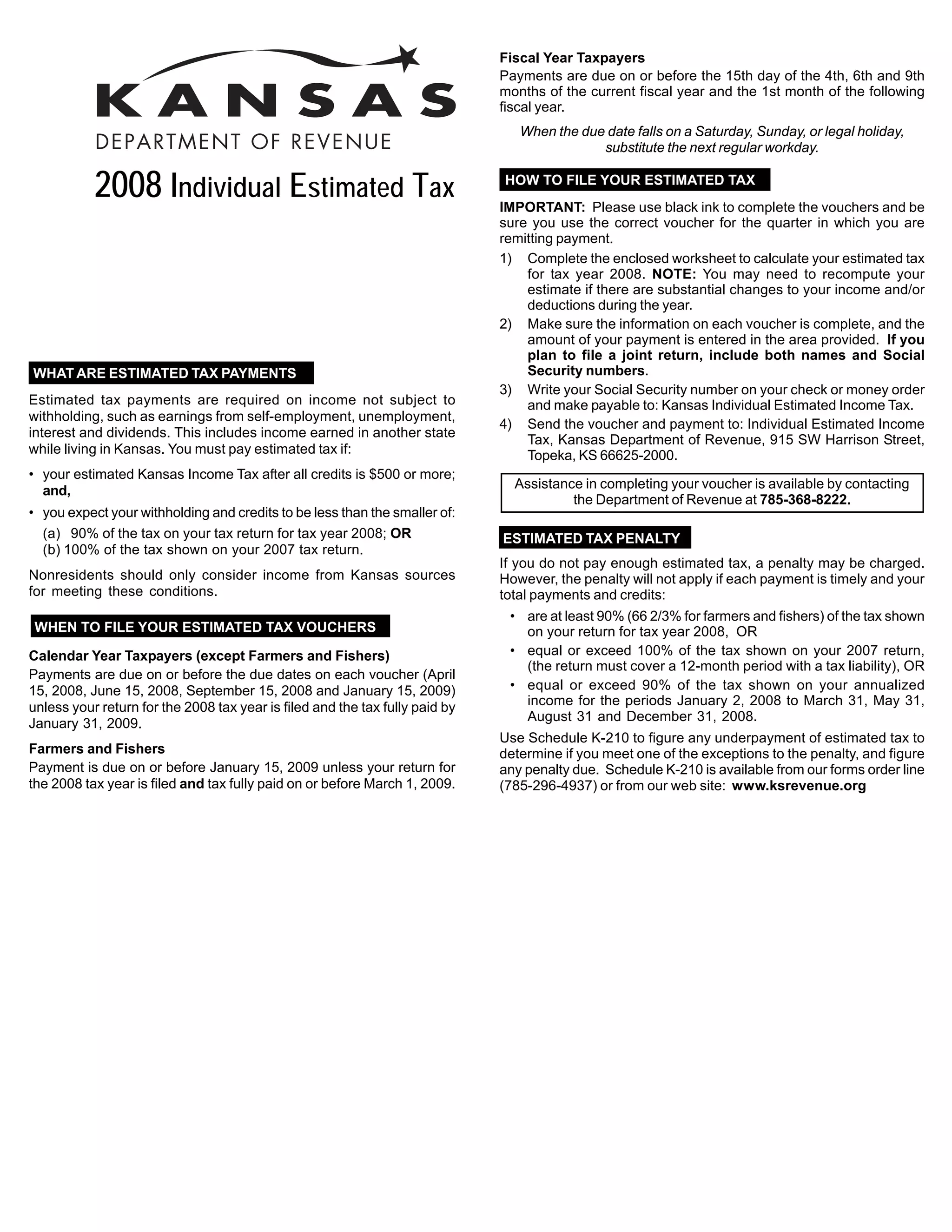

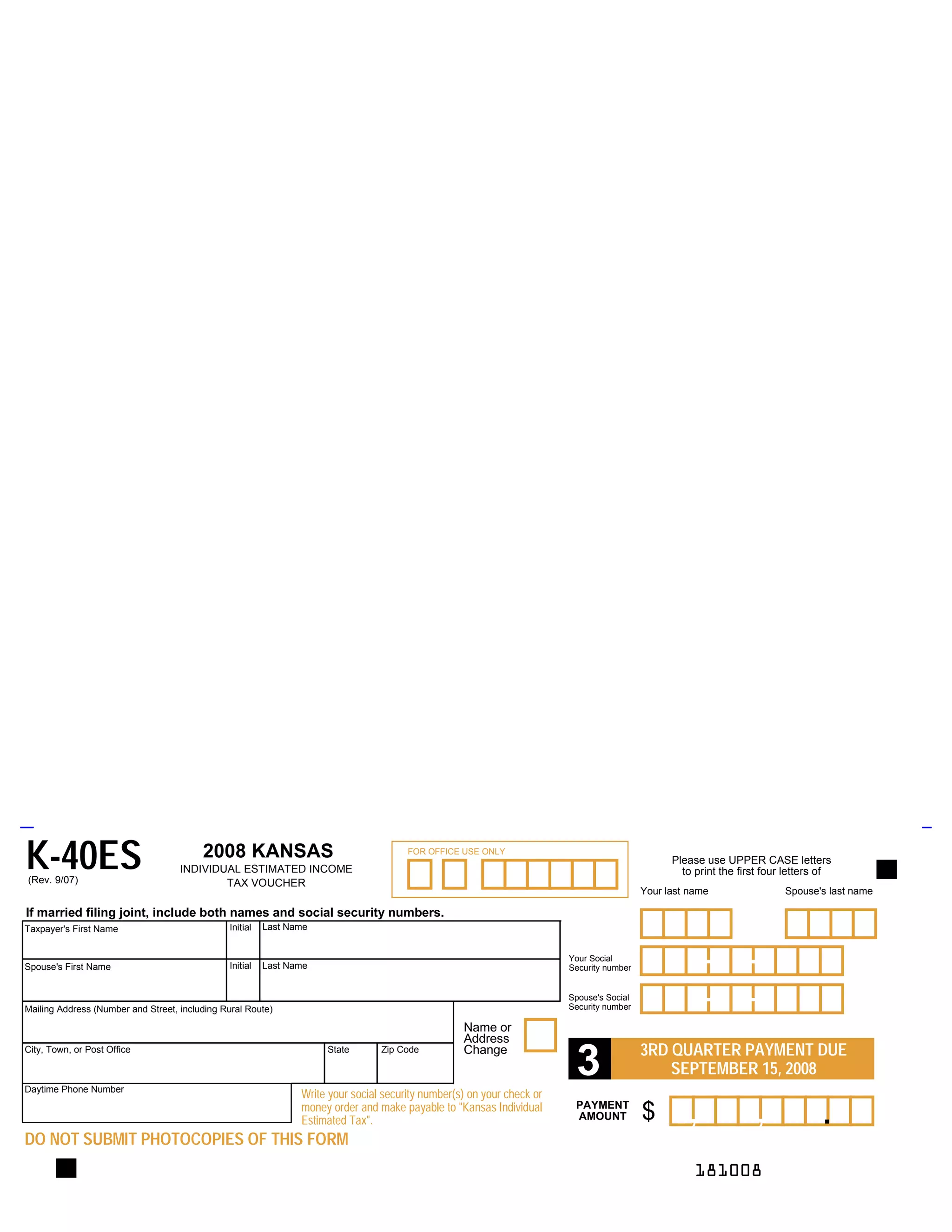

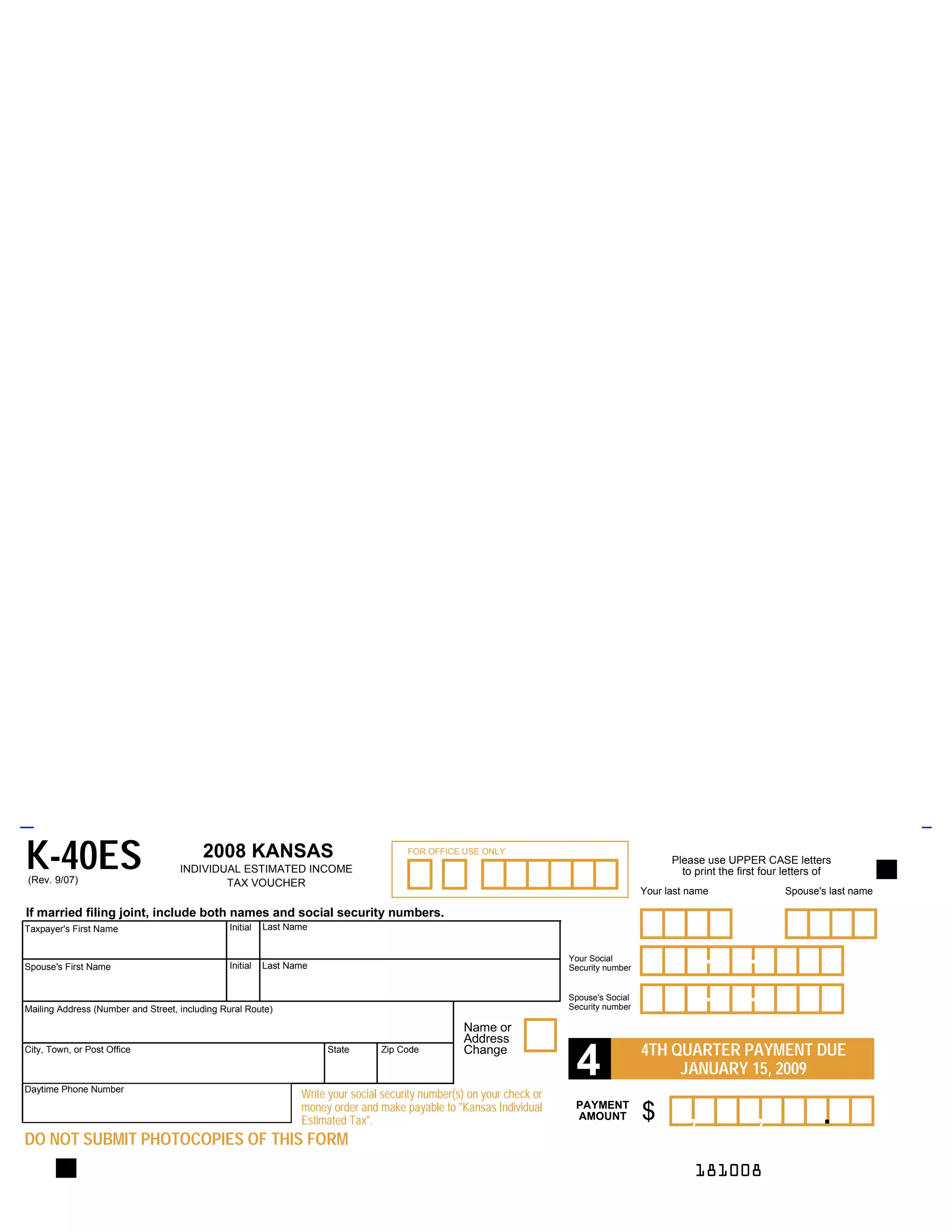

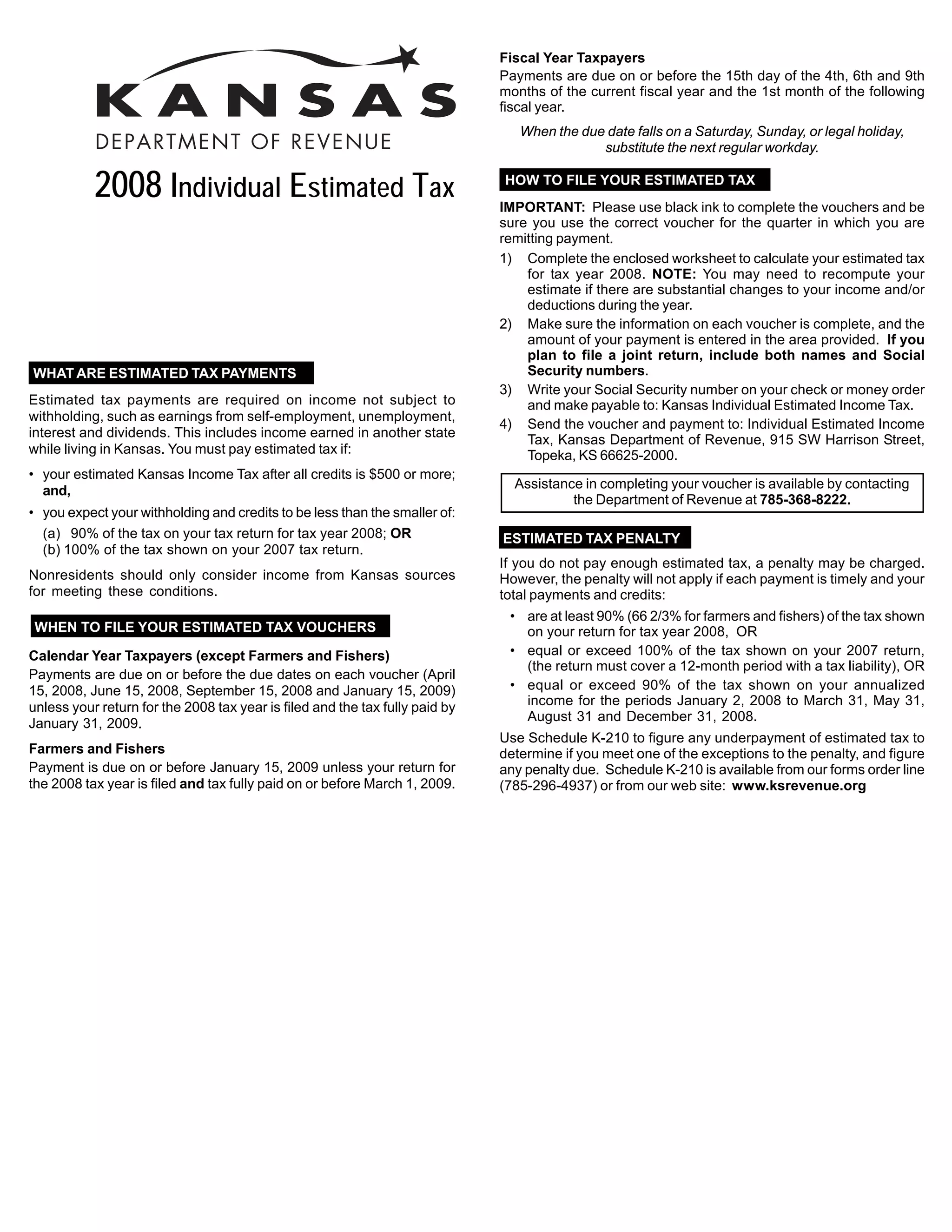

This document is a Kansas individual estimated income tax voucher for 2008. It contains instructions and payment coupons for taxpayers to make estimated tax payments on April 15, 2008 for the first quarter and June 15, 2008 for the second quarter. The voucher requests the taxpayer's name, address, social security number, and payment amount to write on their check or money order, which should be made payable to "Kansas Individual Estimated Tax".