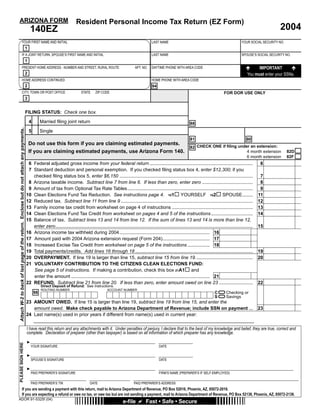

This document is an Arizona state personal income tax return form from 2004. It contains fields for the filer's personal information like name, address, social security number, as well as financial information like income, deductions, credits, payments made and the amount of refund or taxes owed. The form provides instructions for calculating tax liability and contains boxes to check filing status and extensions. It must be signed by the filer and preparer if applicable to declare information is true under penalty of perjury.