Embed presentation

Download to read offline

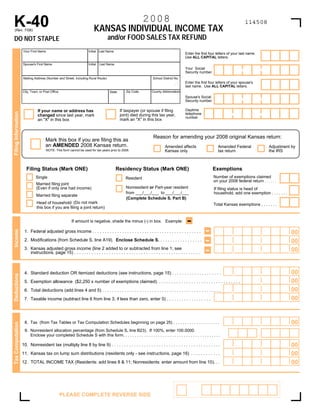

This document is a Kansas individual income tax and food sales tax refund form for tax year 2008. It contains instructions for filing an original or amended tax return. The form includes sections to report income, deductions, exemptions, tax credits, payments, withholdings, refunds or balances due. It also provides options to donate refund amounts to charitable programs or carry over credits to the next year's estimated taxes.