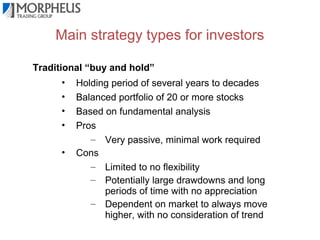

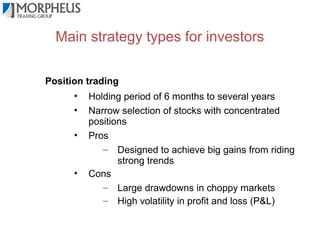

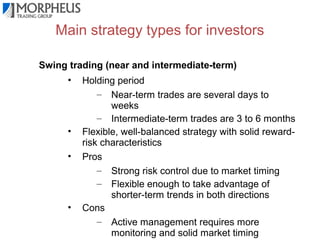

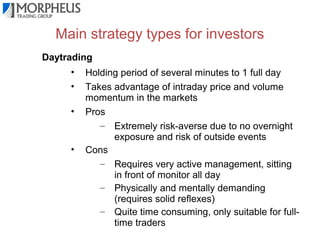

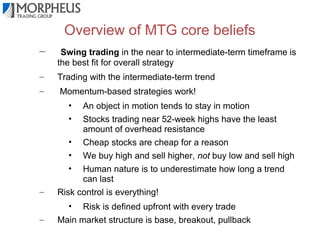

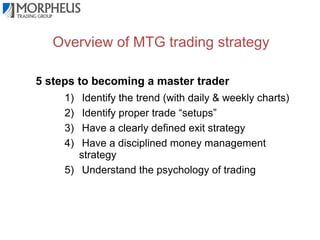

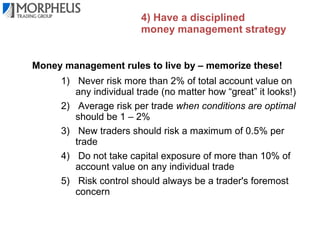

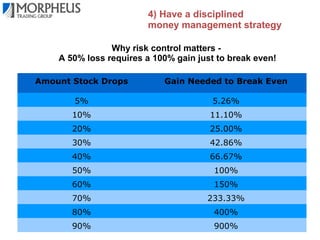

This document outlines different trading strategies and provides an overview of a swing trading strategy called Morpheus Trading (MTG) that aims to take advantage of momentum in the markets. The MTG strategy involves identifying the intermediate-term trend using daily and weekly charts, looking for proper trade setups with a breakout and pullback pattern, having a clear exit strategy, disciplined risk management by limiting losses to 1-2% per trade, and understanding how emotions like greed, fear and hope influence market movements. The strategy aims to "buy high and sell higher" by purchasing stocks trading near 52-week highs rather than bargain hunting for cheap stocks.