2Q 2019 Results

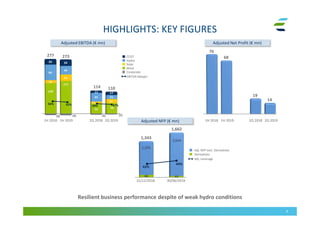

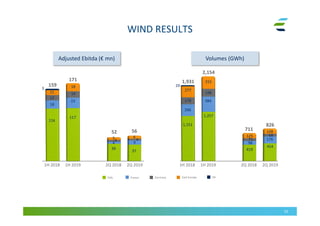

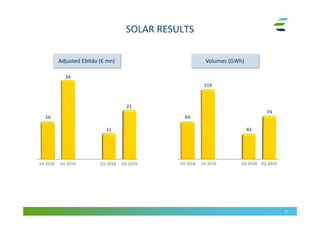

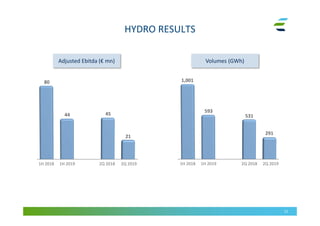

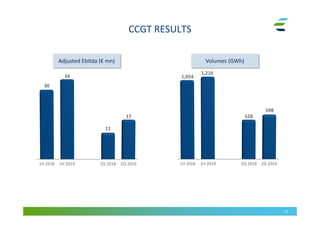

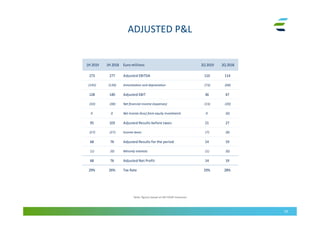

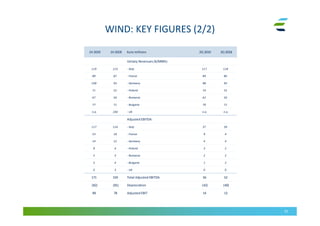

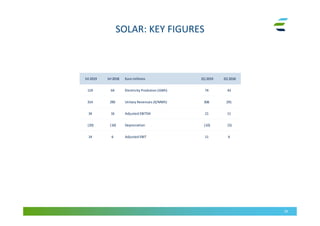

- Adjusted EBITDA was €110 million, down slightly from €114 million in 2Q 2018.

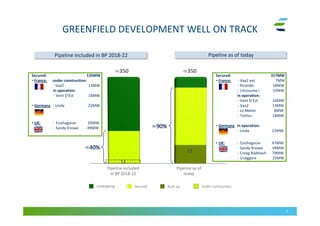

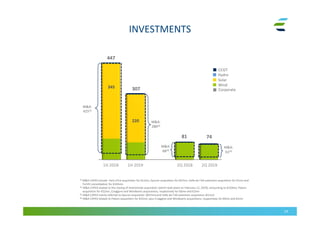

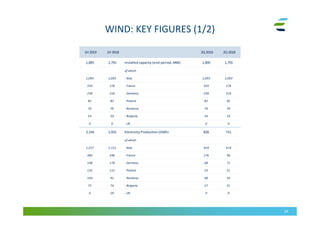

- Greenfield development pipeline remains on track at approximately 350MW.

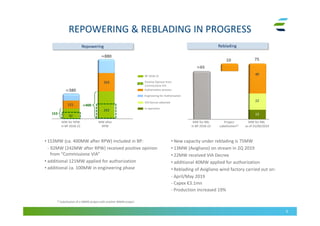

- Repowering and reblading projects are progressing with additional capacity in the authorization and engineering phases.

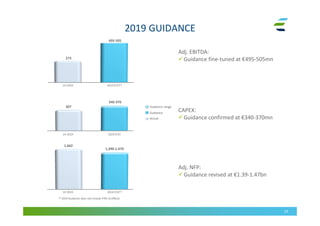

- 2019 guidance was fine-tuned with an Adjusted EBITDA range of €495-505 million and Adjusted NFP revised to €1.39-1.47 billion.