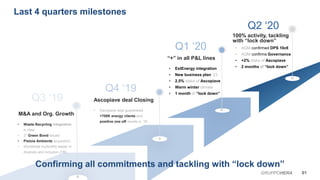

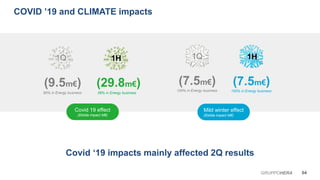

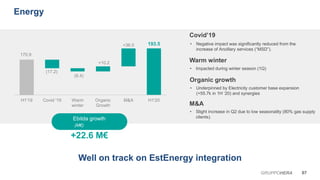

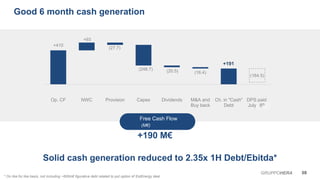

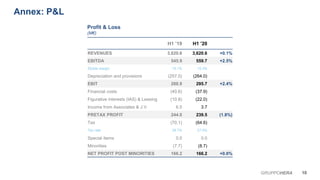

H1 2020 financial results showed solid resilience during the COVID-19 lockdown period. EBITDA increased 2.5% to €559.7 million driven by organic growth and M&A activity, despite negatives from warm winter weather and COVID-19 impacts. Good cash generation reduced net debt to EBITDA ratio to 2.35x. All business lines showed growth with the energy business performing well on EstEnergy integration and increasing customer base.