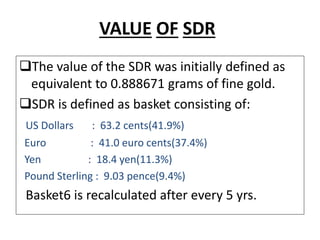

SDRs are international reserve assets created by the IMF to supplement the official reserves of its members. They can be exchanged for freely usable currencies. The value of SDRs is determined by a basket of currencies and is used by IMF members engaging in transactions and for determining interest rates on SDR holdings. While SDRs help improve international liquidity and stability without reliance on gold, some criticize their inequitable distribution and failure to meet liquidity needs or promote development.