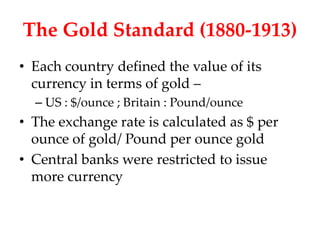

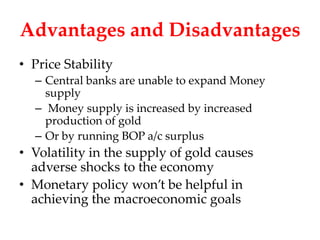

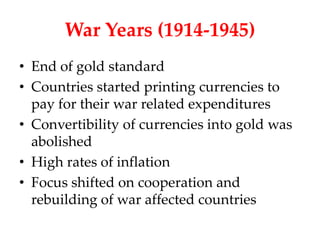

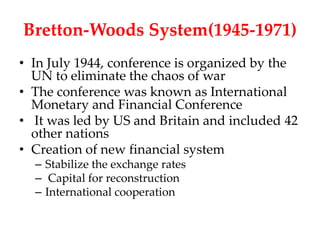

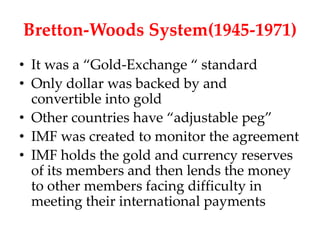

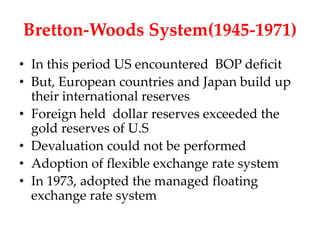

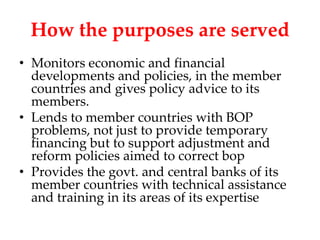

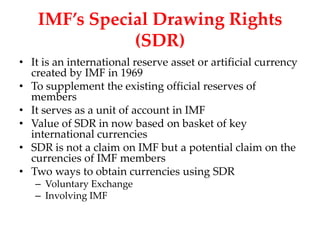

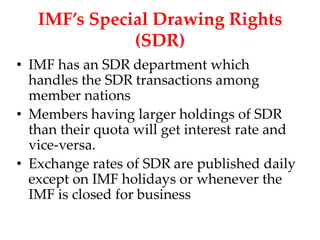

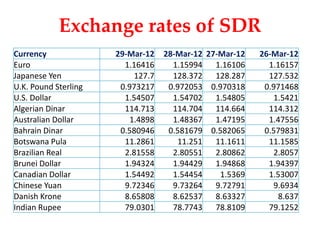

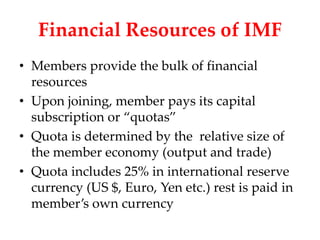

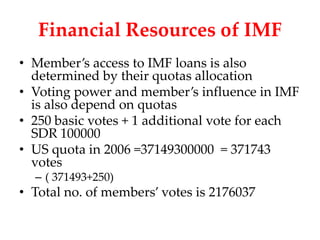

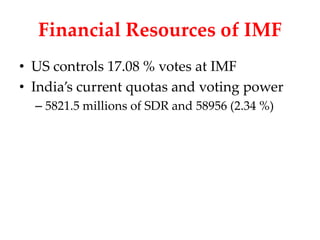

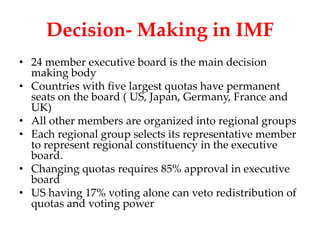

The document summarizes the evolution of international monetary systems from the gold standard era to present day. It describes the Bretton Woods system established in 1944 which created the IMF and established a US dollar-gold standard. It then discusses the collapse of Bretton Woods in the 1970s and adoption of floating exchange rates. It provides details on the IMF's purposes, resources, lending practices, and decision making structure dominated by wealthy member states.