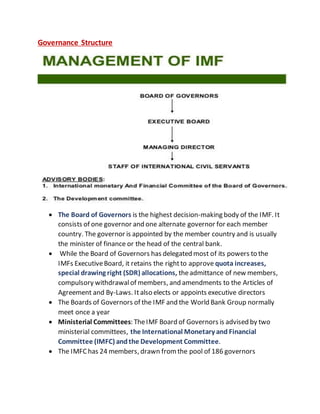

The International Monetary Fund (IMF) is an organization of 186 countries that works to foster global monetary cooperation and financial stability. The IMF provides policy advice, financing, research, and technical assistance to member countries to help them achieve macroeconomic stability and reduce poverty. The IMF monitors the global economy, provides early warnings of economic problems, and acts as a forum for policy discussions among member countries.

![INTERNATIONAL MONETARY FUND [IMF]

The International Monetary Fund(IMF) is anorganizationof 186

countries, working to foster globalmonetary cooperation, securefinancial

stability, facilitate international trade, promote high employment and

sustainableeconomic growth, and reducepoverty around the world.

The IMF works to foster global growth and economic stability.

Itprovides policy advice and financing to members in economic difficulties

and also works with developing nations to help them achieve

macroeconomic stability and reduce poverty.

The IMF tracks global economic trends and performance, alerts its member

countries when it sees problems on the horizon, provides a forumfor policy

dialogue, and passes on know-how to governments on how to tackle

economic difficulties](https://image.slidesharecdn.com/internationalmonetaryfund-200816125238/75/International-monetary-fund-1-2048.jpg)