This document provides an overview of key functions in the accounts receivable module in SAP, including:

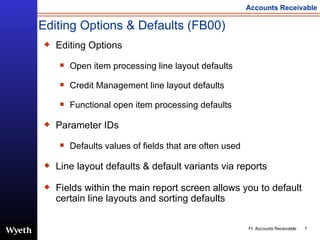

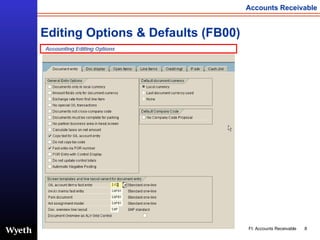

1) Editing options and defaults that can be set for open item processing and credit management.

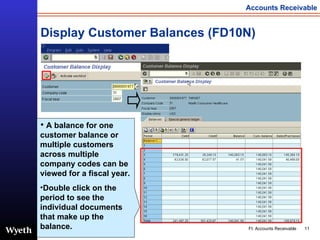

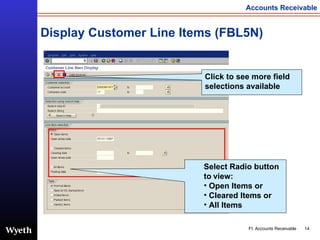

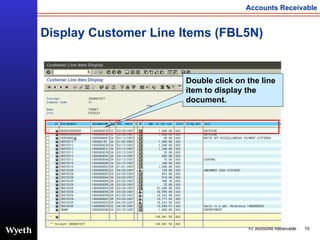

2) Customer line item management and open item management, including displaying line items and balances.

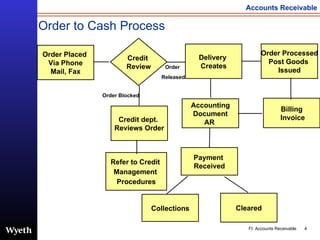

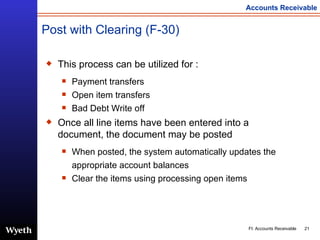

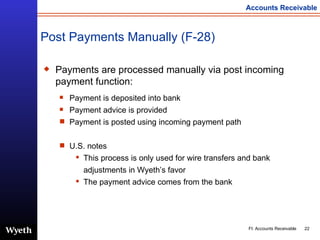

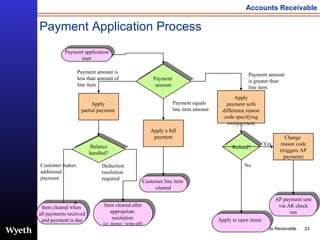

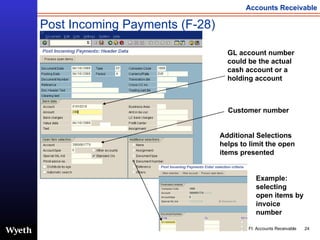

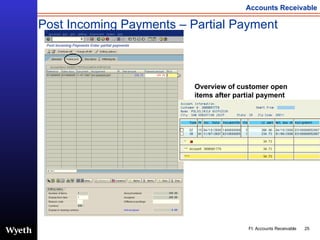

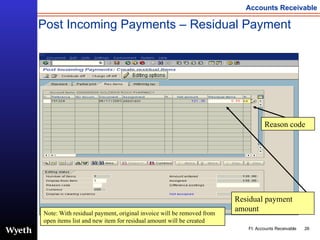

3) Processing open items by clearing customers, posting with clearing, or posting incoming payments manually.

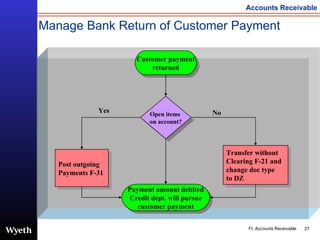

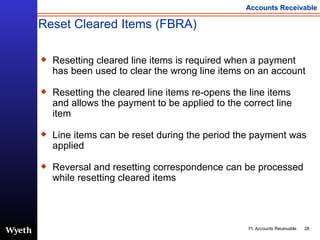

4) Handling bank returned payments and resetting cleared items.

5) Posting transactions without clearing, for transfers or other receivables.