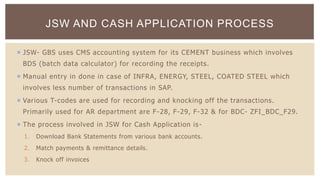

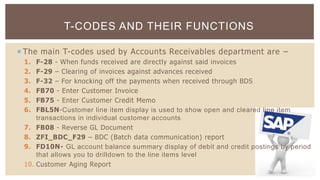

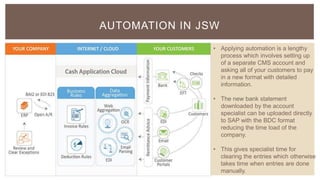

The document outlines the cash application process of JSW Group, detailing how incoming payments are matched to customer invoices to reduce accounts receivable, employing both manual and automated methods. It emphasizes the importance of efficient cash application for improving visibility, reducing resolution time, and highlights challenges such as customer payment practices and internal processes. The document also discusses the benefits of automating the cash application process, including cost savings and the ability to focus on higher value tasks.