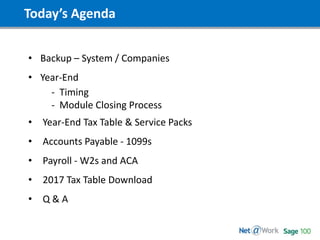

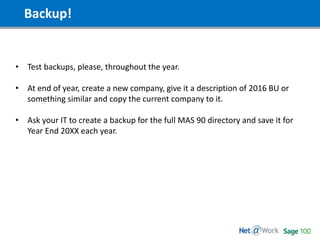

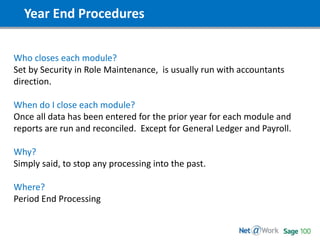

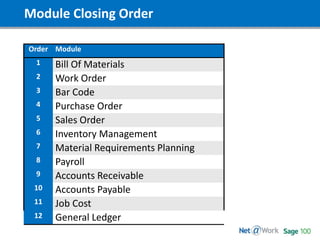

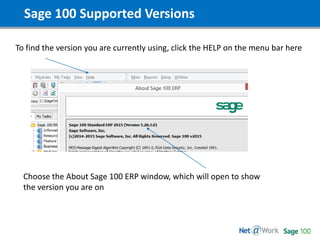

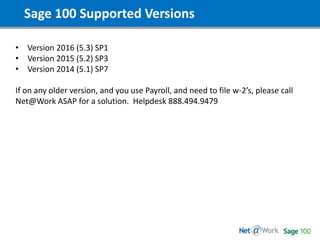

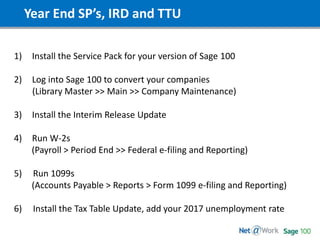

The document summarizes key information for a webinar on year-end procedures in Sage 100. It discusses backing up data, closing modules in a specified order, installing service packs and tax updates, running 1099 and W-2 forms, and important websites for tax information. The webinar covers year-end tasks for various modules like accounts payable, payroll, and general ledger to prepare for the new year.