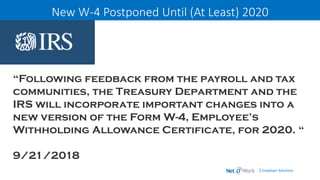

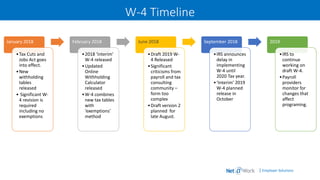

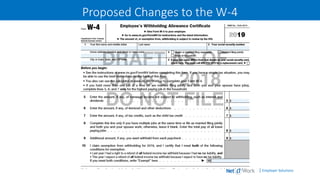

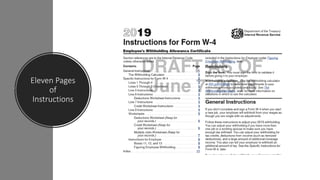

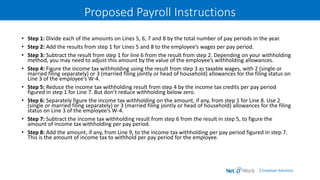

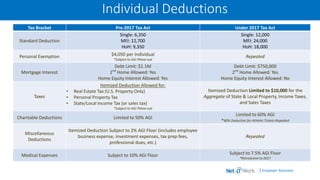

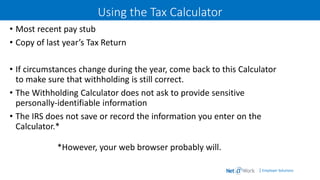

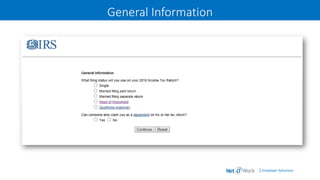

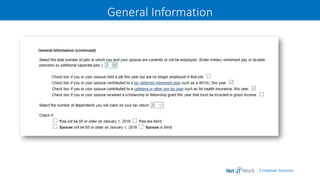

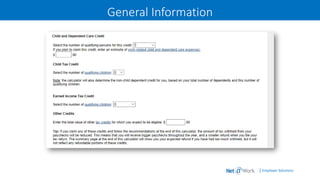

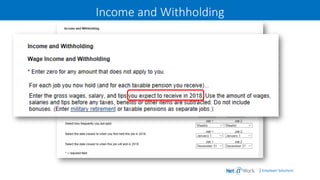

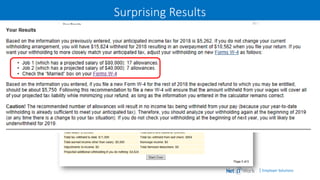

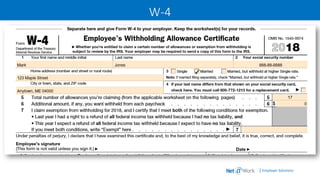

This webinar discussed changes to the W-4 form that will take effect in 2020. The proposed 2019 W-4 was very complex with 11 pages of instructions, so it has been postponed. Modest decreases in federal income taxes are possible for some employees under the new tax law, so payroll departments should encourage employees to use the IRS payroll calculator to ensure accurate tax withholding. The presentation concluded by noting resources payroll professionals can use to stay up to date on the W-4 changes.