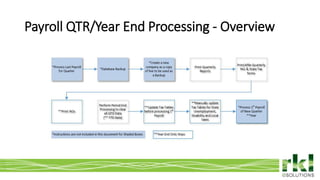

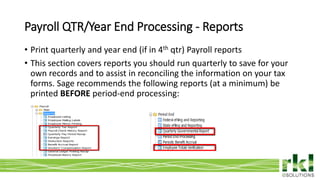

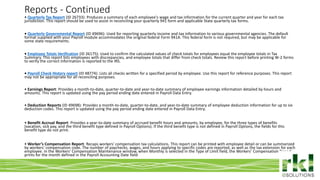

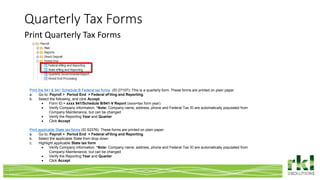

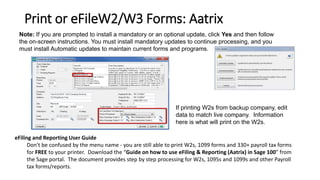

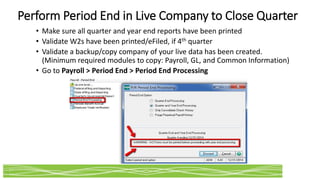

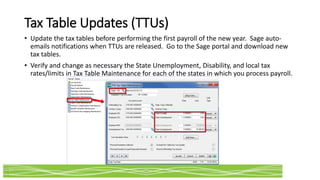

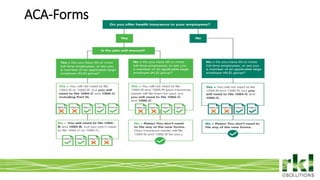

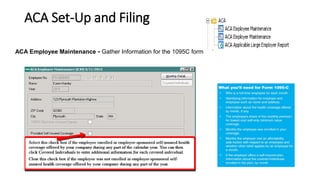

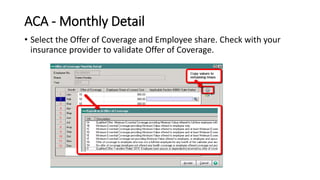

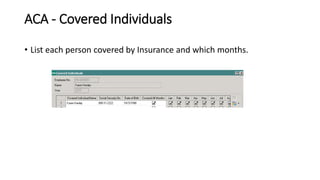

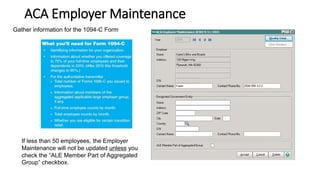

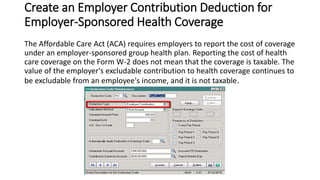

The document outlines the year-end planning procedures for Sage 100 payroll processing, including payroll setup, year-end forms filing, and tax table updates. It highlights necessary reports to generate, backup processes, and the importance of compliance with the Affordable Care Act (ACA). The document also provides resources for further assistance and contact information for support.