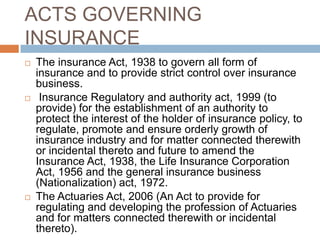

The Insurance Act of 1938 was the first legislation governing all forms of insurance in India and provided strict state control over the insurance business. It aimed to safeguard policyholder interests and establish norms for smoothly conducting the insurance business and minimizing disputes. Subsequent acts like the Insurance Regulatory and Development Authority Act of 1999 established regulatory authorities to further protect policyholders, regulate the industry, and ensure its orderly growth.