Embed presentation

Downloaded 237 times

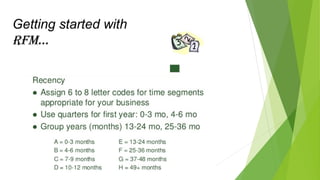

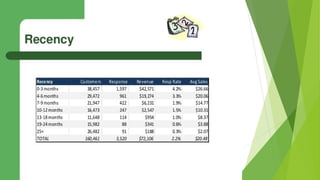

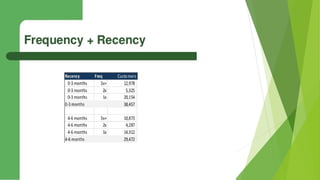

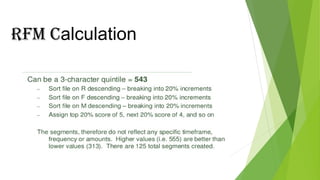

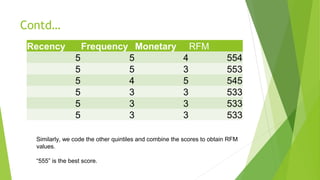

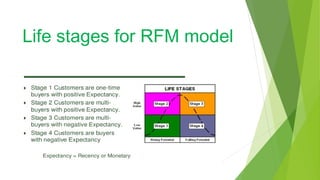

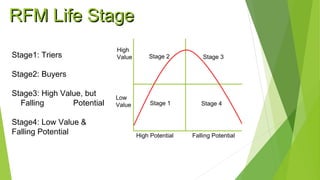

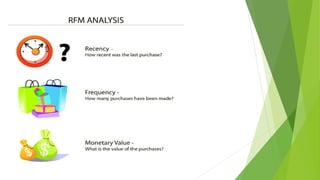

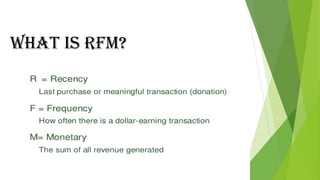

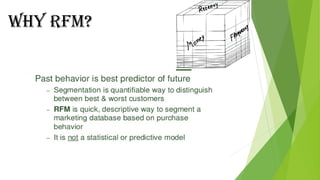

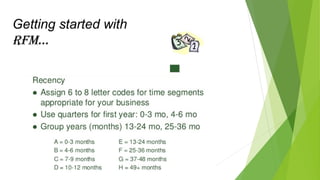

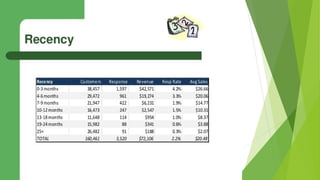

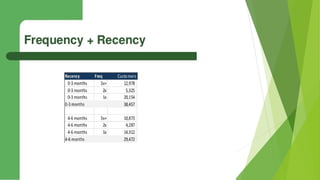

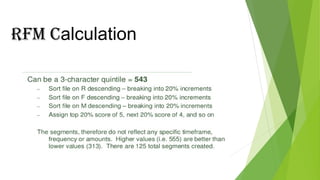

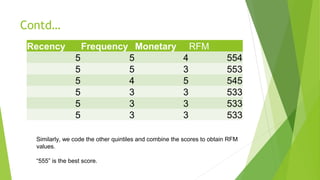

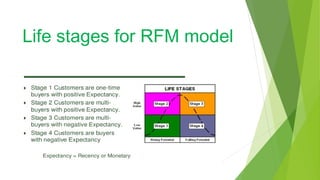

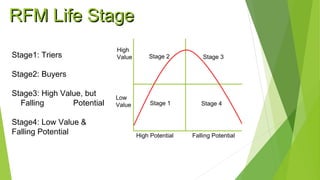

The document discusses the RFM model for customer behavior analytics. RFM stands for Recency, Frequency, and Monetary value. It is a technique used to segment customers based on how recently they made a purchase, how often they make purchases, and the total monetary amount of their purchases. The document provides details on calculating RFM scores, describes different customer life stages based on RFM, and highlights strengths of using RFM analysis, such as targeting the most profitable customers.