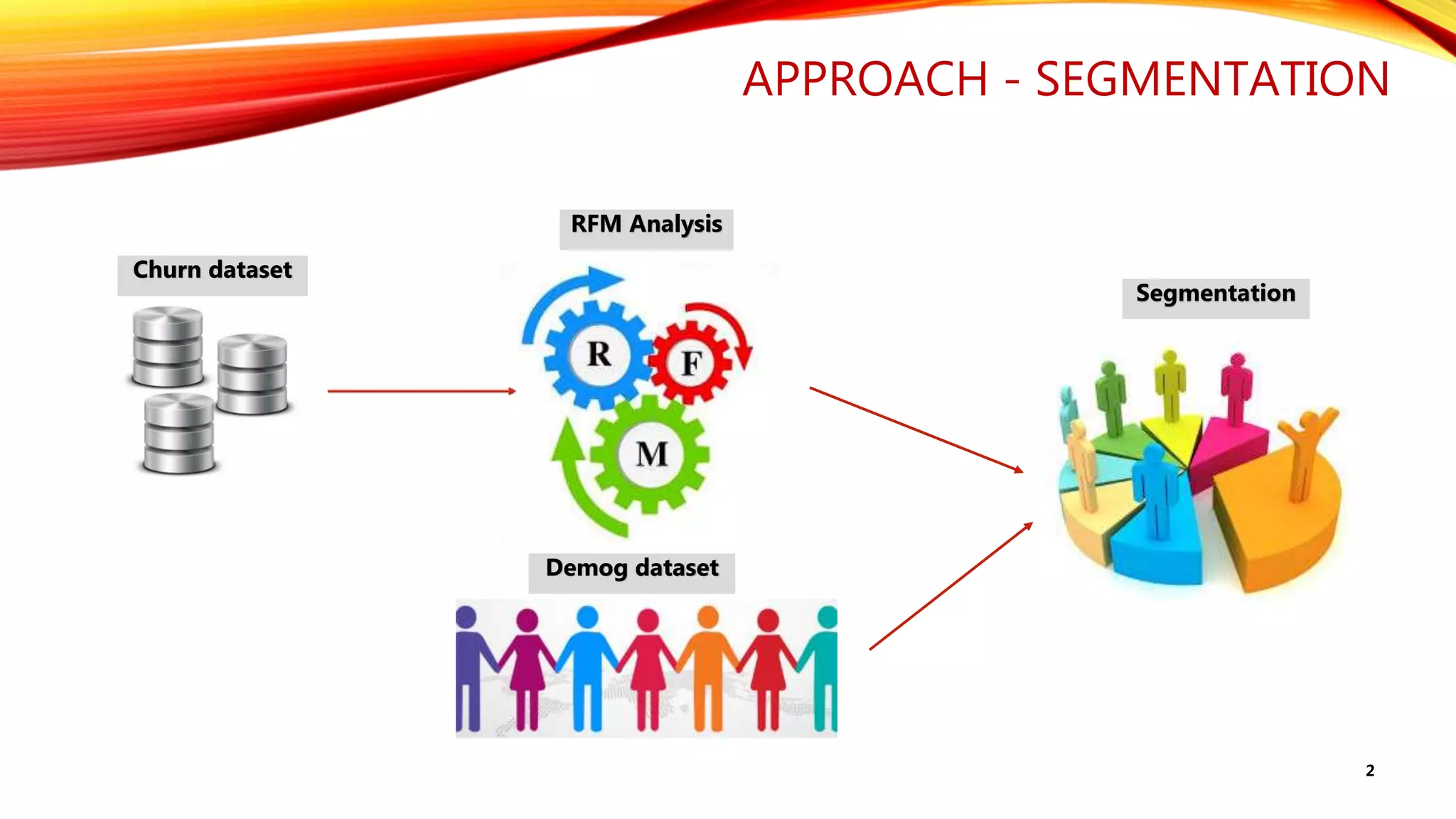

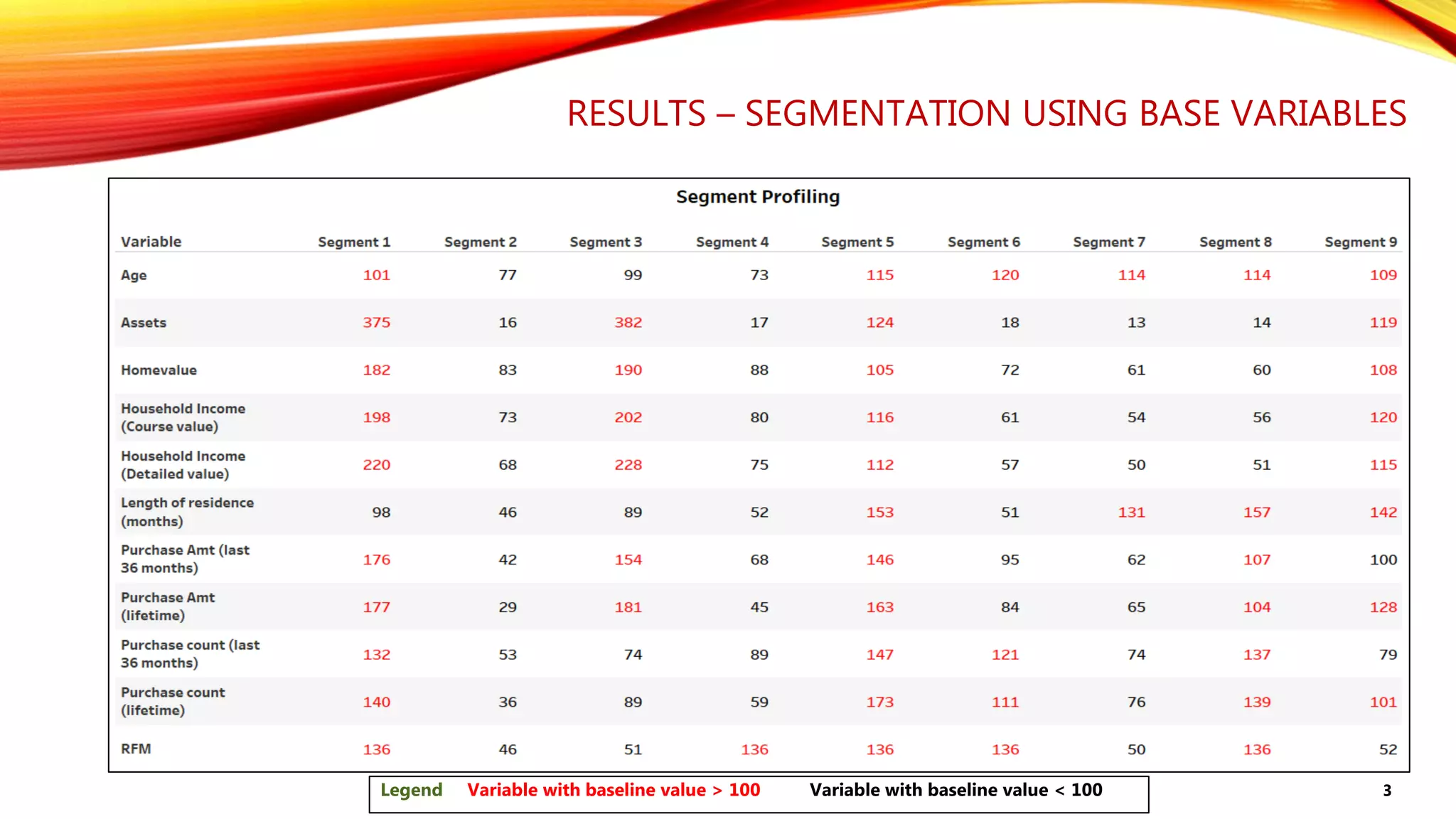

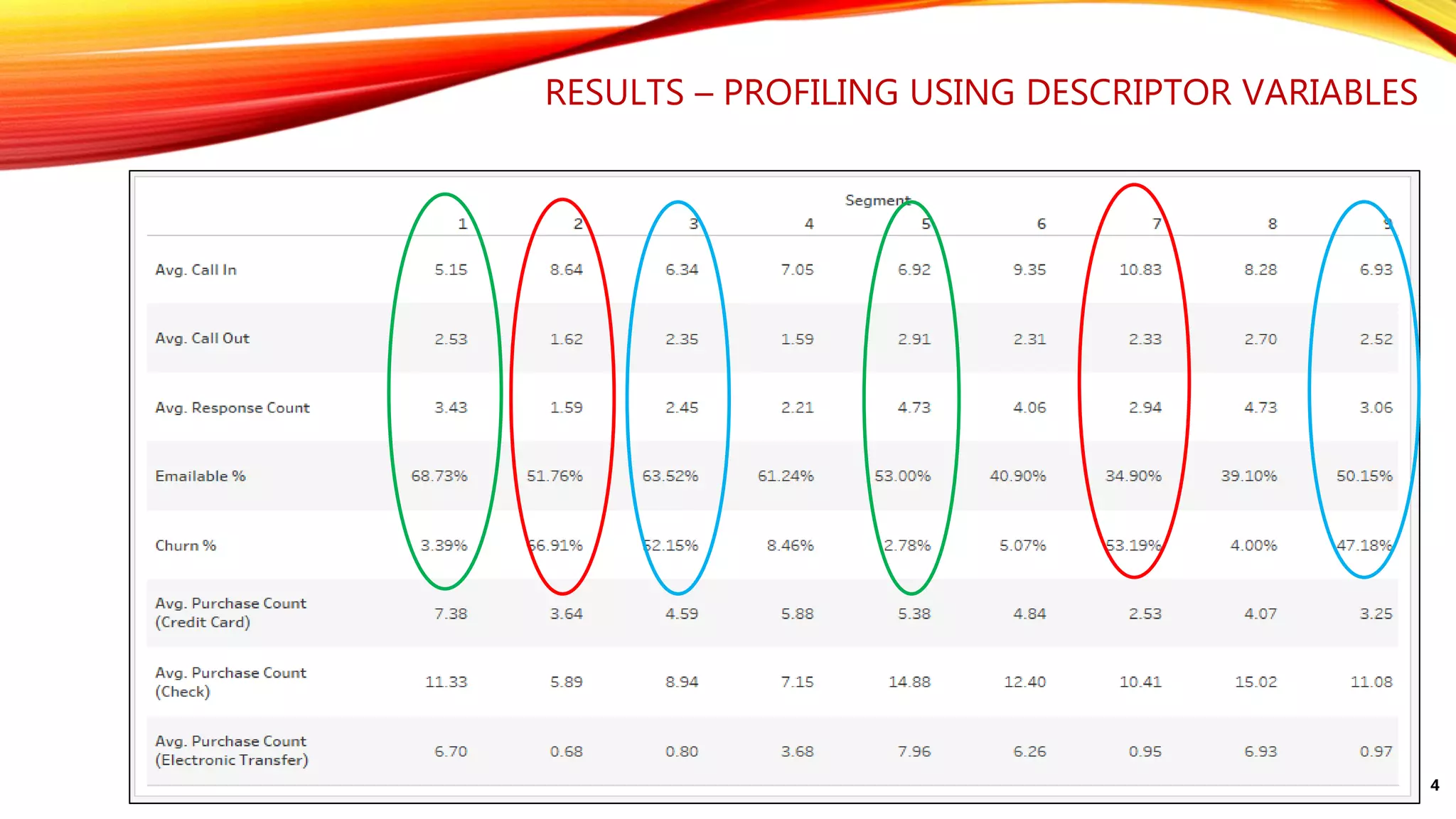

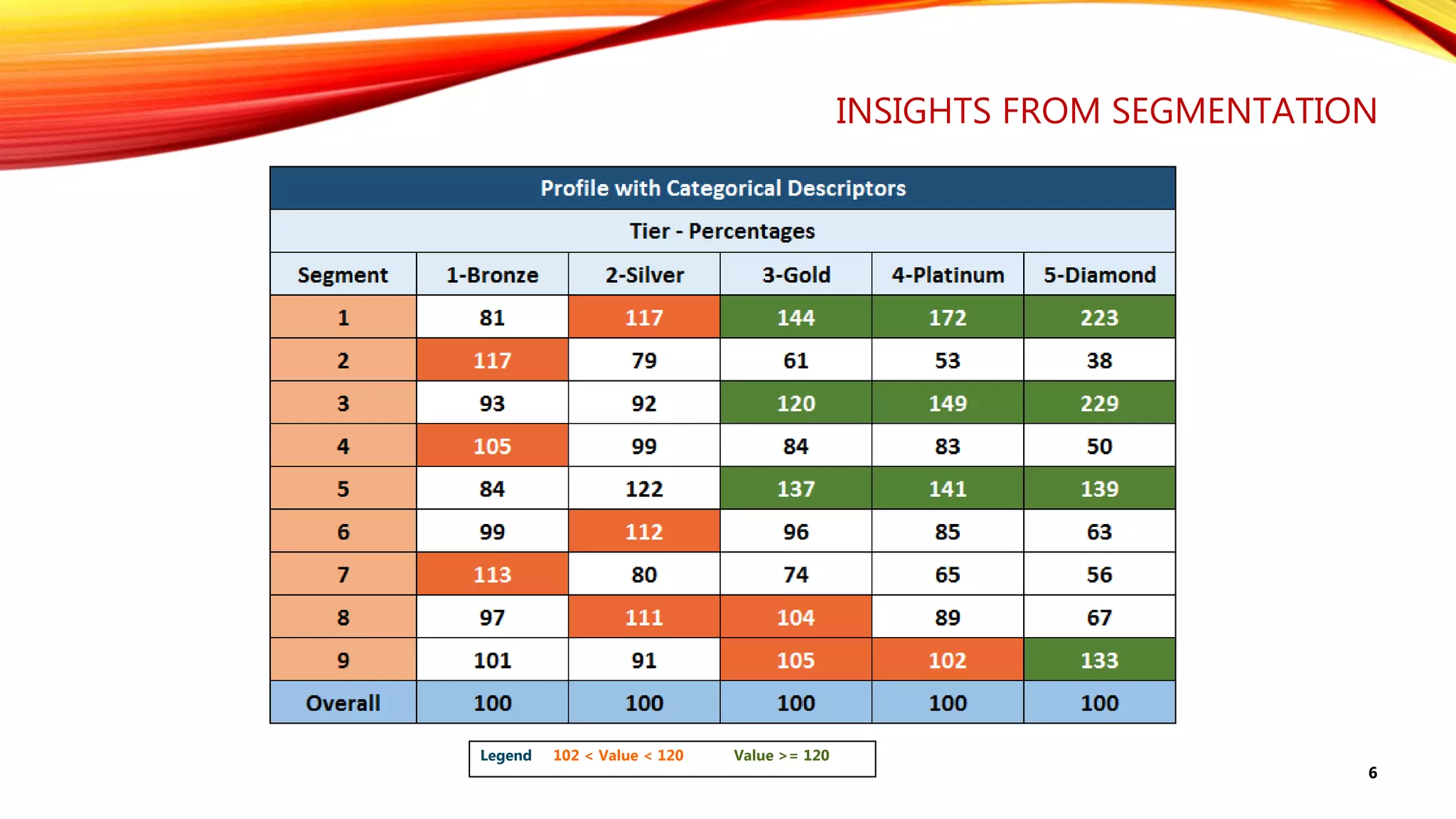

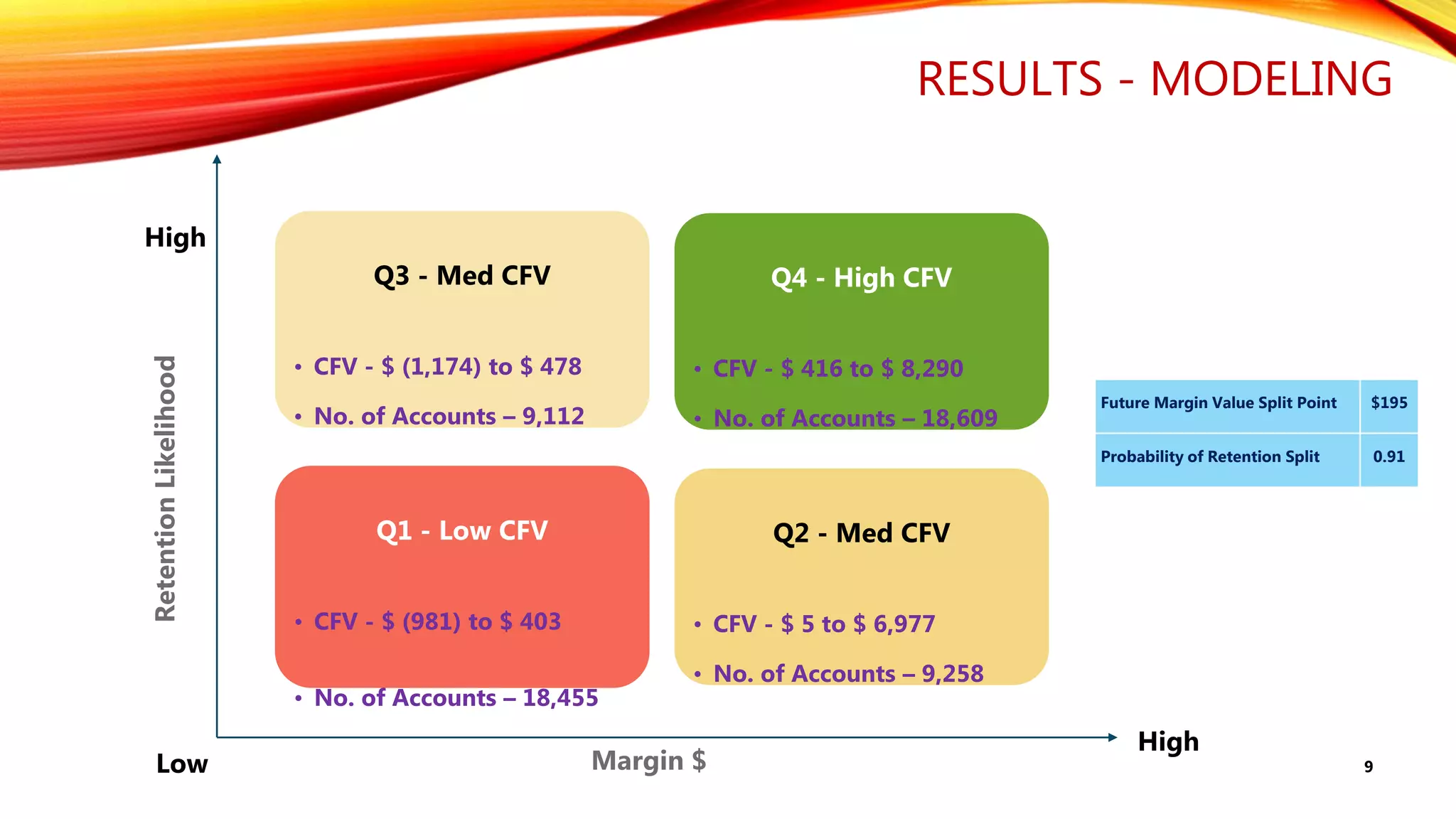

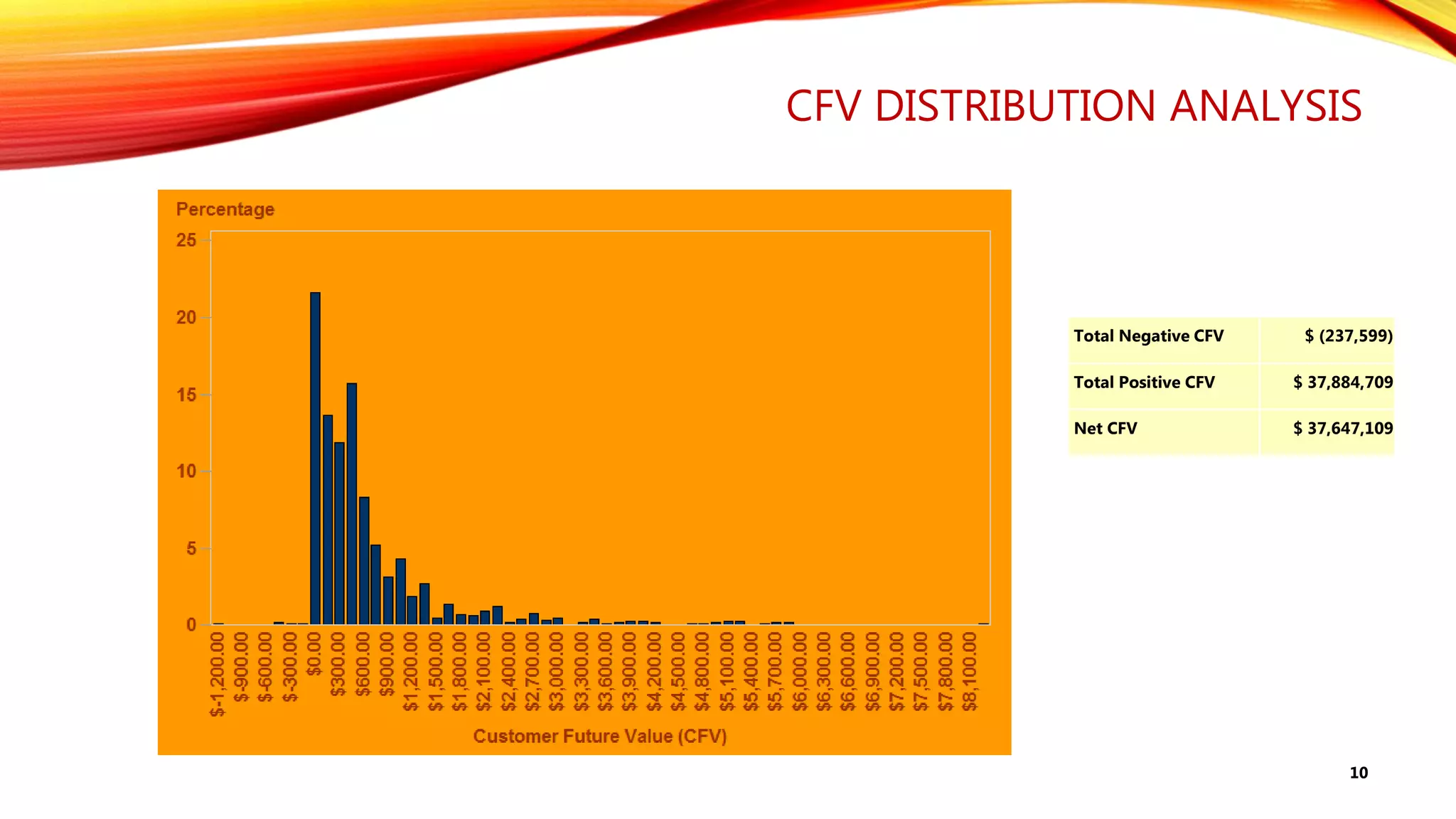

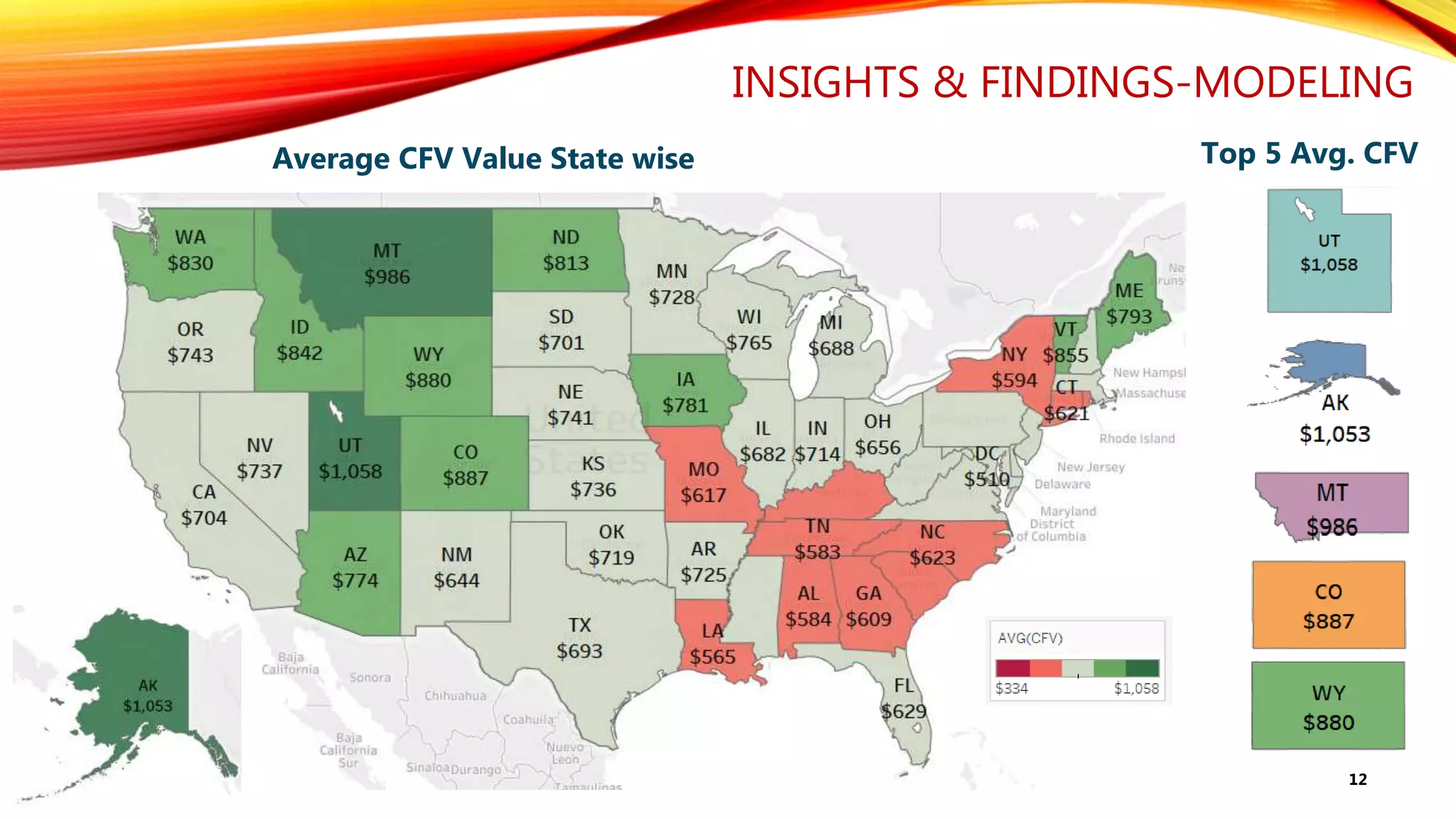

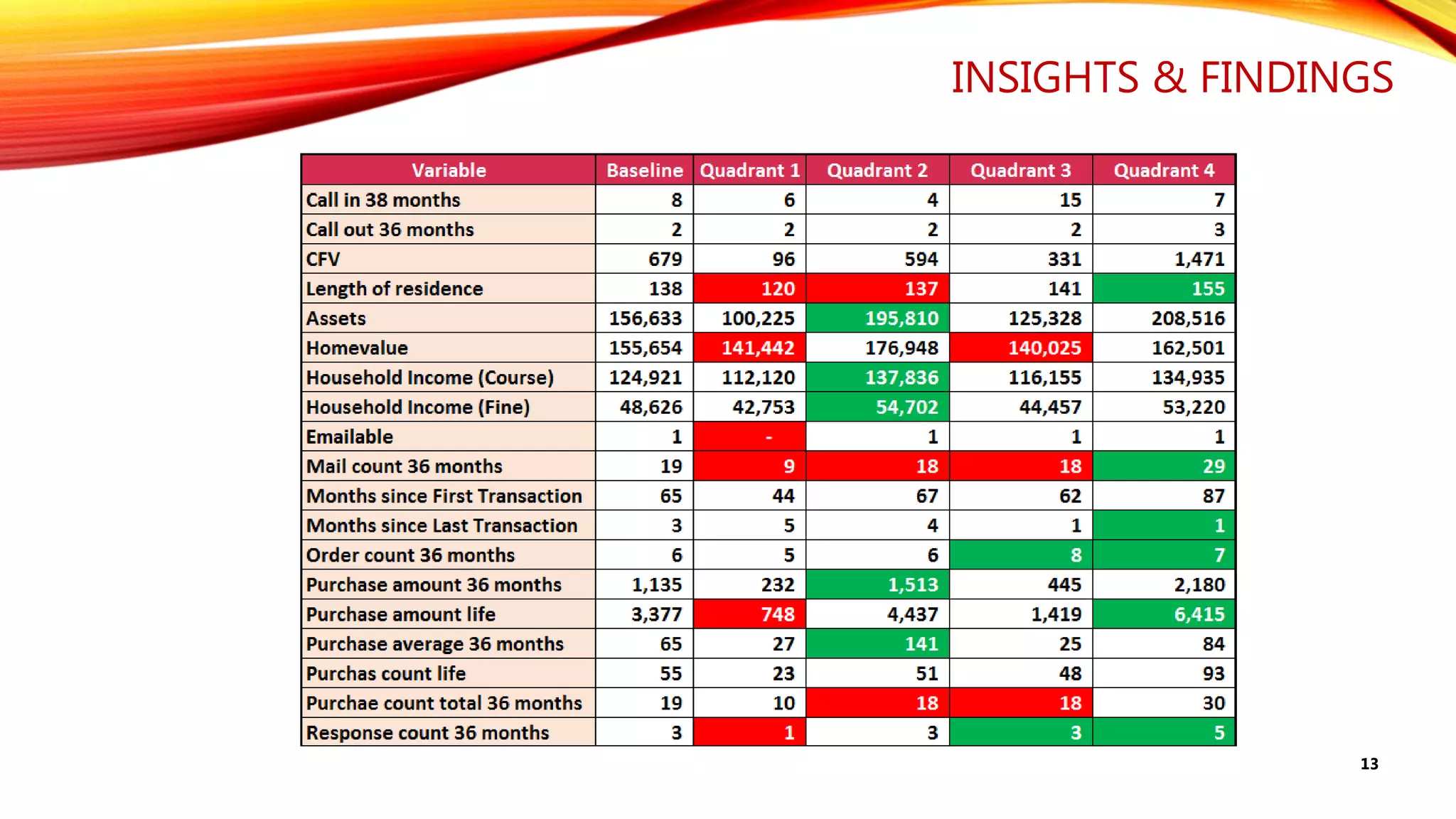

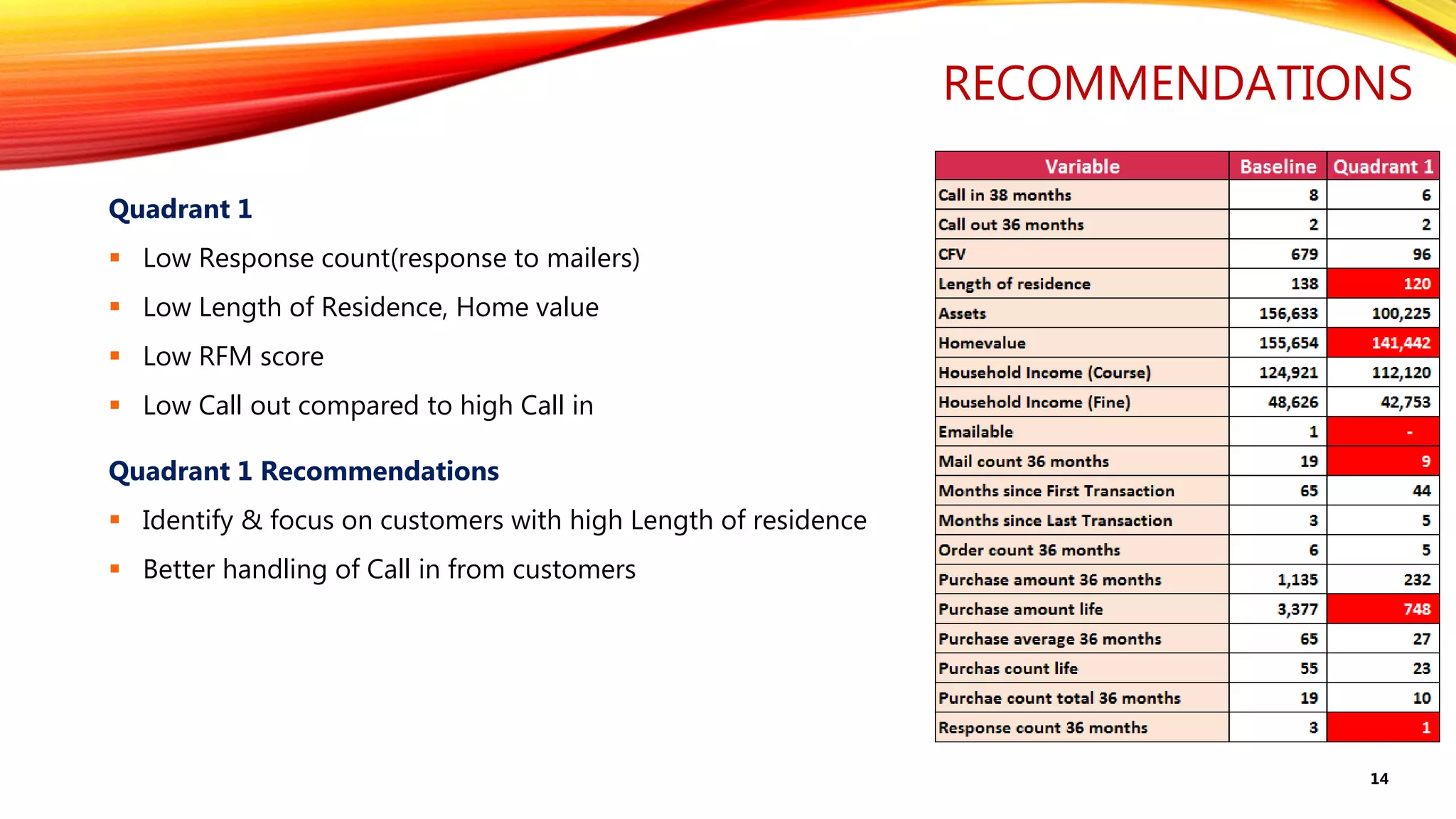

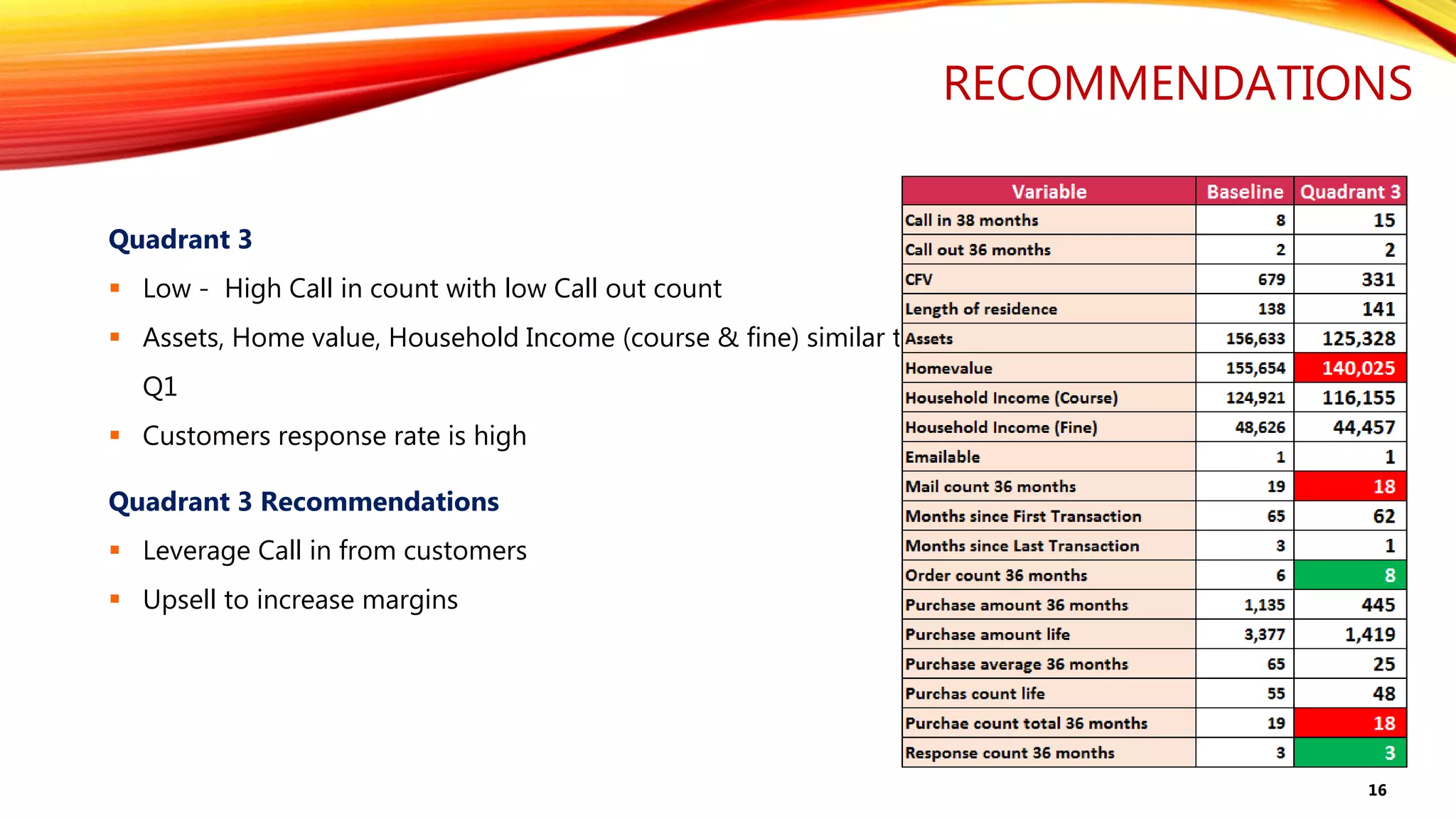

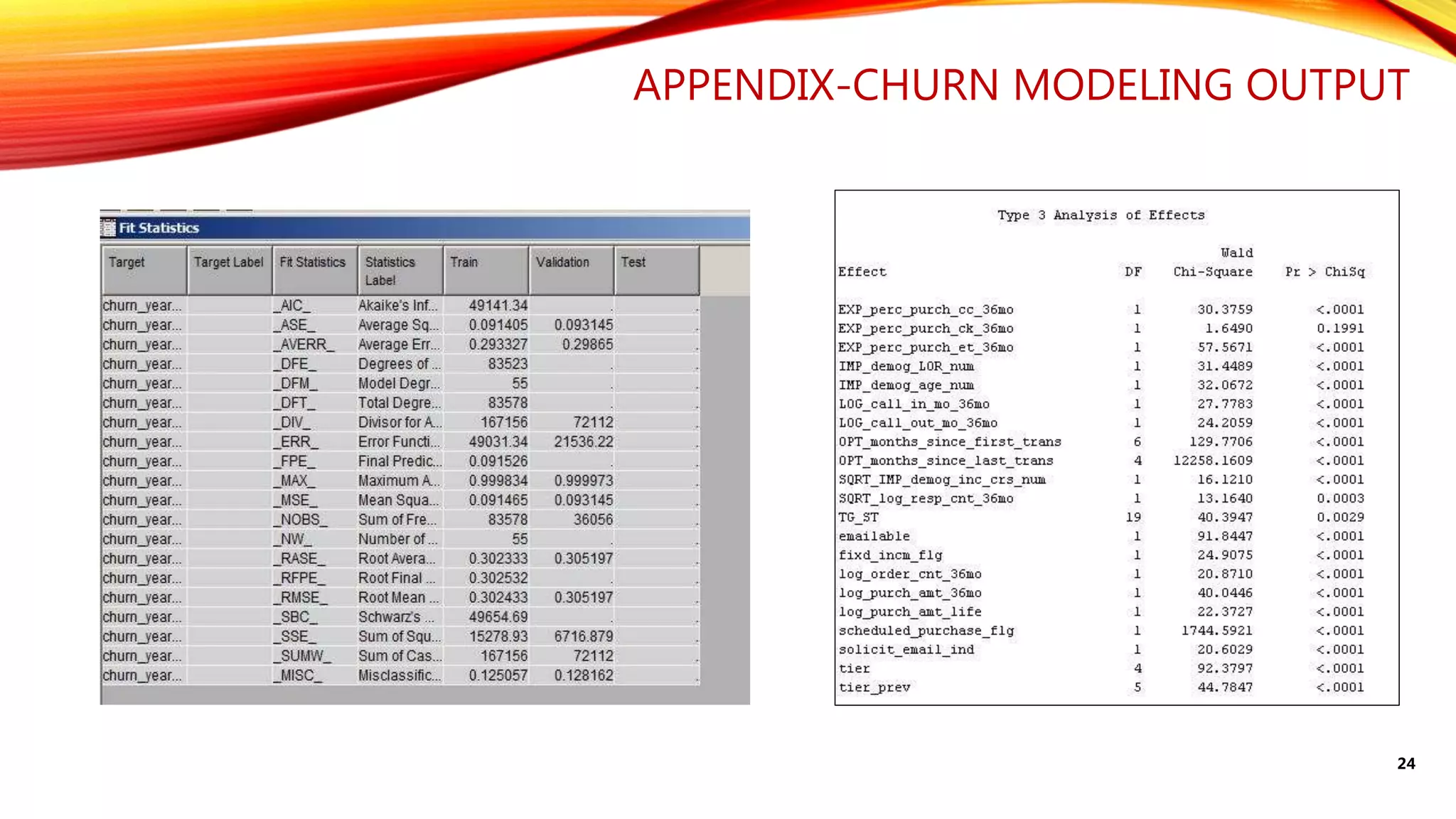

This document summarizes the work of a team that conducted customer segmentation, lifetime value modeling, and recommendations based on the analysis. The team segmented customers using RFM analysis and descriptor variables, identified 7 segments with different characteristics and churn rates. They then modeled customer future value and found segments with high, medium, and low future values. The recommendations target migrating customers between segments to increase revenues.