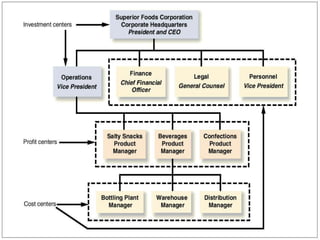

Responsibility accounting deals with planned and actual accounting information about inputs and outputs for organizational responsibility centers. There are four types of responsibility centers: revenue centers measure outputs in monetary terms but not costs; expense centers measure expenses but not revenues; profit centers measure performance in terms of profit; and investment centers hold managers responsible for asset use and profit as well as return on investment. Techniques for measuring responsibility center performance include variance analysis, volume of profit, return on investment, management by objectives, and balanced scorecard systems.