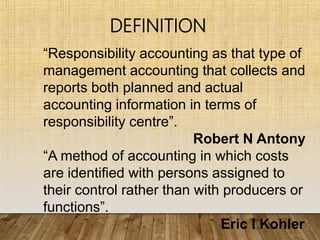

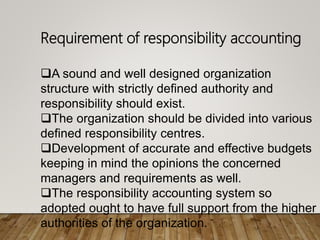

Responsibility accounting is a management accounting method where managers are given decision-making authority over a specific department or division and are held responsible for the activities and results within that area. It requires a clearly defined organizational structure divided into responsibility centers such as cost centers (where managers are responsible for incurred costs), revenue centers (responsible for generating revenue), profit centers (responsible for both costs and revenues), and investment centers (responsible for costs, revenues, and return on capital employed). The goals of responsibility accounting are to improve clarity of goals, assist with planning and budgeting, improve quality and cost control, allow for objective evaluation of managers, and decentralize decision-making.