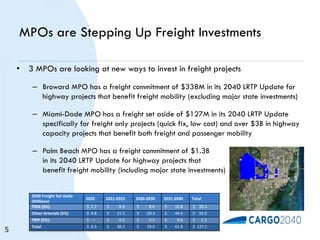

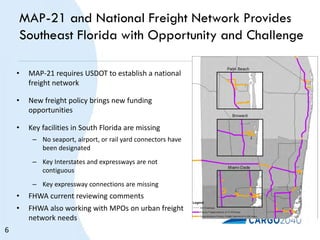

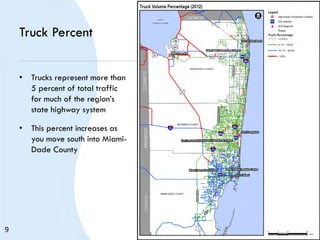

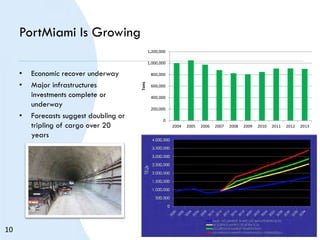

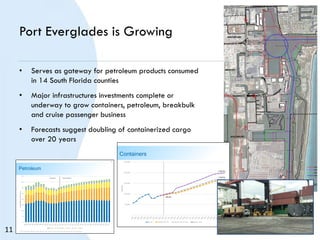

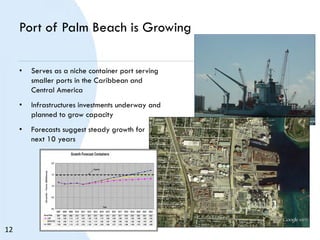

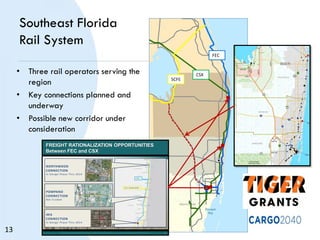

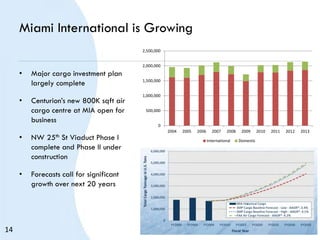

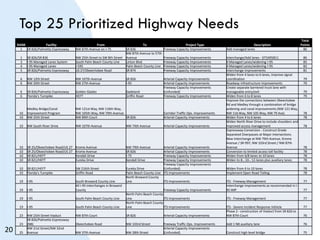

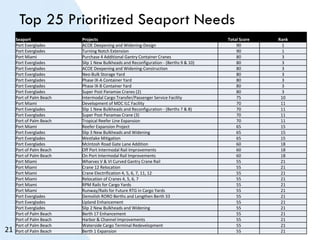

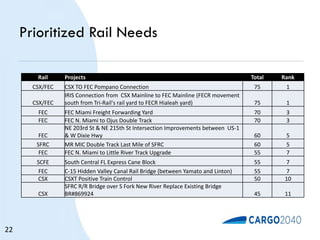

This document provides a summary of the 2040 Southeast Florida Regional Freight Plan presented to the Miami-Dade Freight Transportation Advisory Committee. The plan screens the regional highway network for freight bottlenecks, reviews capital needs for airports, seaports and railroads, provides an updated prioritized list of freight projects, and estimates the economic impacts of the freight industry in Southeast Florida. It also incorporates key freight and logistics initiatives to position the region as a global logistics hub. The document outlines significant freight investments that have been made and priorities for future highway, seaport, airport and rail investments based on projected growth in freight volumes.