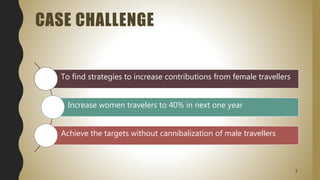

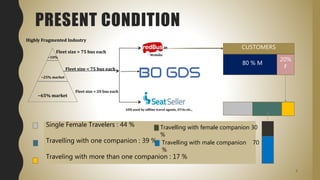

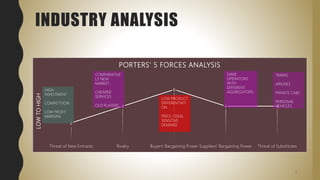

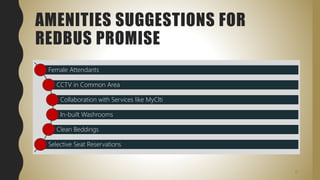

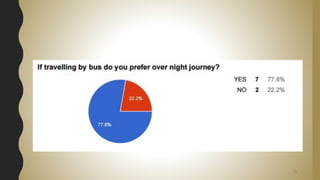

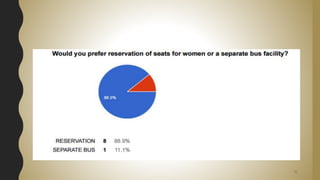

The document outlines a strategy to increase the proportion of female travelers to 40% within the next year, while maintaining existing male traveler numbers. It includes a market analysis, SWOT analysis, and proposed marketing strategies aimed specifically at women aged 21-40. The document emphasizes the need for safety features, customer care, and tailored services to enhance female traveler experiences.