Recent trends in corporate reporting covers many topics including intangible assets reporting, triple bottom line reporting, human resource accounting, forensic accounting, and corporate social responsibility. The key topics discussed are:

- Intangible assets now constitute 75-90% of company value so accurate reporting is important under IFRS standards.

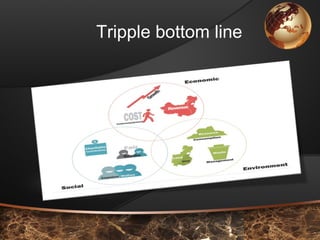

- Triple bottom line reporting requires companies to report on their environmental and social impacts, not just financial performance, to promote sustainability.

- Human resource accounting aims to identify and measure human capital to provide feedback to managers and support employee morale and loyalty.

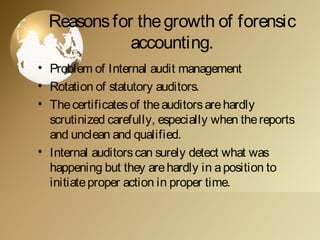

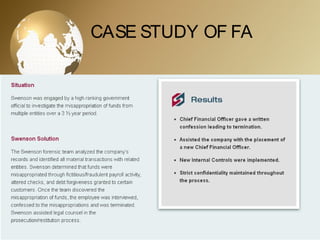

- Forensic accounting integrates accounting, auditing, and investigation skills for dispute resolution in courts or to detect internal issues not found through