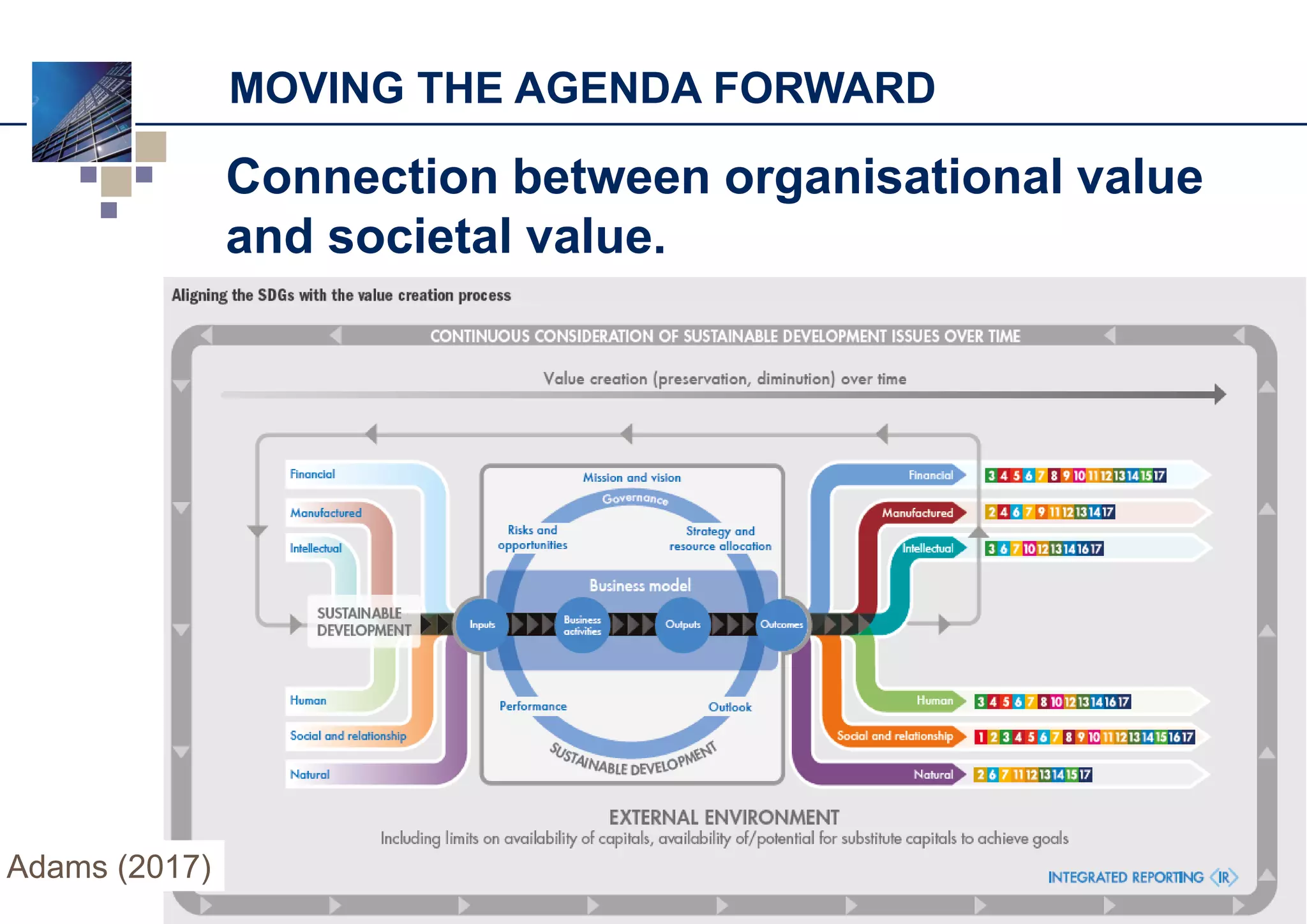

This document discusses integrated reporting from an academic perspective. It defines integrated reporting as an organization's value creation story that explains how it will thrive in the short, medium, and long term by thinking beyond just financial profit. The document also outlines some benefits of integrated reporting such as reputation enhancement, better stakeholder relationships, and attracting long-term investors. However, it notes that more empirical evidence is still needed on the transformative benefits. It concludes by discussing some challenges to moving integrated reporting forward like education needs and the need for better alignment and organizational transformation.