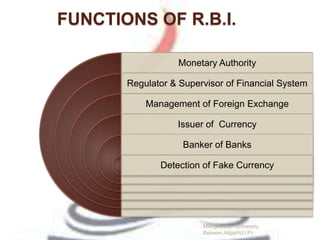

The document discusses the functions of the Reserve Bank of India (RBI). It states that RBI serves as India's central banking institution and monetary authority, formulating and implementing monetary policy. It regulates and supervises the country's financial system, manages foreign exchange, issues currency, acts as a banker to commercial banks, and detects counterfeit currency. RBI works to maintain public confidence in the banking system and provide efficient financial services, while ensuring adequate credit flows to productive sectors of the economy.