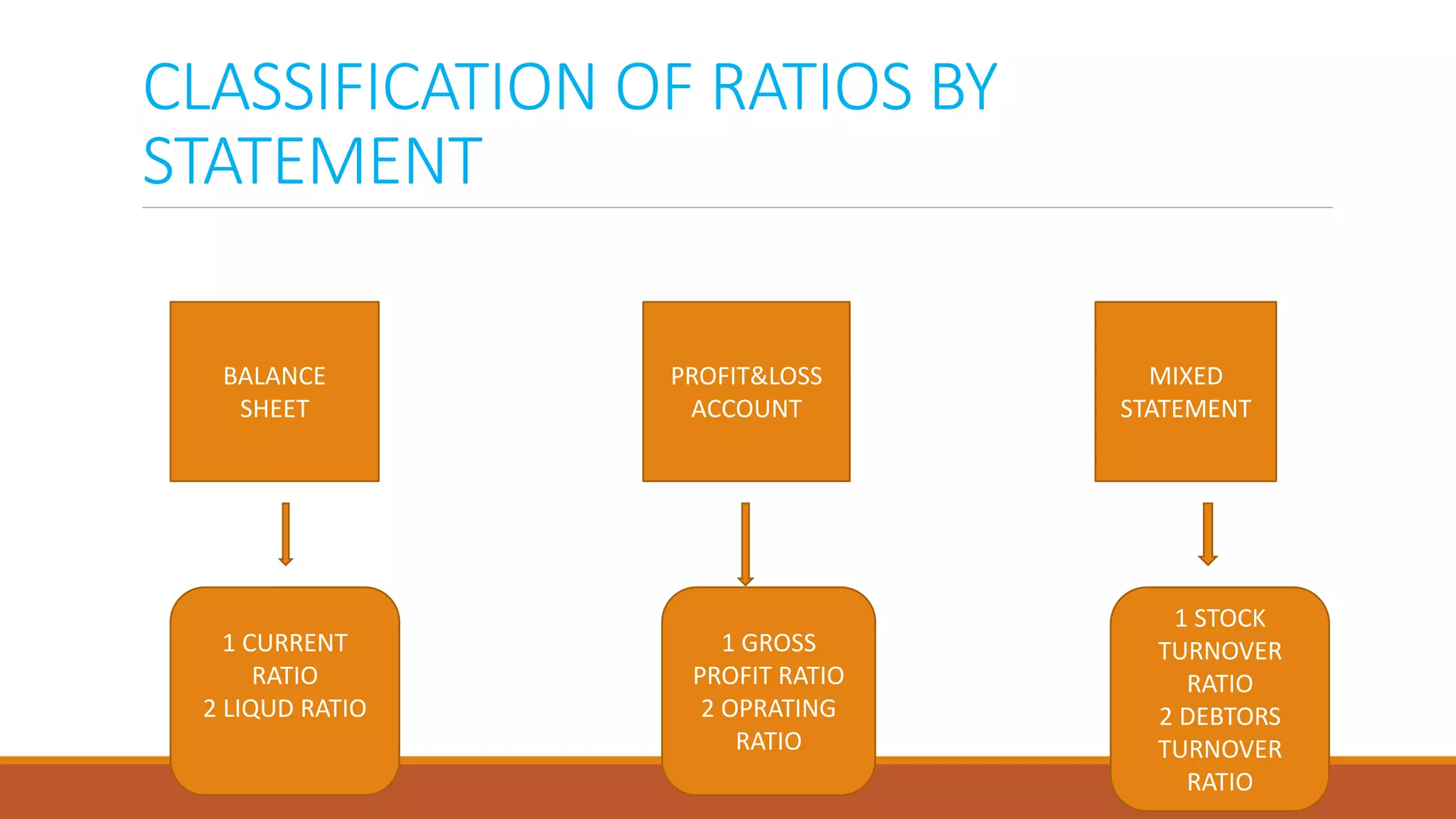

This document discusses various types of financial ratios used in ratio analysis including liquidity, solvency, activity, and profitability ratios. It provides examples of specific ratios under each type such as current ratio, debt-to-equity ratio, inventory turnover ratio, and net profit margin. The document also discusses limitations of ratio analysis including its use of historical data and different accounting methods between companies. Finally, it outlines advantages like simplifying comparisons and highlighting weak spots as well as uses of ratio analysis in areas like forecasting, decision making, and investment decisions.