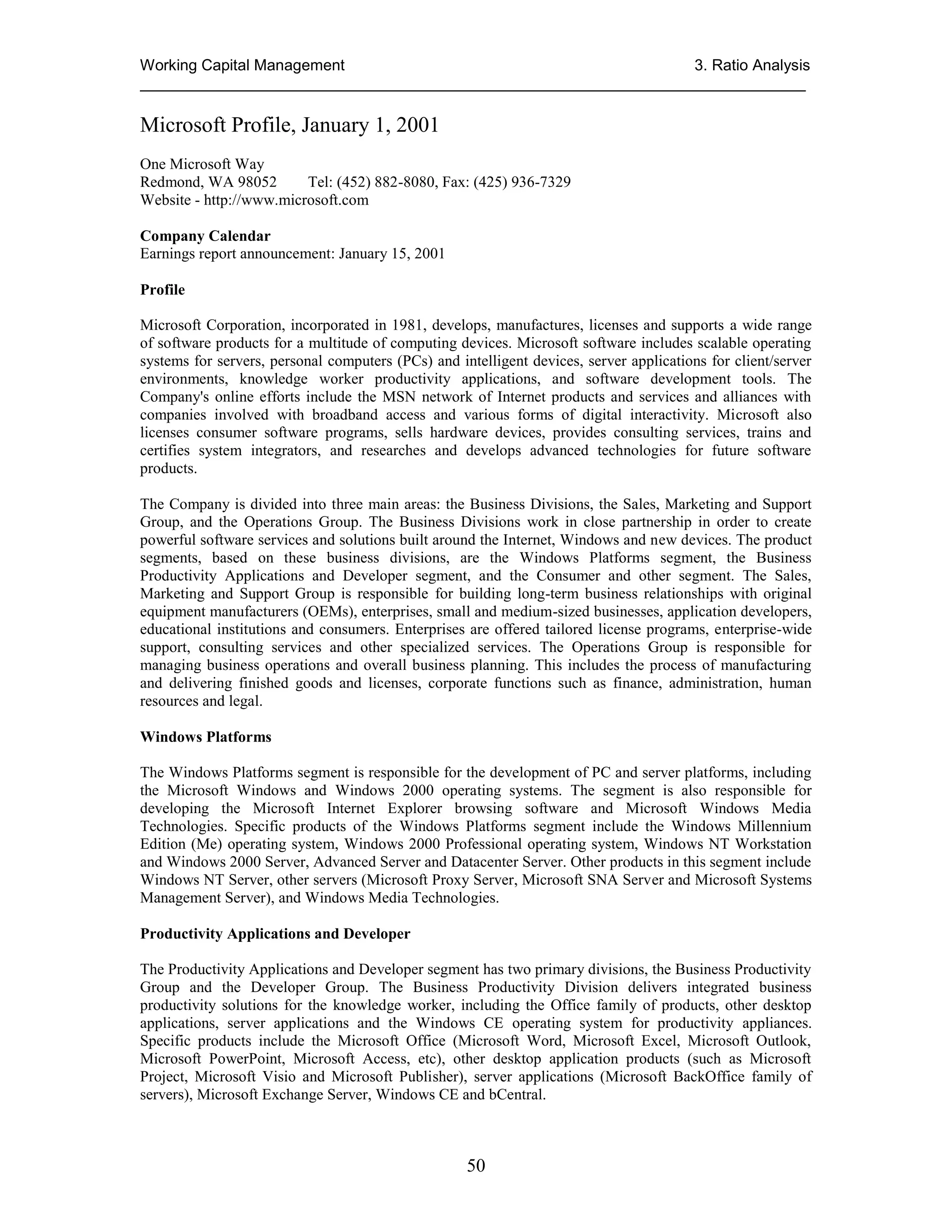

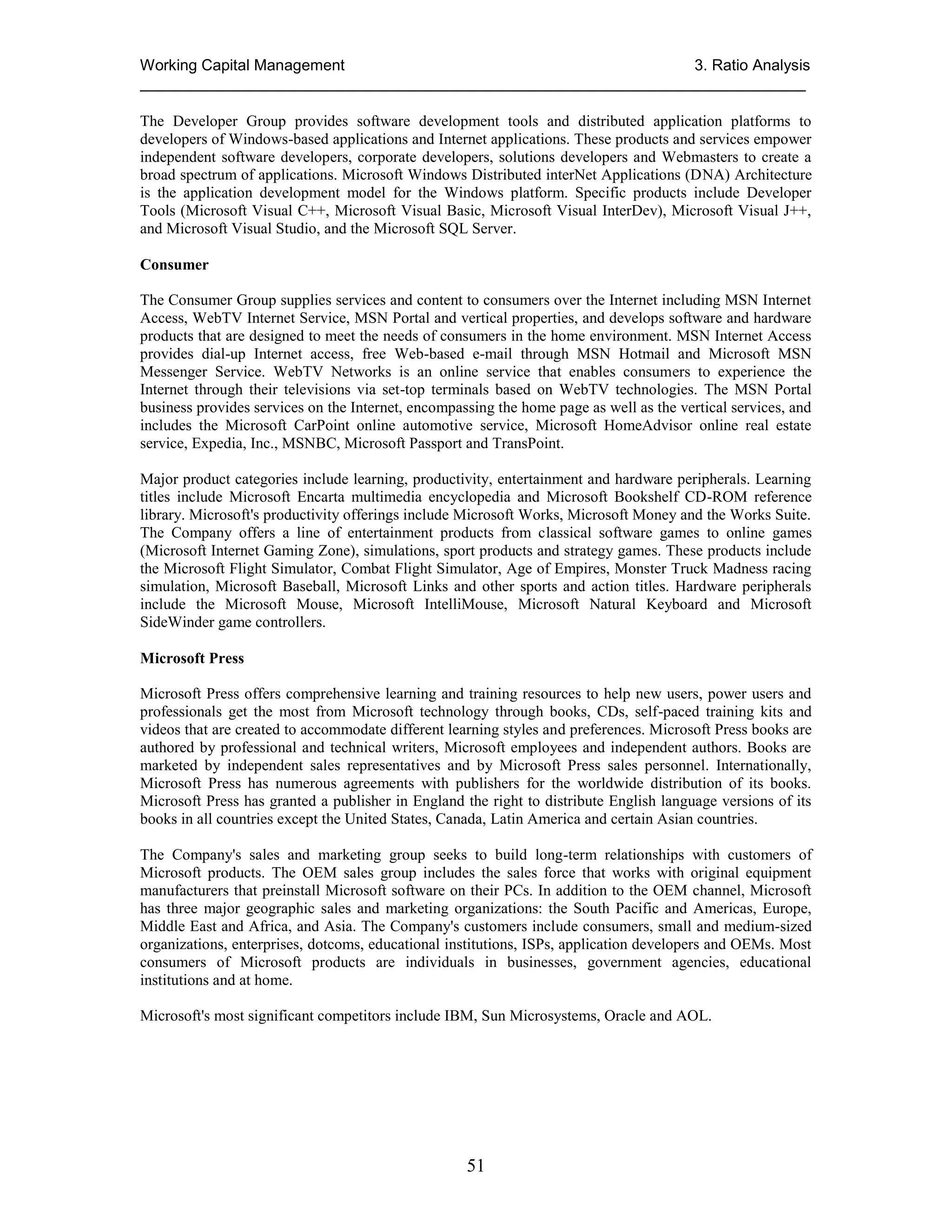

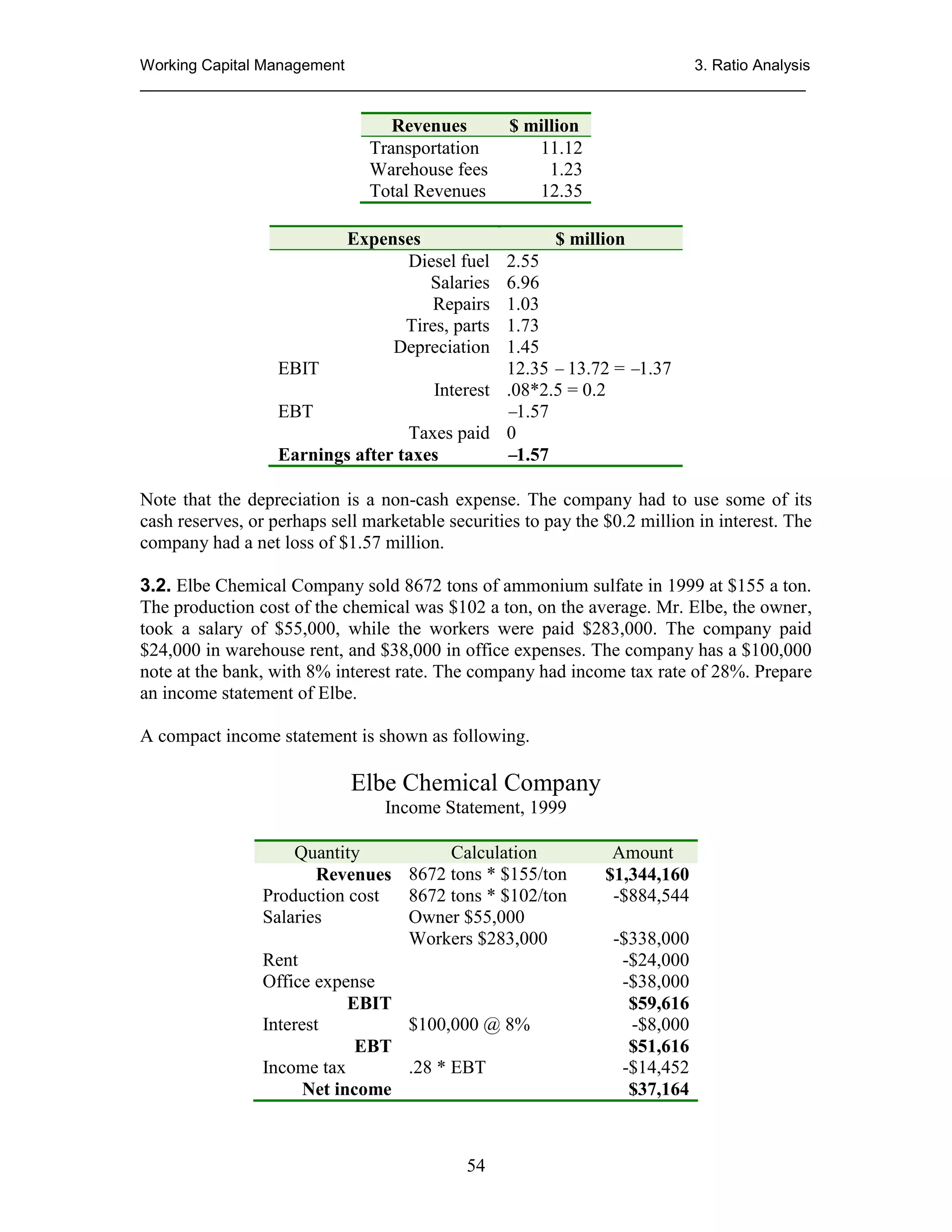

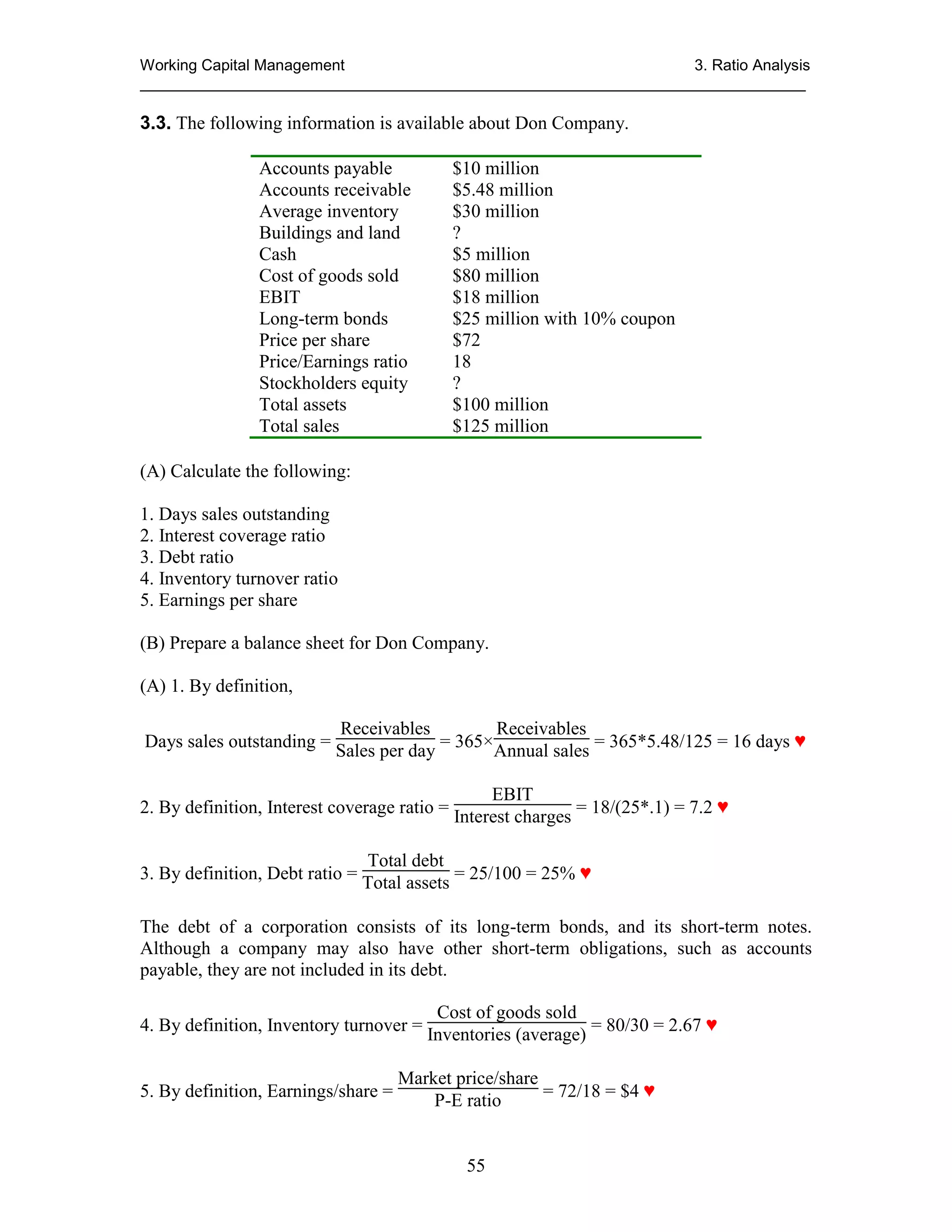

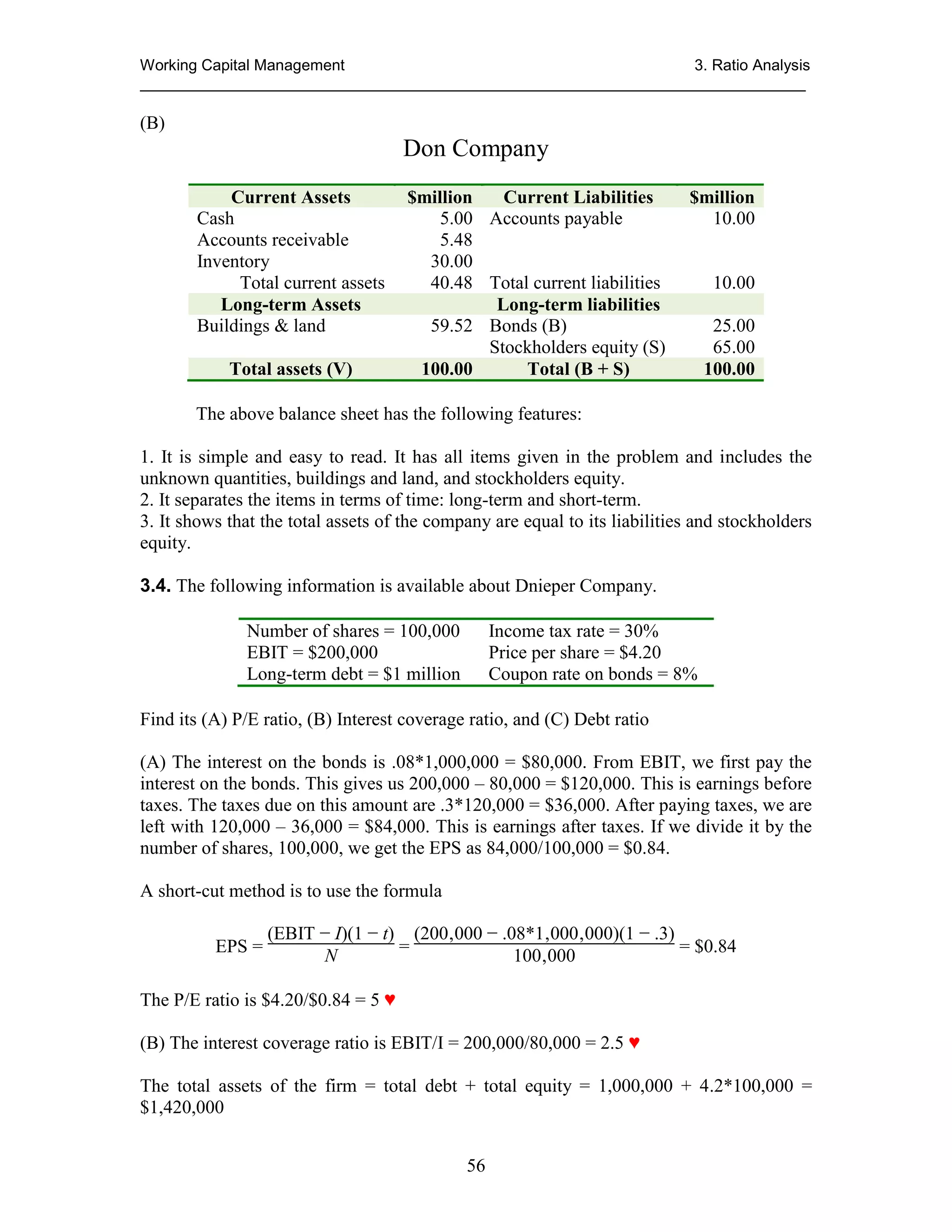

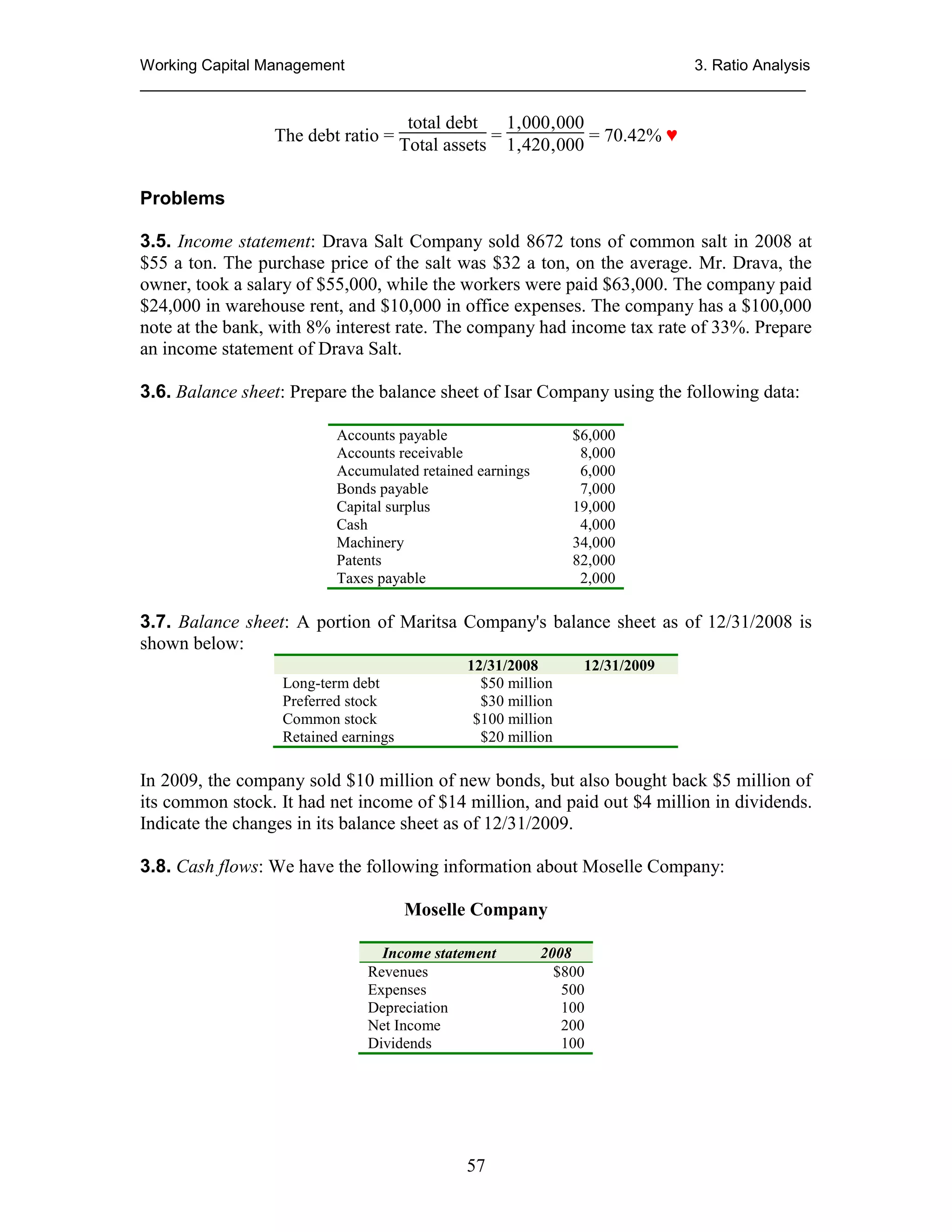

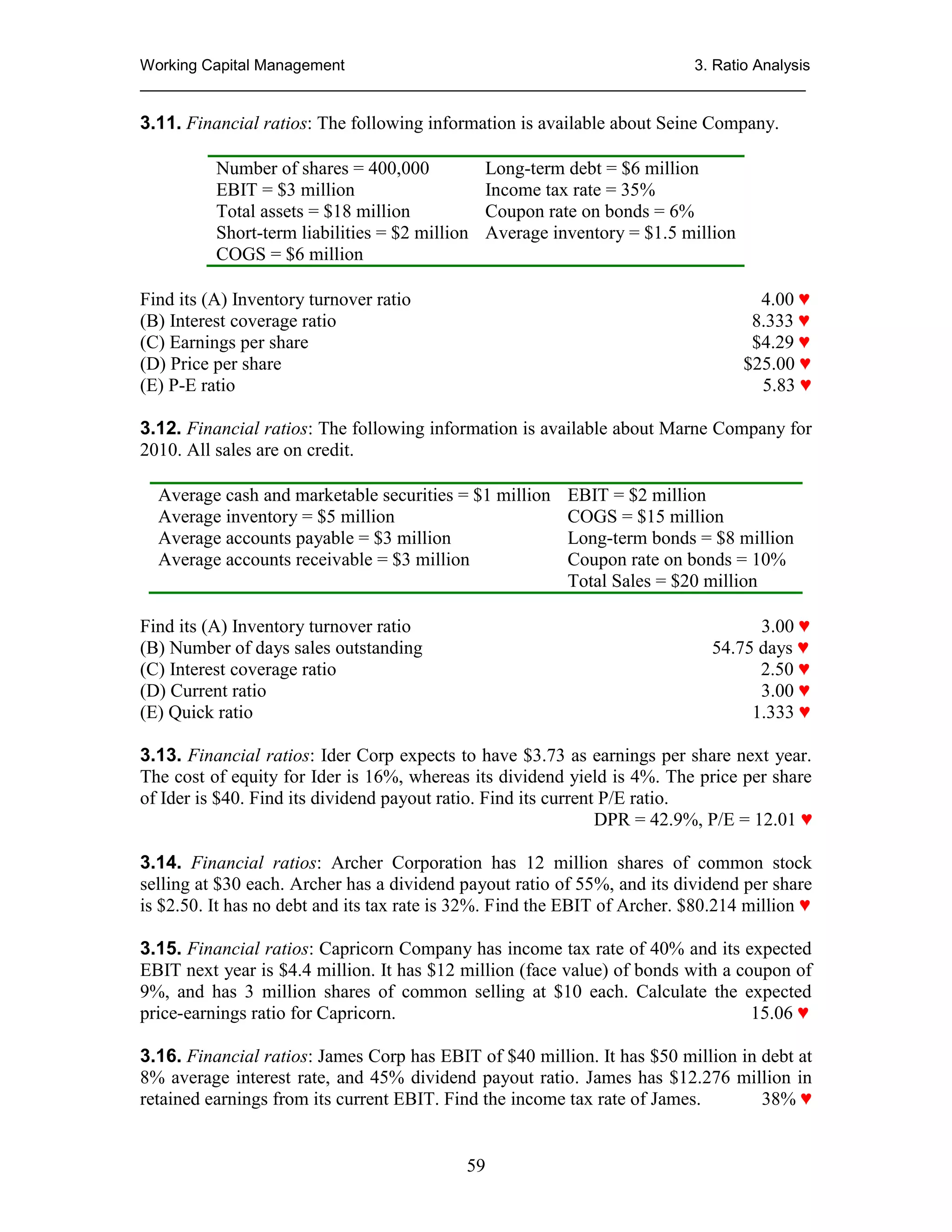

1. The document discusses ratio analysis and financial statements, specifically discussing the balance sheet of a firm and how it is made up of assets, liabilities, and equity.

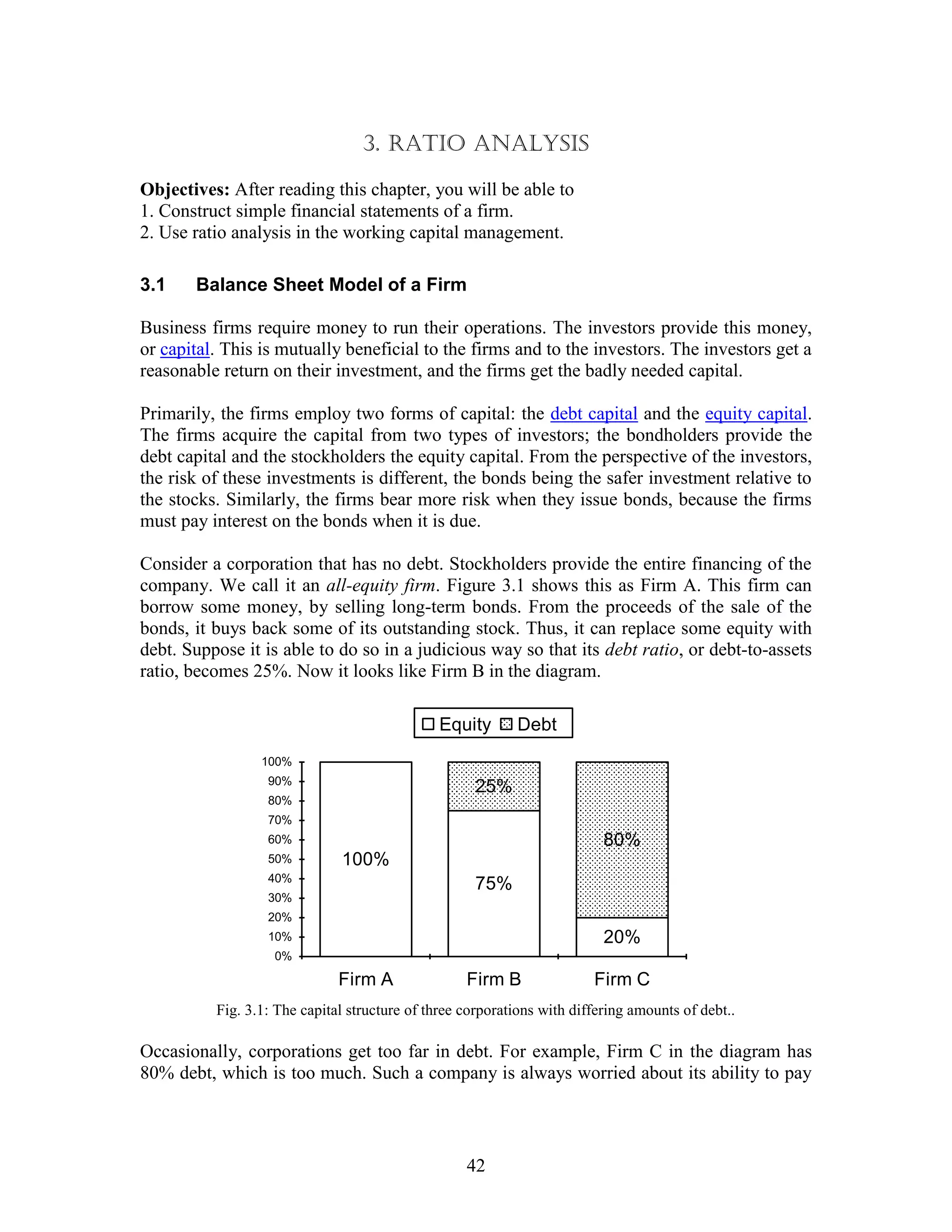

2. It then discusses the capital structure of firms and how they obtain debt capital from bondholders and equity capital from stockholders. Different examples of firms' capital structures are shown through diagrams.

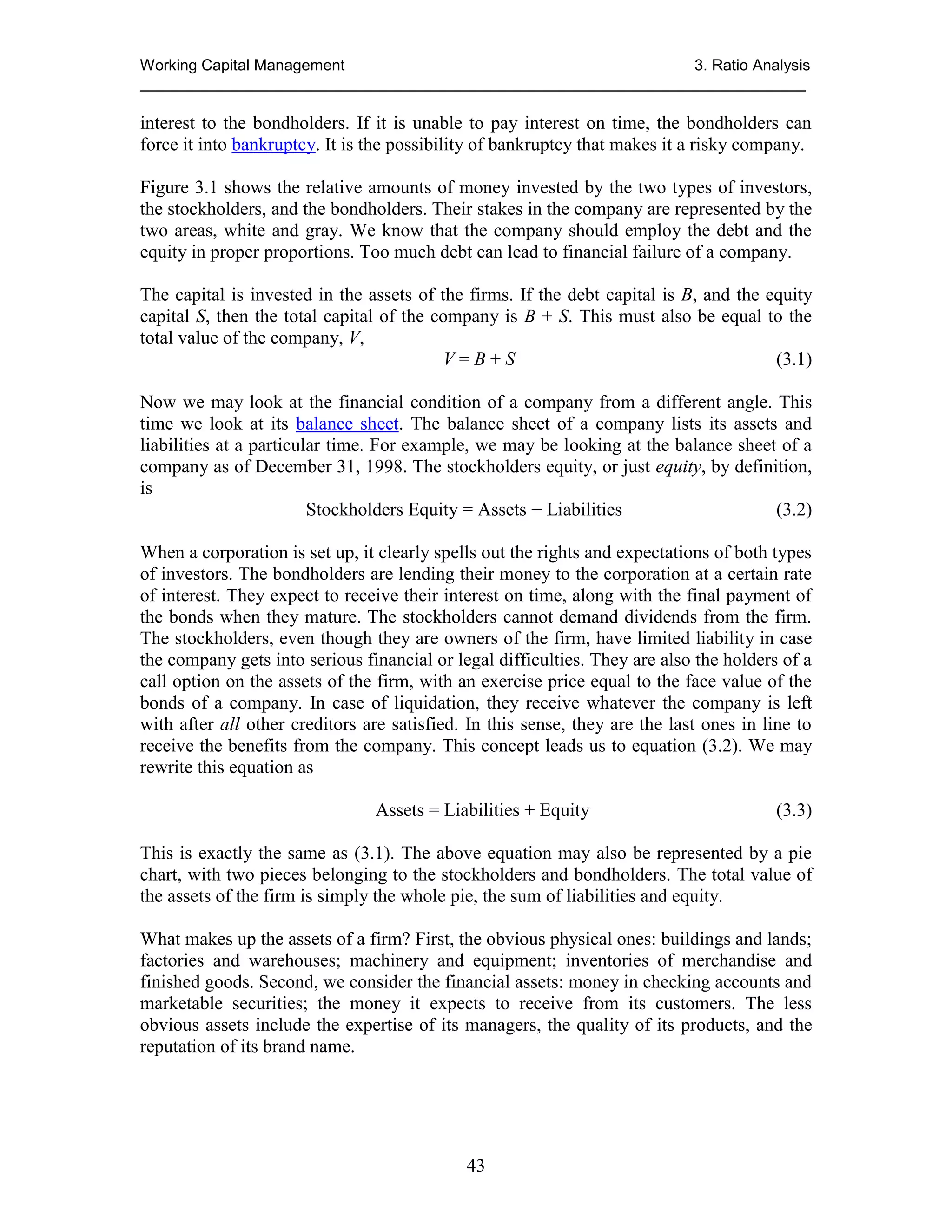

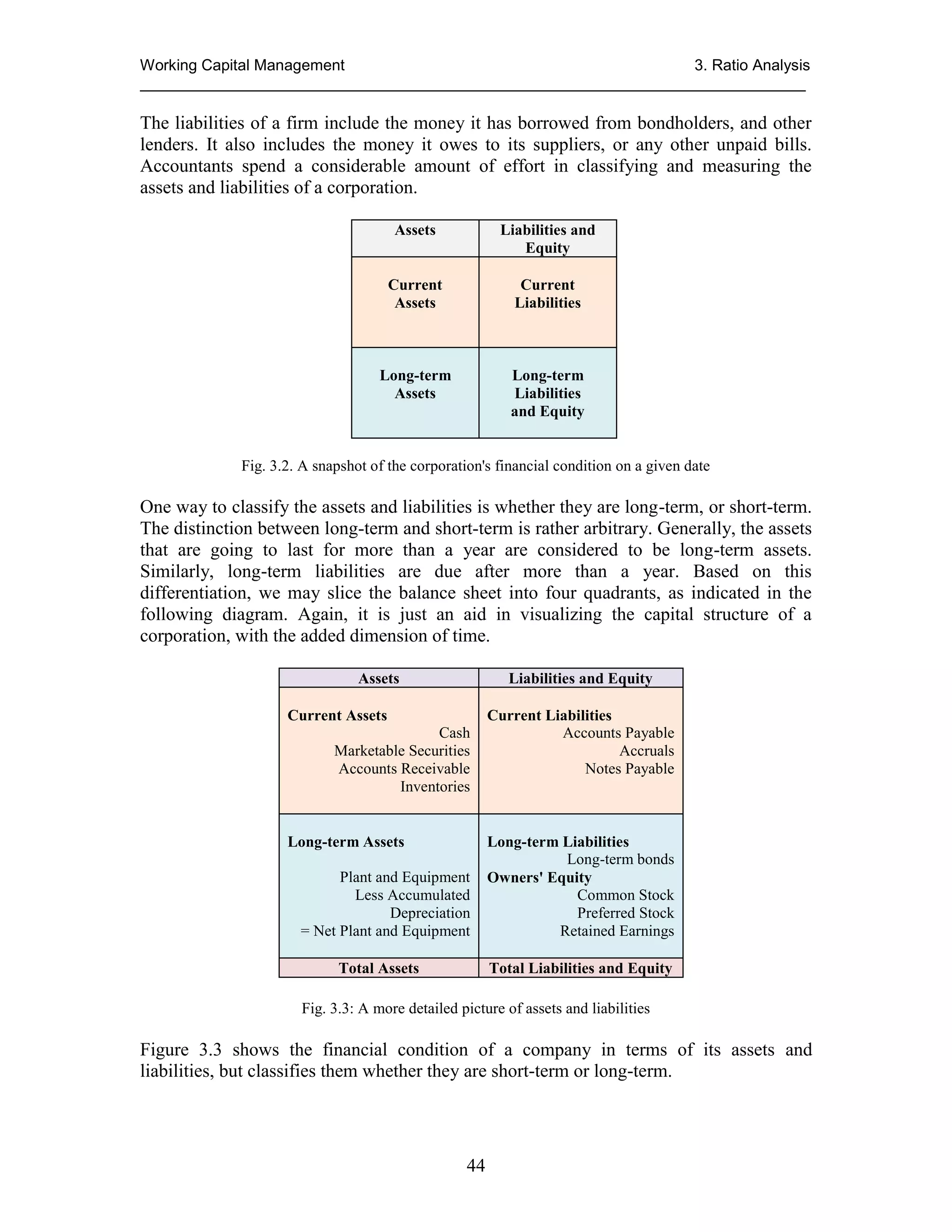

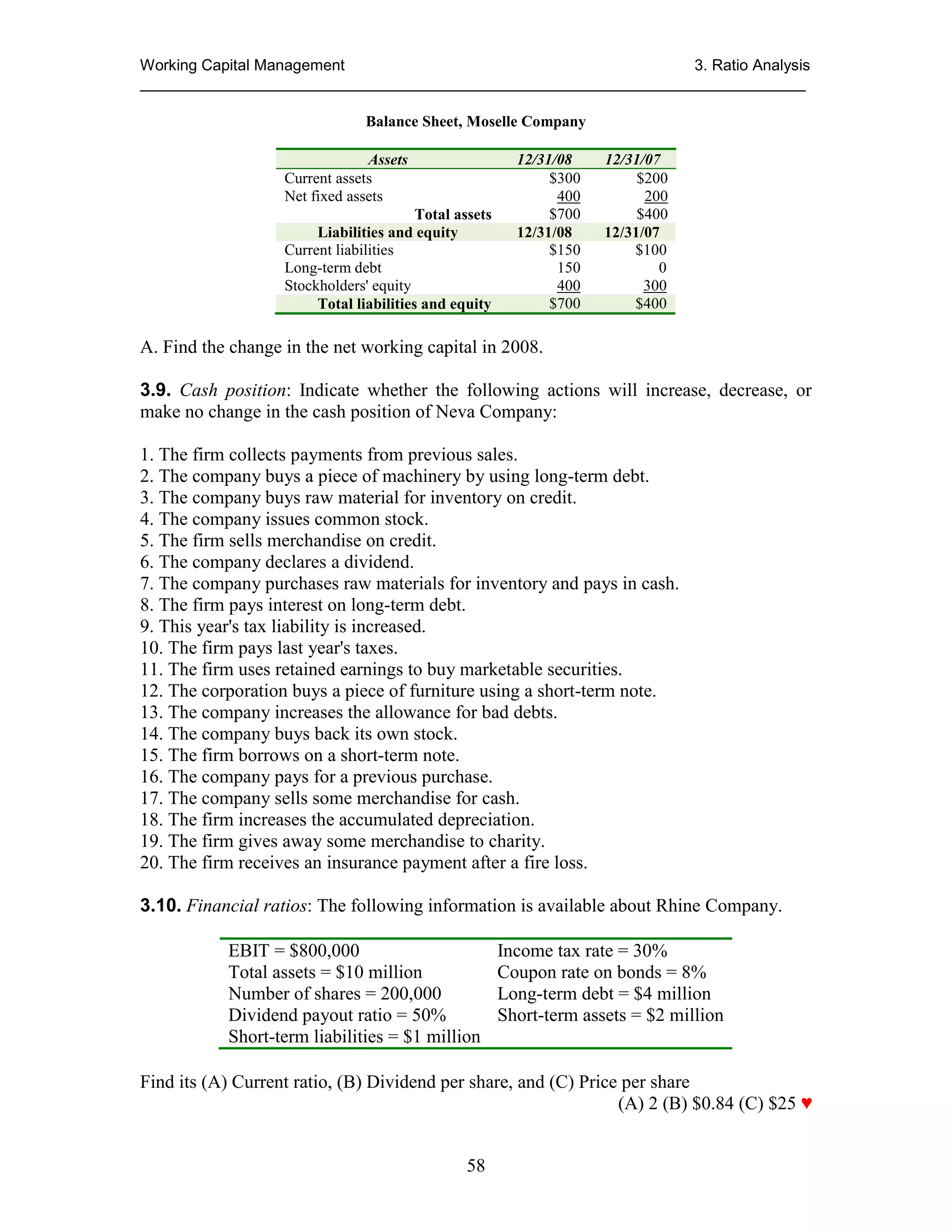

3. The document then discusses the classification of assets and liabilities on a balance sheet as current or long-term and provides a more detailed breakdown of the line items that make up each section of the balance sheet.