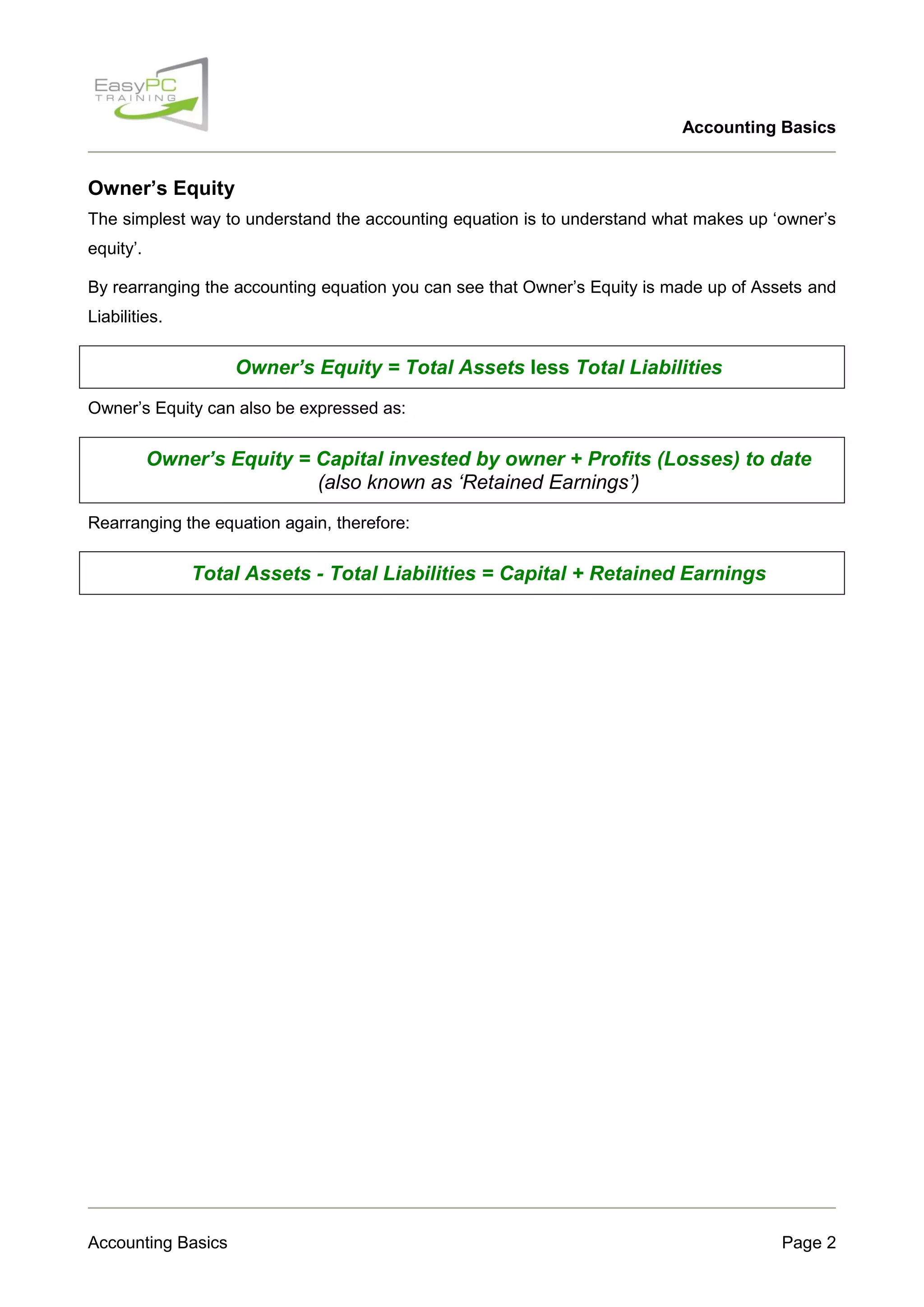

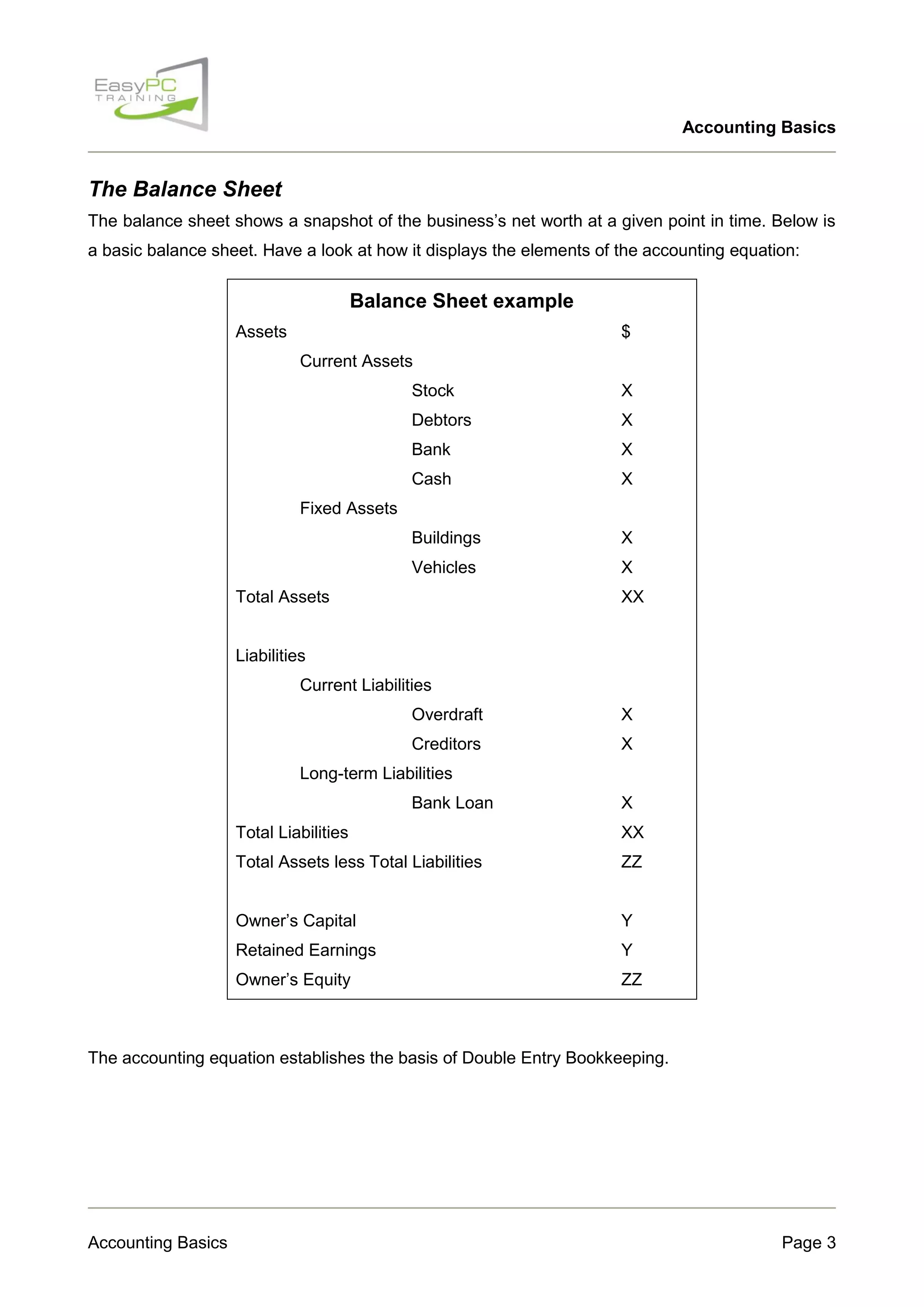

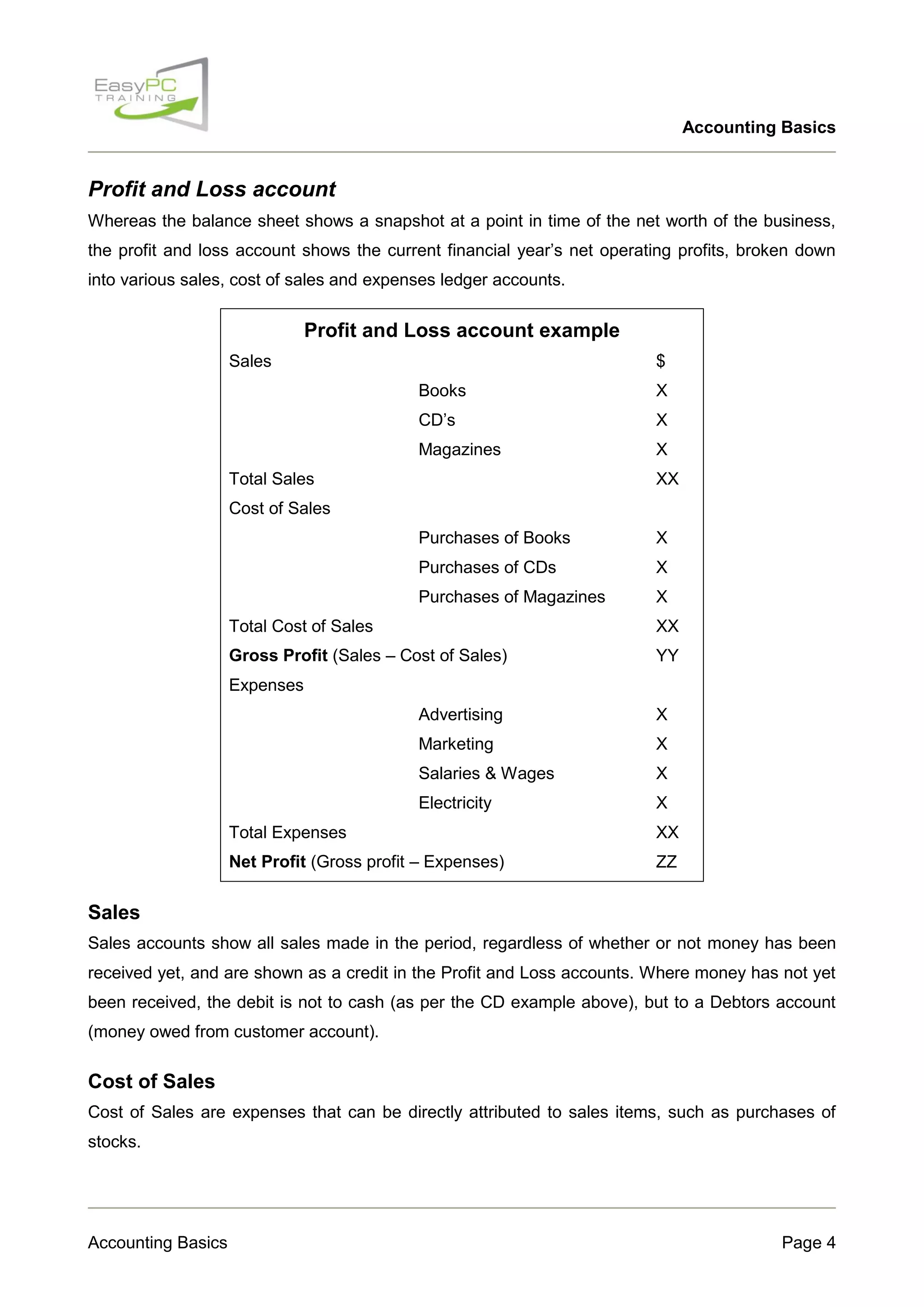

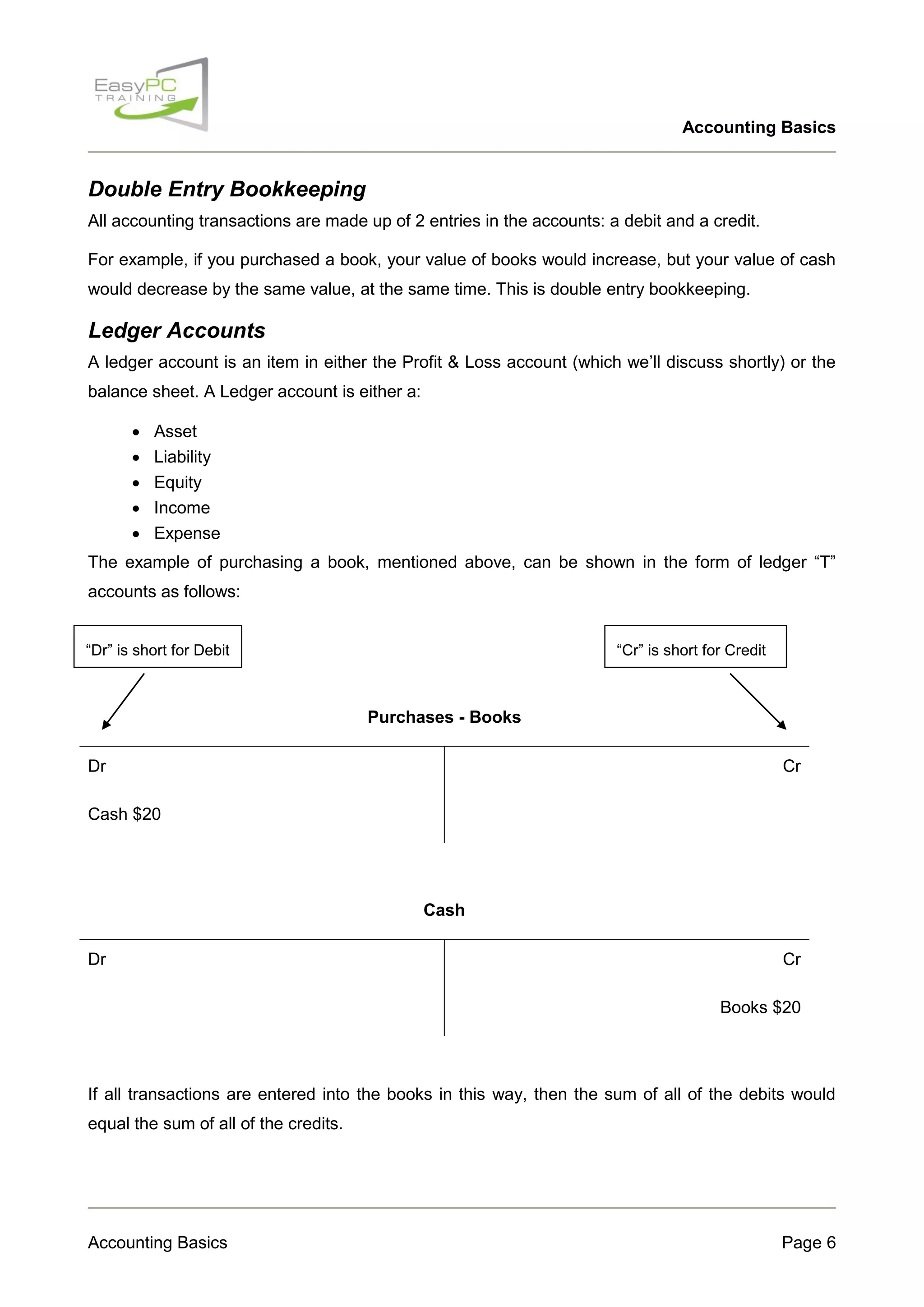

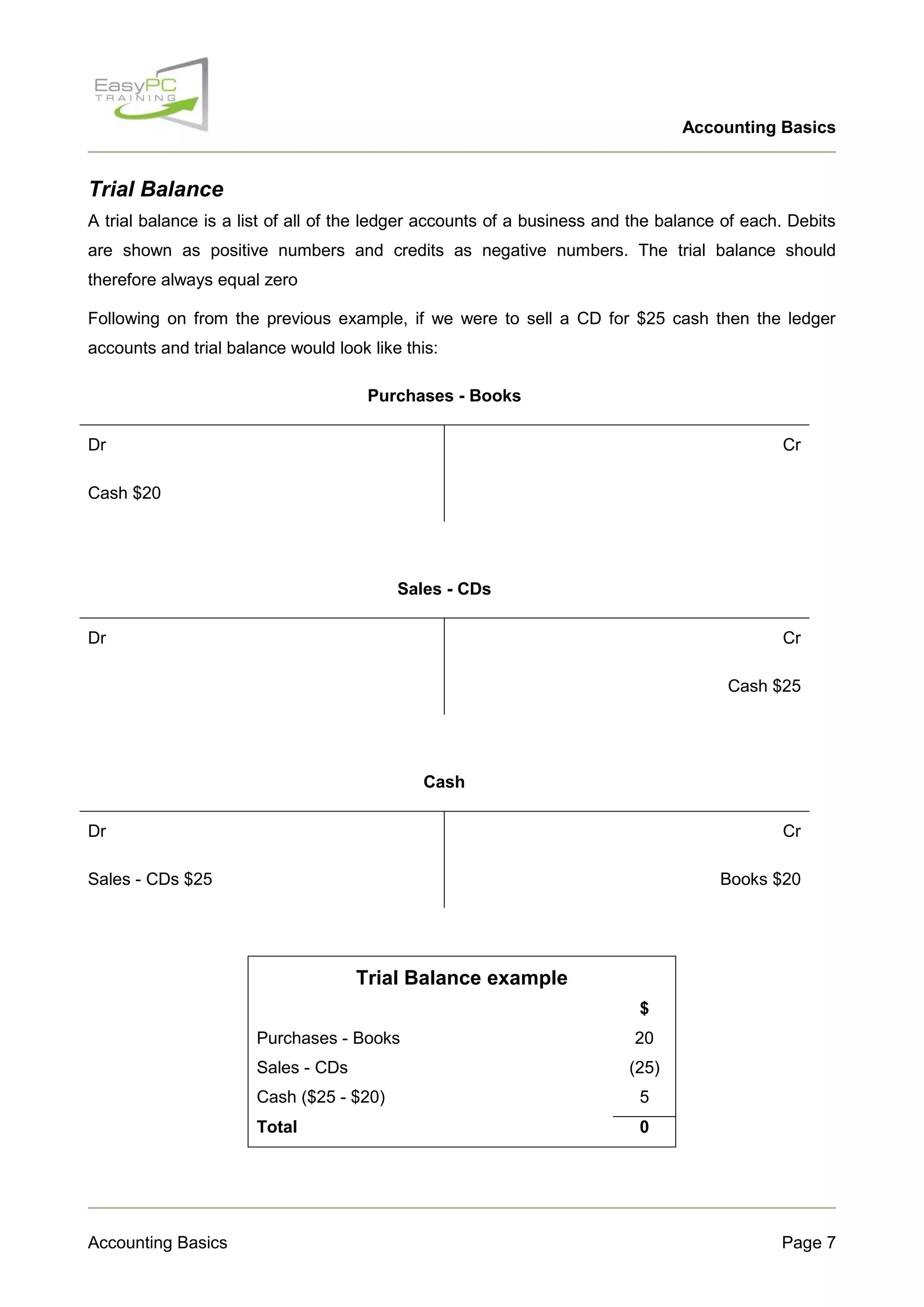

This document provides an overview of basic accounting concepts and principles. It explains the accounting equation that balances assets, liabilities, and owner's equity. It also describes the key financial statements of a balance sheet and profit and loss statement. The balance sheet presents the financial position at a point in time, while the profit and loss statement shows revenues, expenses and profits over a period. Additionally, it outlines the basics of double entry bookkeeping, ledger accounts, and how a trial balance can verify the accuracy of bookkeeping entries.