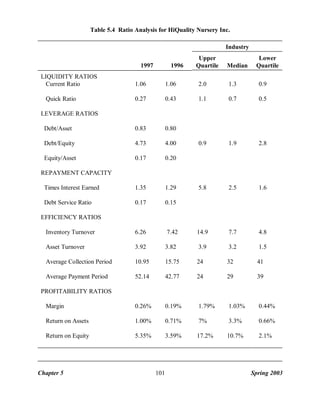

The document discusses various types of financial ratios used to analyze a company's financial statements. It introduces ratio analysis and defines five categories of ratios: liquidity ratios, leverage ratios, repayment capacity ratios, efficiency ratios, and profitability ratios. Specific ratios are then defined within each category. Liquidity ratios like the current ratio and quick ratio measure a company's ability to meet short-term obligations. Leverage ratios like the debt ratio and debt-to-equity ratio indicate the relative proportion of debt and equity used to finance assets. Repayment capacity ratios examine income statement relationships to measure the ability to repay fixed obligations. Efficiency ratios assess how well a company manages its assets, and profitability ratios gauge the ability to generate profits