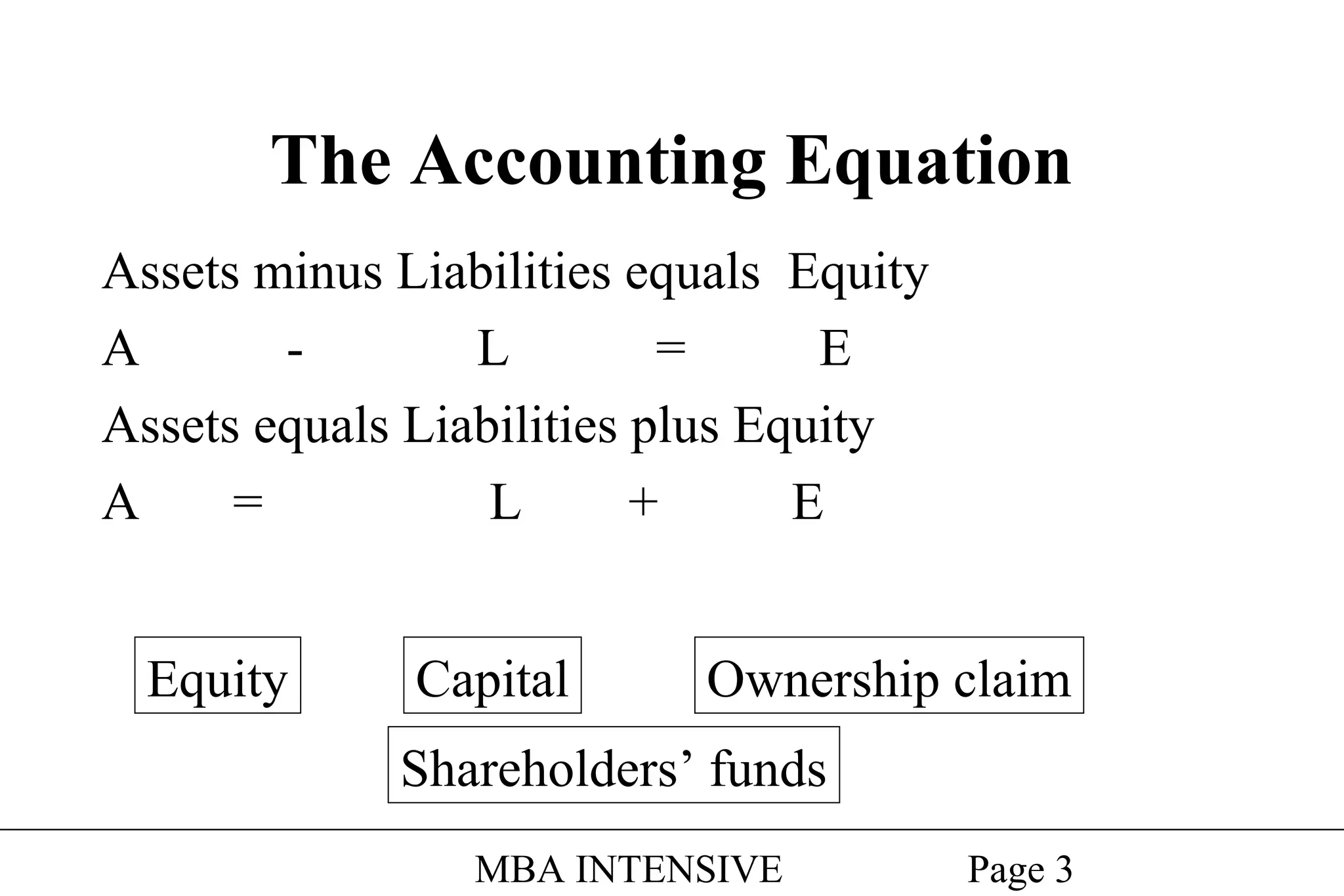

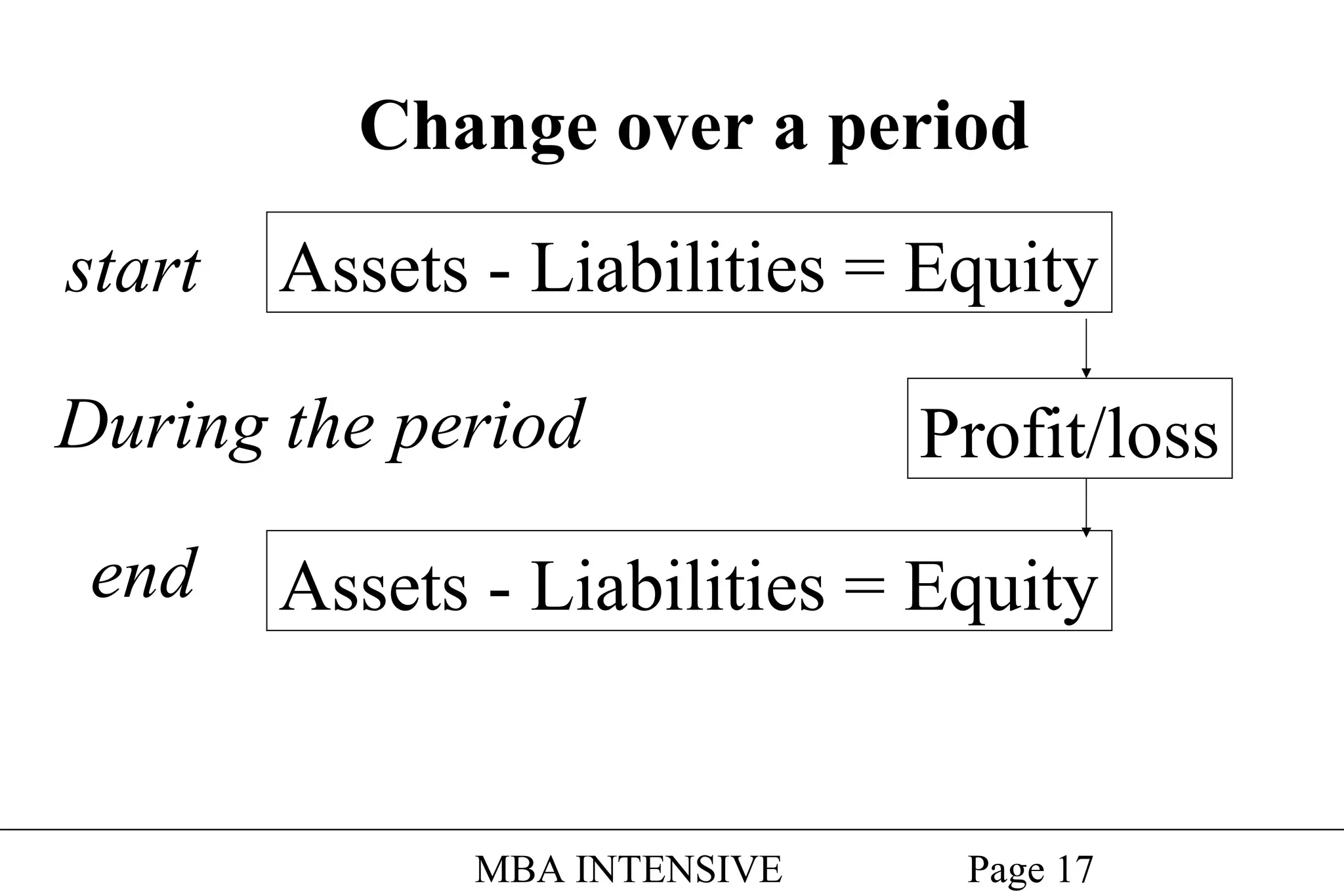

This document provides an overview of accounting and financial statement analysis. It defines accounting and describes the accounting equation and key financial statements. It discusses how accounting provides a representation of a company and can be creative. The roles and uses of accounting are outlined. The document then covers analyzing and interpreting financial statements, including calculating and using ratios to assess a company's profitability, liquidity, asset management, financial structure, and market value. Limitations of ratio analysis are also noted.