This document discusses various types of financial ratios used in financial statement analysis, including:

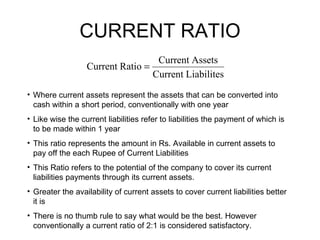

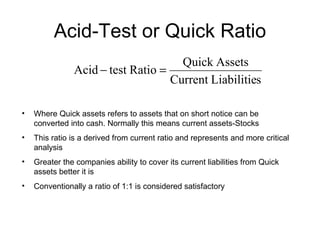

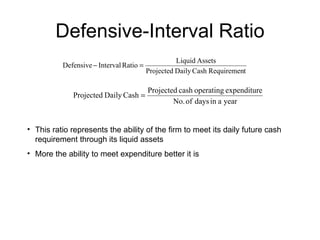

1. Liquidity ratios like the current ratio and acid-test ratio, which measure a company's ability to pay short-term debts with its current assets.

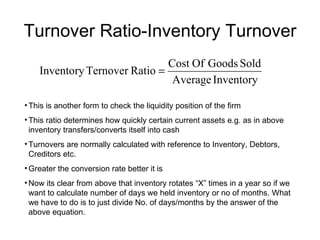

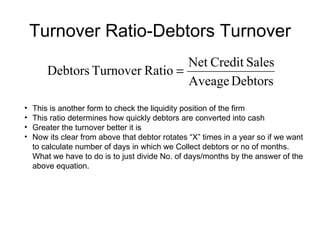

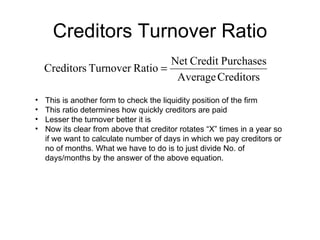

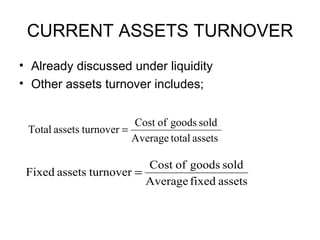

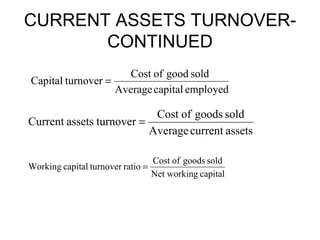

2. Turnover ratios like inventory, debtors, and creditors turnover, which measure how efficiently a company utilizes its current assets.

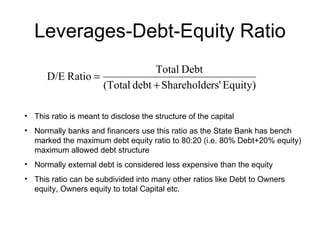

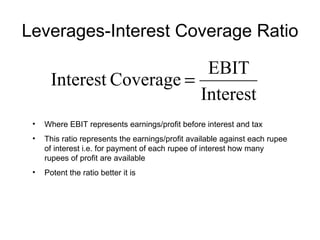

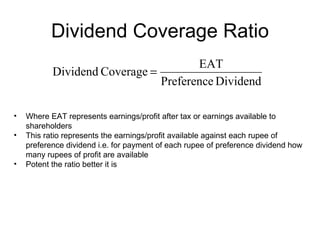

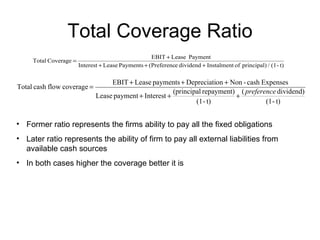

3. Leverage ratios like the debt-to-equity ratio and interest coverage ratio, which indicate the degree of a company's financial leverage.

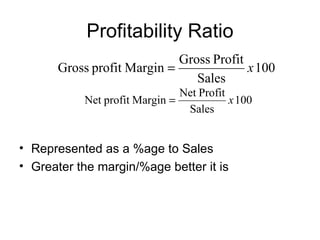

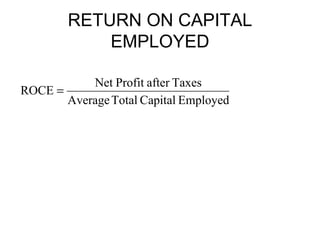

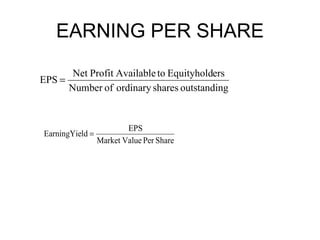

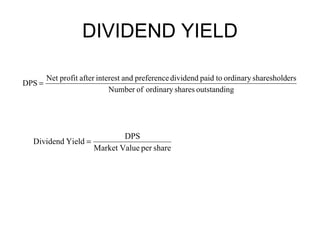

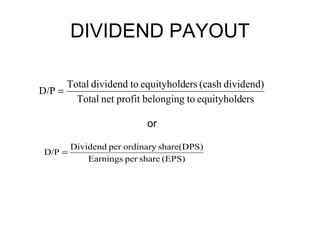

4. Profitability ratios like gross profit margin, which measure a company's ability to generate profits from sales.

5. Activity ratios, which measure how efficiently