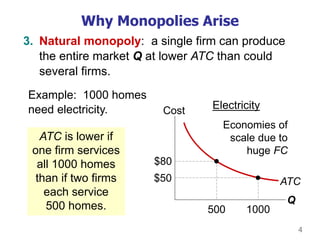

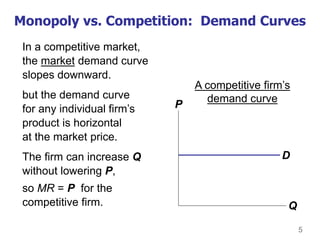

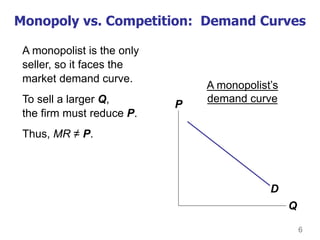

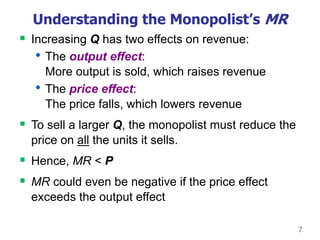

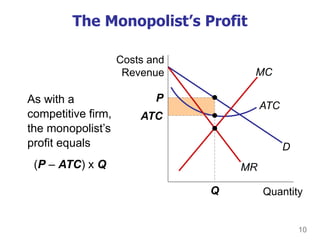

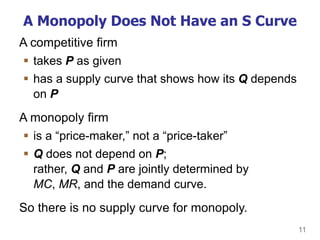

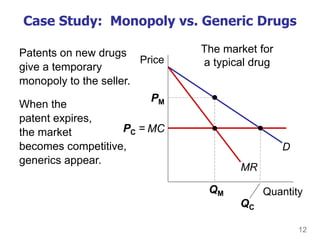

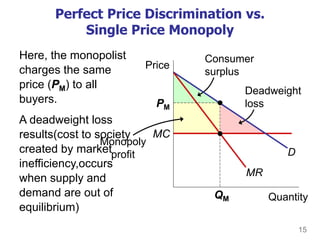

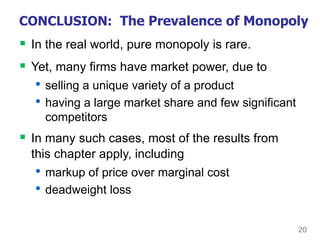

This document discusses monopolies and profit maximization under monopoly. It begins by asking several questions about why monopolies arise, how monopolies choose price and quantity, and what governments can do about monopolies. It then defines a monopoly and explains that monopolies arise due to barriers to entry in the market. A monopoly faces a downward-sloping demand curve and sets price and quantity by producing where marginal revenue equals marginal cost. This results in the monopoly price being above marginal cost and a deadweight loss to society.