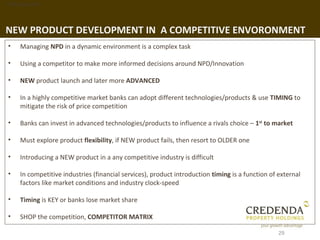

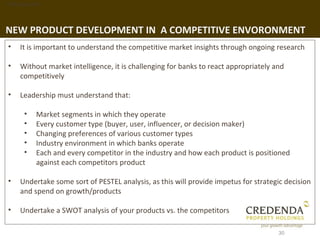

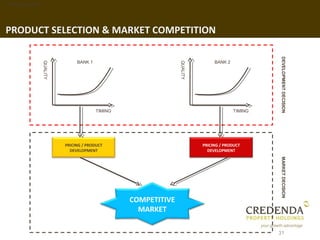

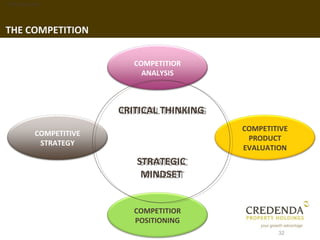

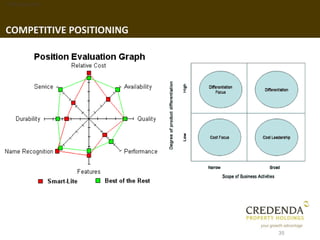

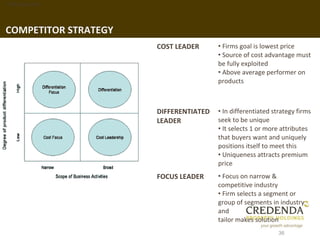

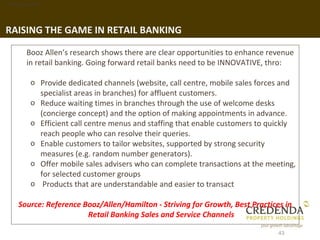

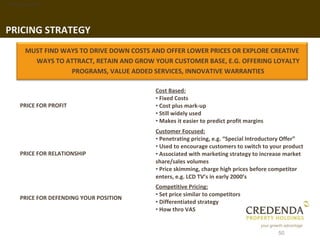

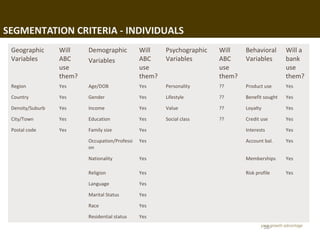

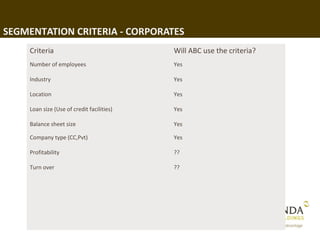

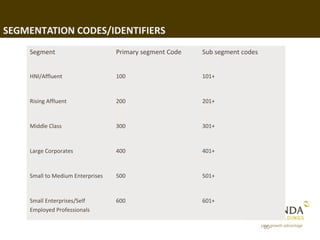

This document discusses strategies for conducting financial, pricing, and risk analysis for new product development in financial institutions. It emphasizes the importance of historical financial data analysis, financial forecasting, understanding product profitability, identifying profitable and unprofitable customers, and using financial analysis to understand competitors. The document also discusses components of sales analysis and some common pitfalls in financial analysis.