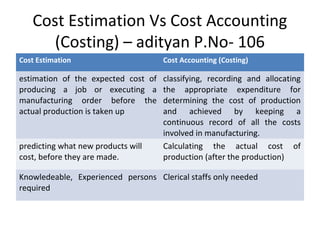

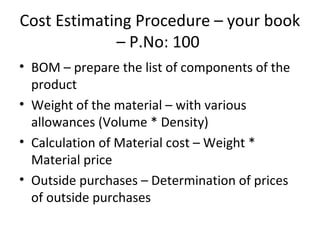

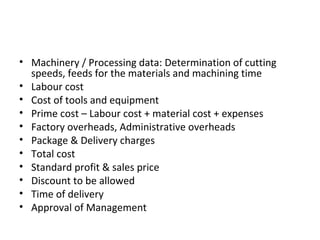

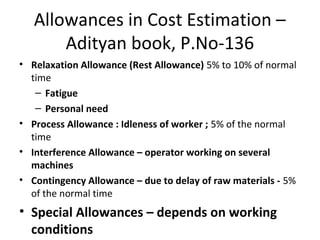

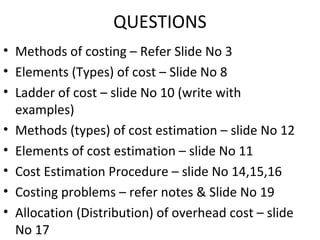

This document discusses various concepts related to cost estimation. It defines cost estimation and cost accounting, and describes different methods of costing like job costing, output costing, operating costing and process costing. It also covers elements of cost like direct, indirect and overhead costs. Methods of cost estimation include guesstimates, budgetary, using past history, and parametric estimating. The cost estimation procedure involves preparing a bill of materials, calculating material, labor and overhead costs. Allowances in cost estimation and allocation of overhead costs are also discussed. Finally, problems related to material, labor and ladder of costs are presented.