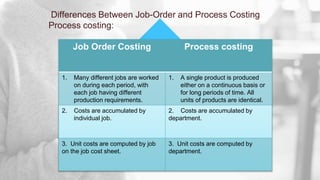

- The group members presented on process costing and differences between job order costing and process costing. Job order costing tracks costs by individual jobs while process costing accumulates costs by department for mass produced identical units.

- Weighted average and FIFO methods were discussed for assigning costs in process costing. Cost reconciliation reports track costs through work in process and finished goods accounts.

- Questions provided examples of process costing data to prepare journal entries and cost reconciliation reports tracking materials, labor, and overhead costs through departments.