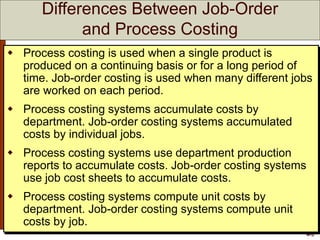

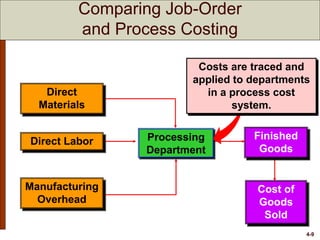

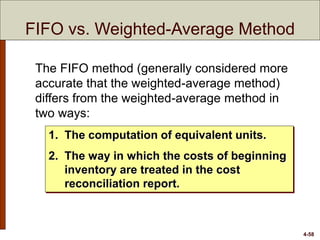

- Process costing is used for products that are similar and produced continuously, while job-order costing is used for unique jobs.

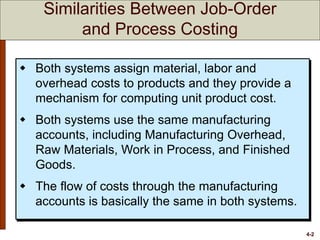

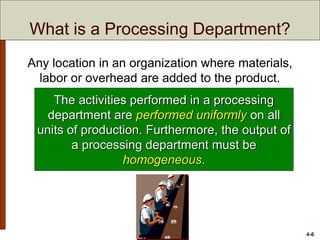

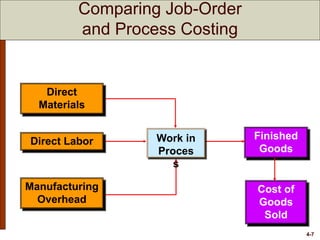

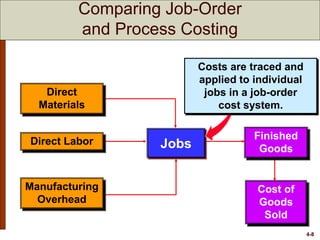

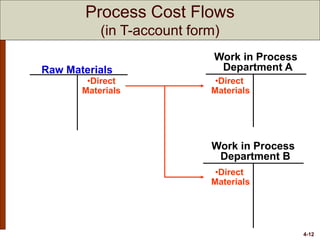

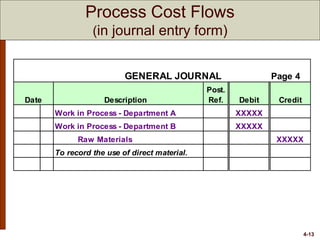

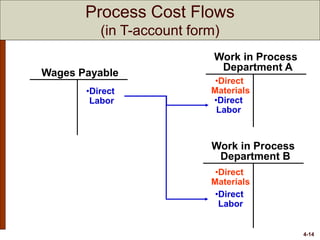

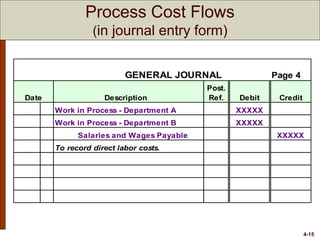

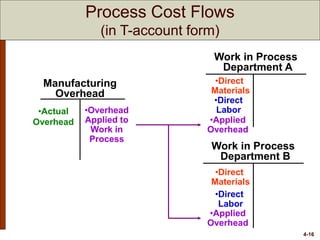

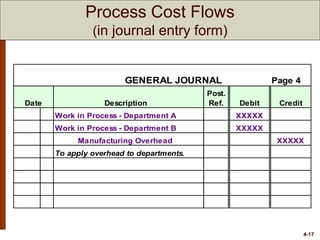

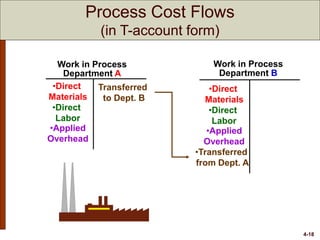

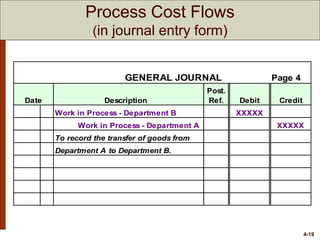

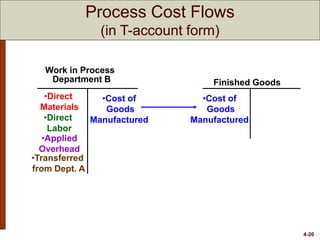

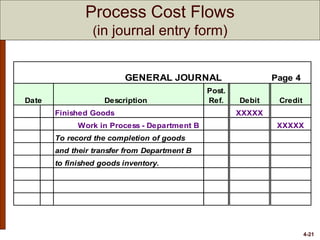

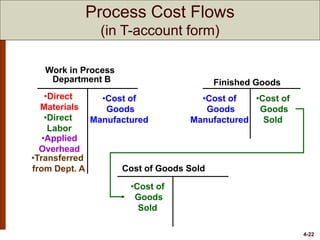

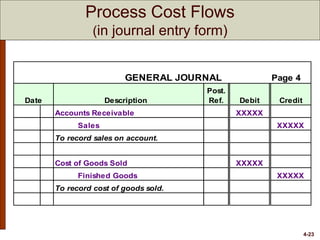

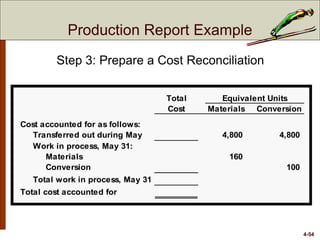

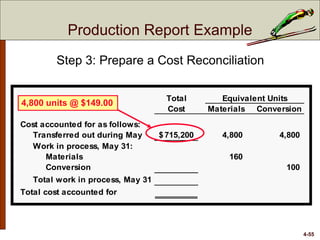

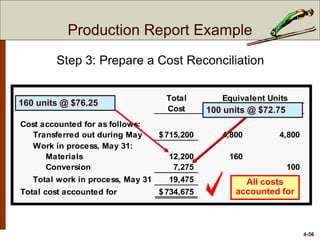

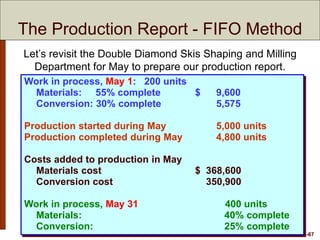

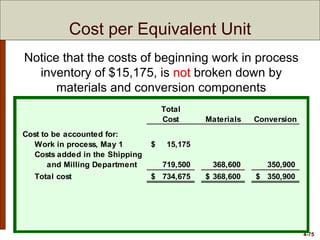

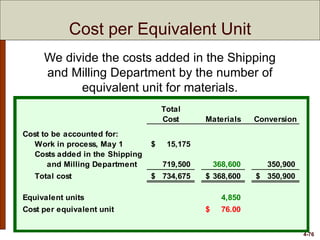

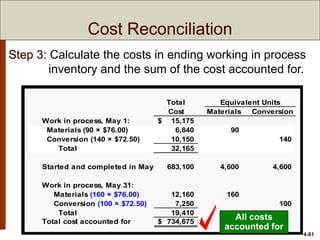

- Process costing accumulates costs by department rather than individual jobs. Costs flow through manufacturing accounts like Work in Process and are ultimately transferred to Finished Goods.

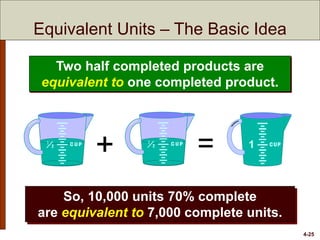

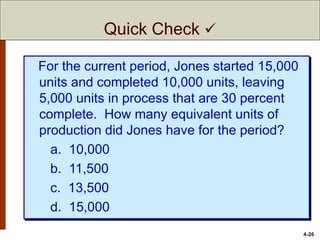

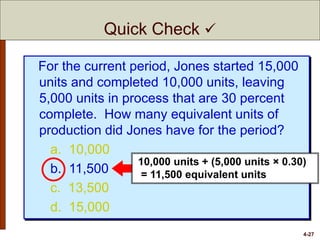

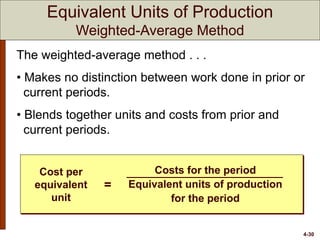

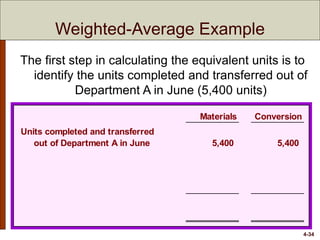

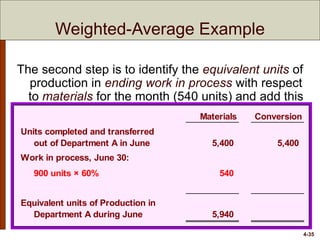

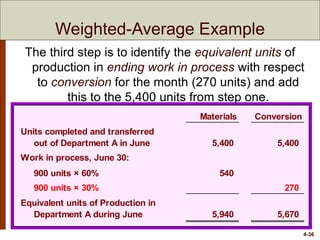

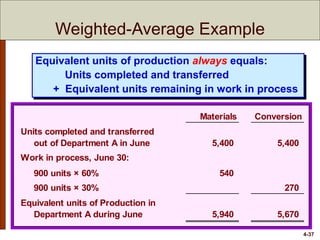

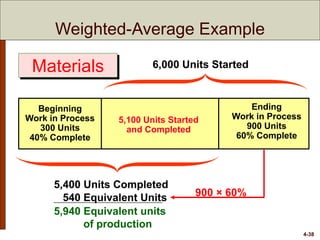

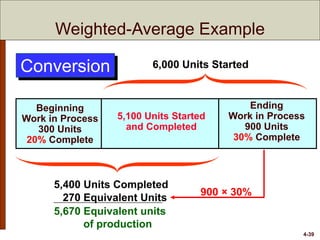

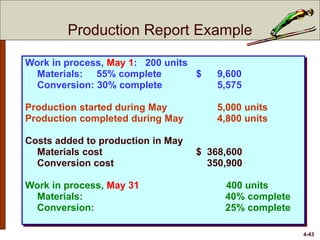

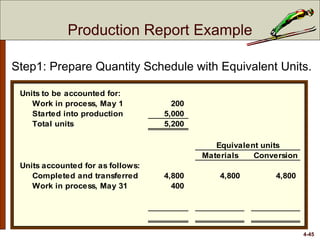

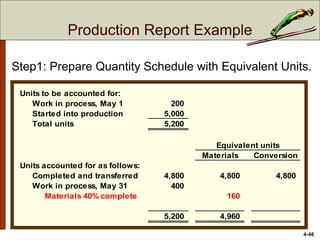

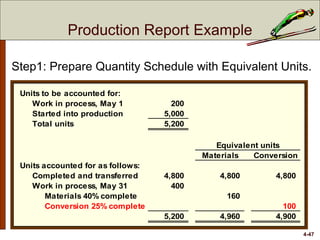

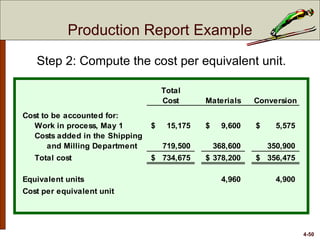

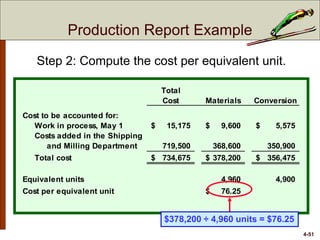

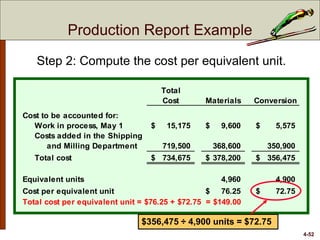

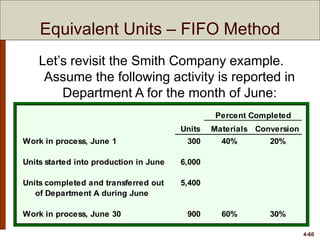

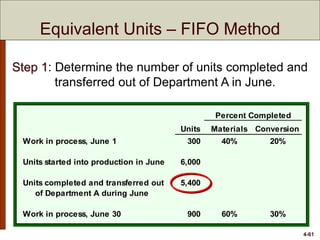

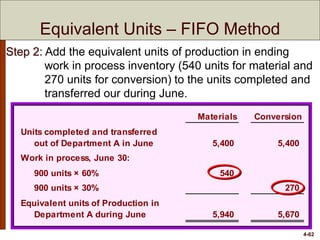

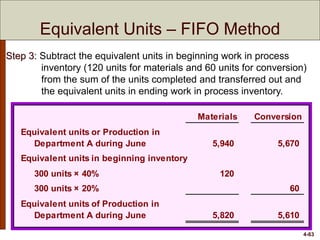

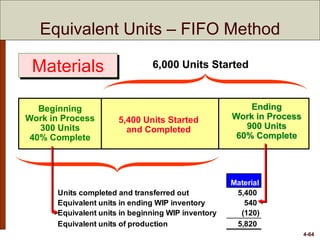

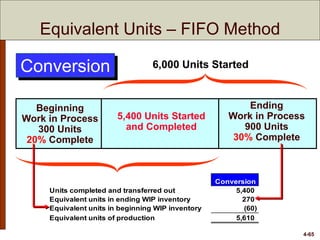

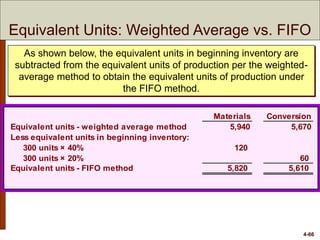

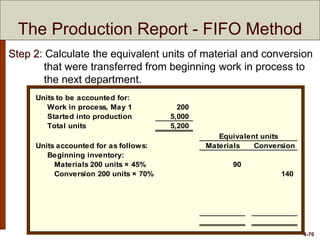

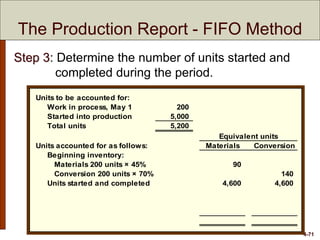

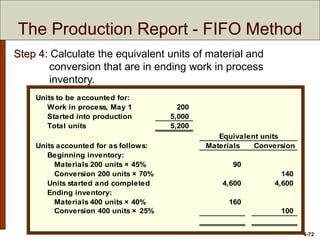

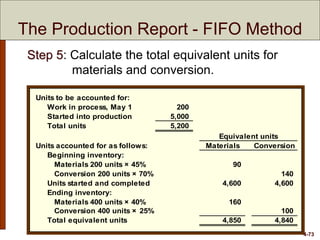

- Equivalent units of production considers partially completed units by calculating a percentage of completion and combining it with fully completed units to determine total production for the period.