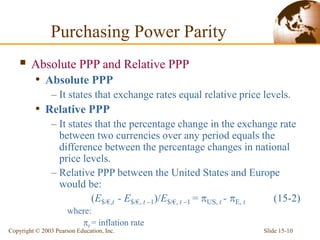

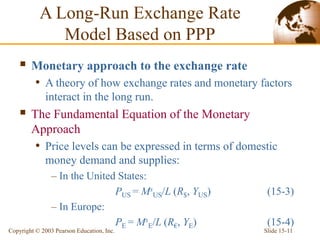

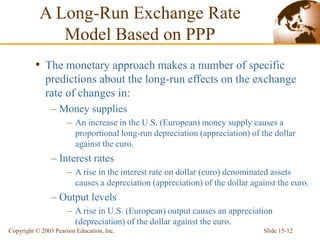

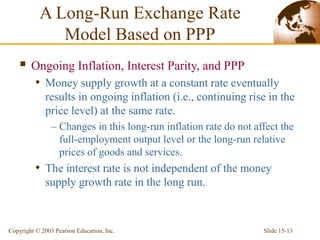

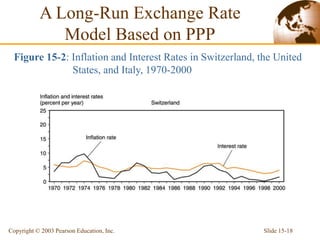

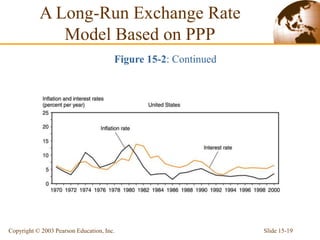

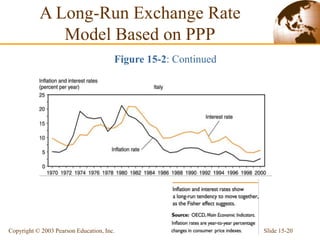

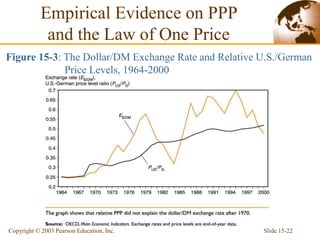

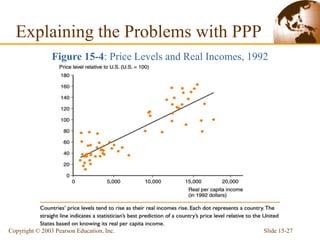

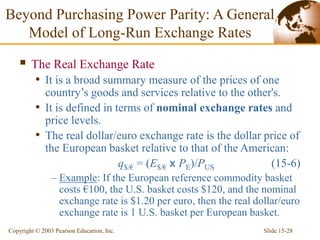

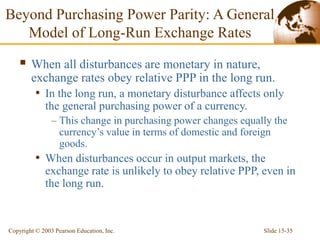

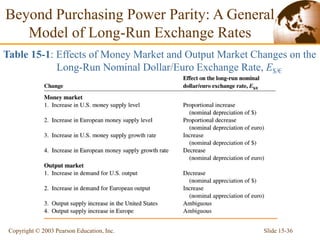

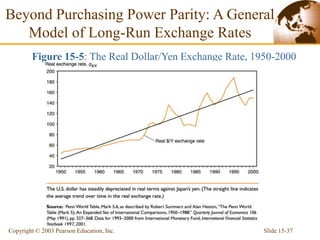

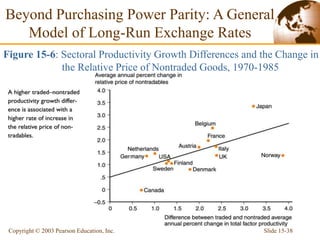

The document summarizes theories of long-run exchange rates, including purchasing power parity (PPP) and factors that determine real exchange rates. PPP holds that exchange rates equal price levels between countries in the long run. Empirical evidence does not strongly support PPP due to trade barriers, pricing differences, and measurement issues. A general model recognizes that real exchange rates are influenced by relative demand and supply shifts between countries. Nominal exchange rates are determined by real exchange rates and relative price levels, which are influenced by monetary factors like money supplies.

![Slide 15-39

Copyright © 2003 Pearson Education, Inc.

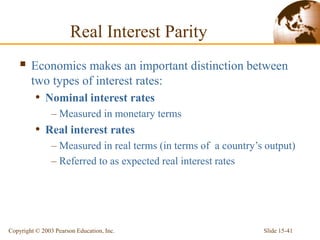

In general, interest rate differences between countries

depend not only on differences in expected inflation,

but also on expected changes in the real exchange

rate.

Relationship between the expected change in the real

exchange rate, the expected change in the nominal

rate, and expected inflation:

(qe

$/€ - q$/€)/q$/€ = [(Ee

$/€ - E$/€)/E$/€] – (e

US - e

E) (15-8)

International Interest Rate Differences

and the Real Exchange Rate](https://image.slidesharecdn.com/krugmanobstfeldch15-230213061856-ffe96ea0/85/Price-Levels-39-320.jpg)

![Slide 15-40

Copyright © 2003 Pearson Education, Inc.

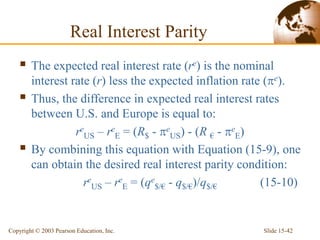

Combining Equation (15-8) with the interest parity

condition, the international interest gap is equal to:

R$ - R€ = [(qe

$/€ - q$/€)/q$/€] + (e

US - e

E) (15-9)

• Thus, the dollar-euro interest difference is the sum of

two components:

– The expected rate of real dollar depreciation against the

euro

– The expected inflation difference between the U.S. and

Europe

• When the market expects relative PPP to prevail, the

dollar-euro interest difference is just the expected

inflation difference between U.S. and Europe.

International Interest Rate Differences

and the Real Exchange Rate](https://image.slidesharecdn.com/krugmanobstfeldch15-230213061856-ffe96ea0/85/Price-Levels-40-320.jpg)