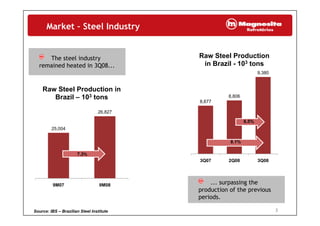

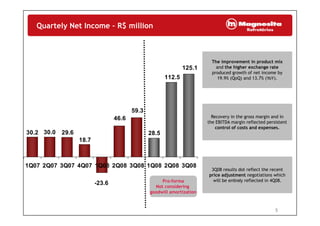

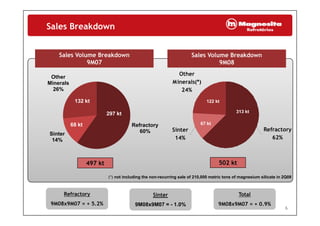

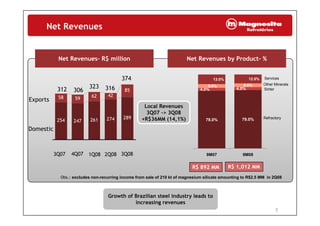

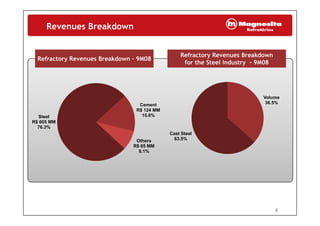

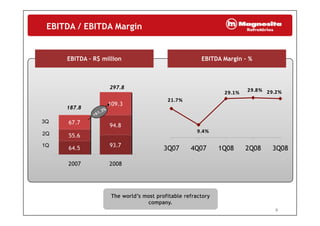

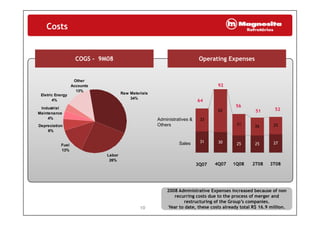

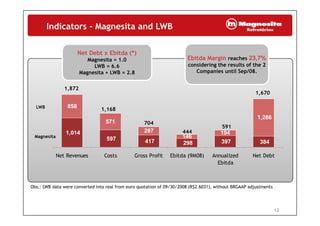

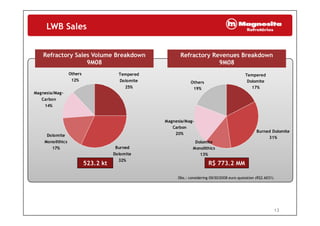

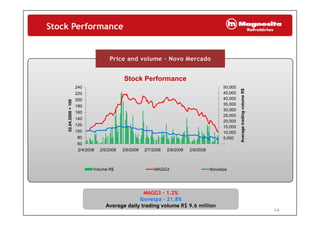

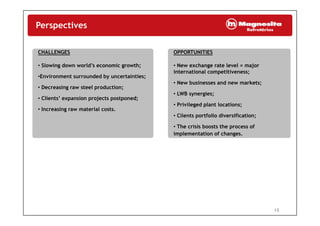

Magnesita completed its acquisition of LWB Refractories, gaining access to new markets in North America, Europe and Asia. Steel production in Brazil remained strong in 3Q08, driving revenues higher. Net income grew 19.9% quarter-over-quarter and 13.7% year-over-year due to improved product mix and exchange rates. Cost controls helped increase EBITDA margins. The company has challenges from slowing global growth and uncertainties, but opportunities from synergies with LWB and portfolio diversification.