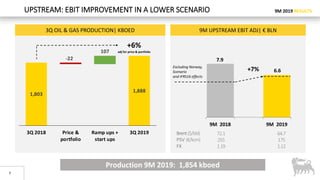

- Production for 9M 2019 was 1.85 million barrels of oil equivalent per day, a 2% increase over 9M 2018. Four new start-ups are planned for production.

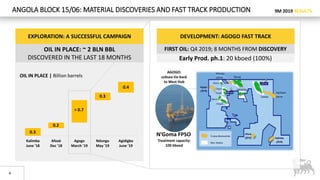

- Exploration discoveries totaled 650 million barrels of oil equivalent in equity resources.

- A deal was announced to acquire ExxonMobil's assets in Norway to form Vår Energi, which will have over 350 thousand barrels of oil equivalent per day of production by 2023.

- Financial results for 9M 2019 include cash flow from operations of €9.4 billion, a 5% increase over 9M 2018, and capex of €5.6 billion.