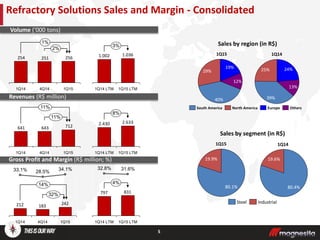

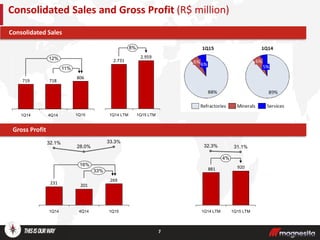

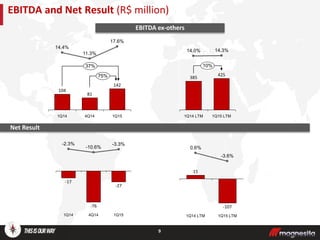

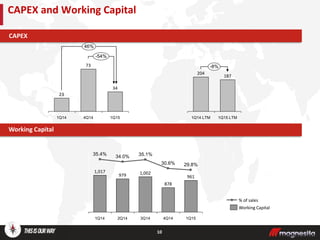

In the first quarter of 2015, Magnesita saw increases in revenue and gross profit compared to the fourth quarter of 2014 and first quarter of 2014. Revenue was up 11% to R$806 million compared to the first quarter of 2014, and gross profit increased 33% to R$269 million in the same period comparison. EBITDA excluding other items was R$142 million, up 37% from the first quarter of 2014. However, net income was negative at R$27 million, though an improvement from a R$76 million loss in the fourth quarter of 2014. Working capital as a percentage of sales declined to 29.8% as of the end of the first quarter of 2015.