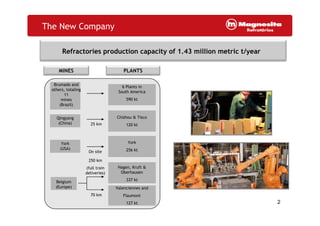

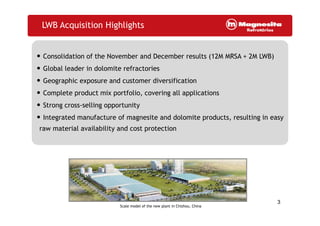

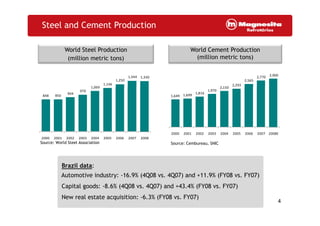

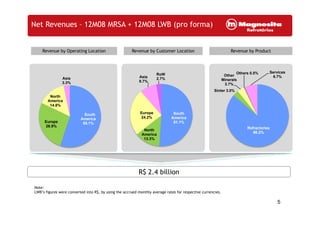

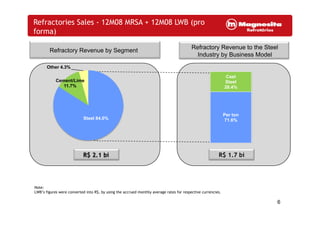

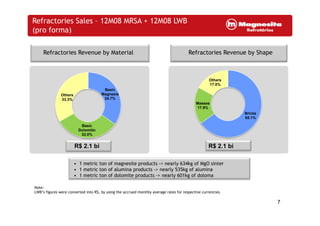

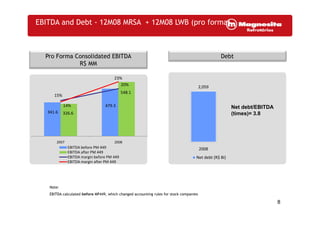

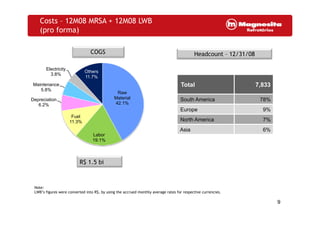

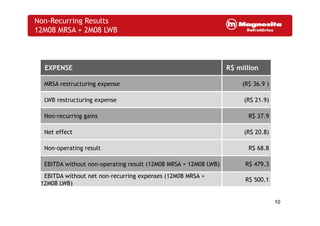

This document summarizes the 4Q08 results of a company that produces refractory materials. It acquired LWB in 2008, becoming a global leader in dolomite refractories with increased geographic exposure and a more complete product portfolio. On a pro forma basis combining the companies, revenues were R$2.4 billion in 2008 with EBITDA of R$479 million. Cost of goods sold was primarily raw materials and labor. The company had over 7,800 employees globally at the end of 2008 following the acquisition. Non-recurring restructuring expenses from the acquisition totaled R$20.8 million for the period.