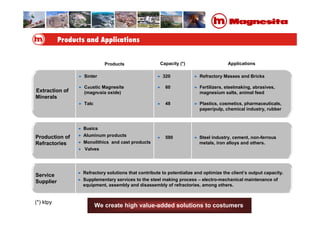

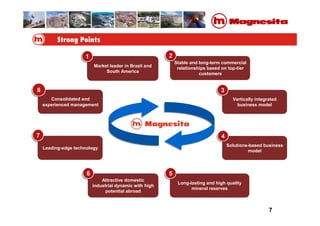

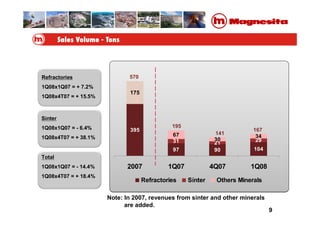

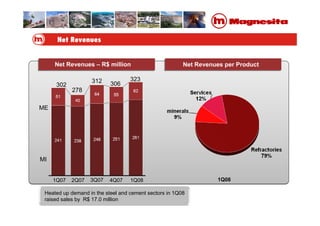

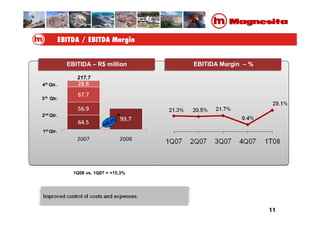

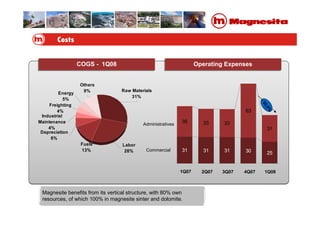

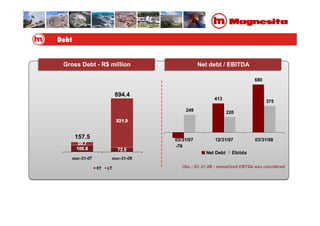

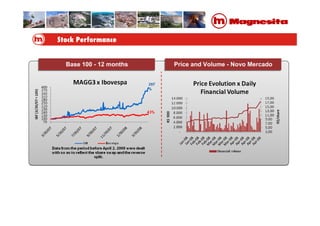

The document discusses Magnesita S.A., a Brazilian refractory company. It outlines the company's history and key events, including being founded in 1939, listing on the stock exchange in 1969, and migrating to Novo Mercado rules in 2008. It also describes the acquisition of control by GP and Gávea, ending family management. The document provides financial information, an overview of products and applications, and highlights Magnesita's leadership position, assets, and growth strategy.