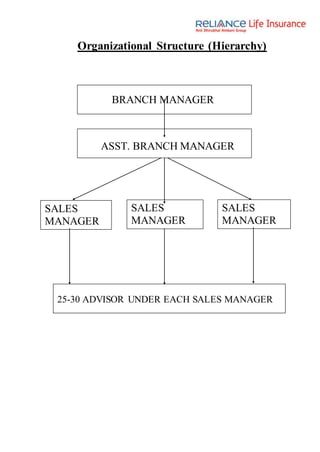

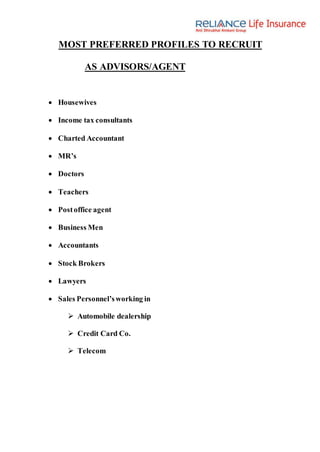

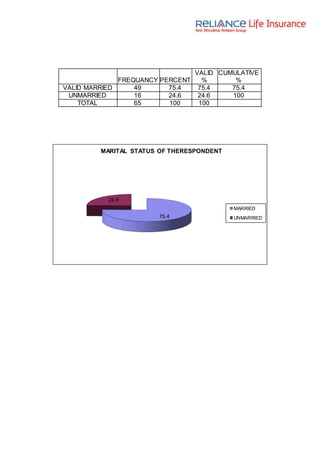

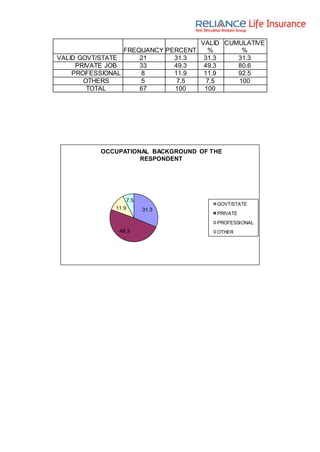

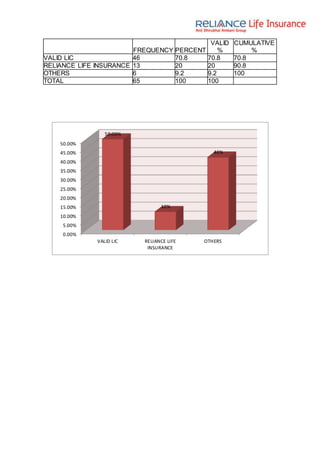

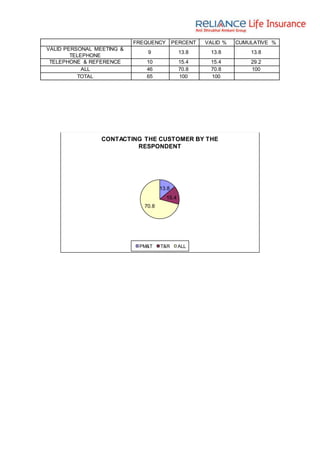

This document is a project report submitted by Ankit Kumar for his Bachelor of Business Administration degree. The report focuses on distribution enhancements for Reliance Life Insurance. It includes an executive summary, introduction to the company, objectives of the project, research methodology used, findings from recruiting new advisors, recommendations, and conclusion. The main points are identifying different customer profiles to recruit as insurance advisors, conducting a market survey on life insurance training programs and top centers, and analyzing competitors of Reliance Life Insurance.