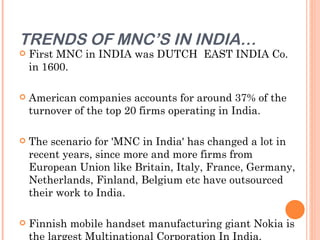

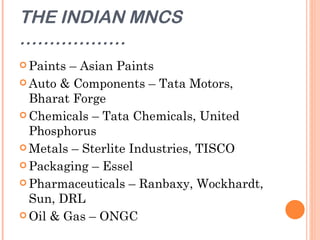

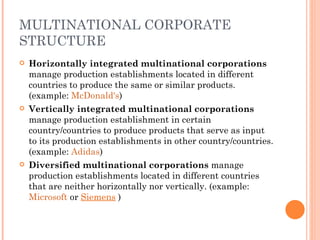

This document provides an overview of international financial management and multinational corporations (MNCs). It discusses how MNCs expand business across borders to access resources. The international financial environment and foreign exchange markets enable trade, investment, and financing between countries. MNCs have objectives like expanding globally and lowering costs. India is an attractive location for MNCs due to its large market, low labor costs, and manufacturing potential. The document outlines the structure, advantages, and constraints of MNCs and their valuation considering international cash flows and exchange rate risk.

![VALUATION MODEL FOR AN

MNC

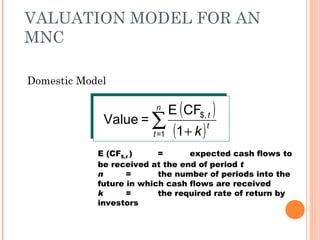

Valuing International Cash Flows

m

n ∑

[E (CFj , t ) ×E (ER j , t )]

Value = ∑ j =1

t =1 (1 + k ) t

E (CFj,t ) = expected cash flows

denominated in currency j to be received by the U.S.

parent at the end of period t

E (ERj,t ) = expected exchange rate at

which currency j can be converted to dollars at the

end of period t](https://image.slidesharecdn.com/presentationonifm-120310061456-phpapp01/85/Presentation-on-mnc-25-320.jpg)

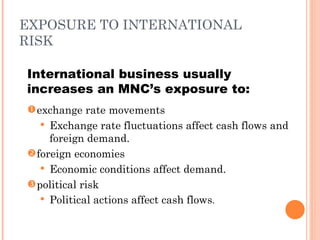

![VALUATION MODEL FOR AN

MNC

Impact of New International Opportunities

on an MNC’s Value

Exposure to

Foreign Exchange Rate

Economies Risk

m

n ∑

[E ( CFj , t ) × E (ER j , t ) ]

j =1

Value = ∑

t =1 (1 + k ) t

Political Risk](https://image.slidesharecdn.com/presentationonifm-120310061456-phpapp01/85/Presentation-on-mnc-27-320.jpg)