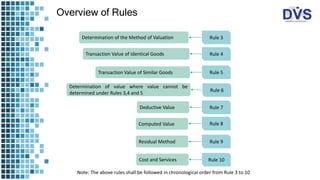

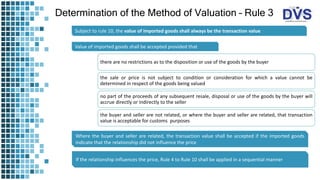

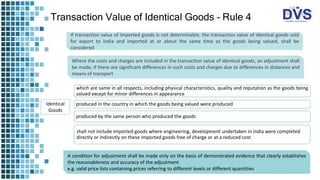

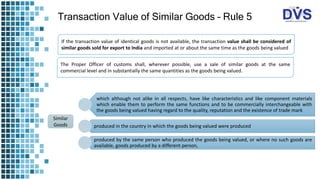

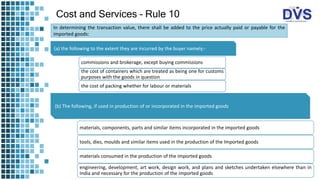

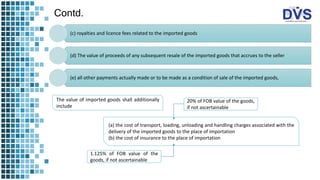

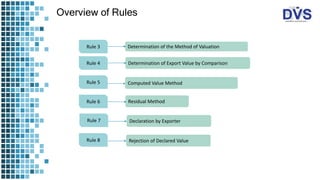

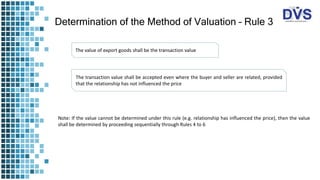

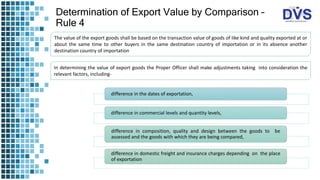

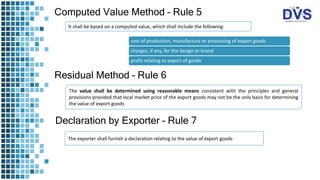

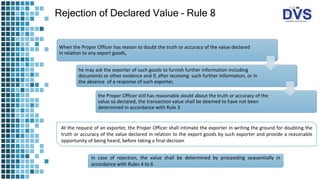

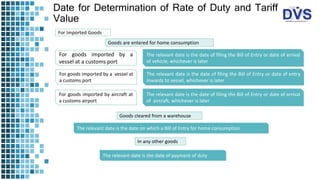

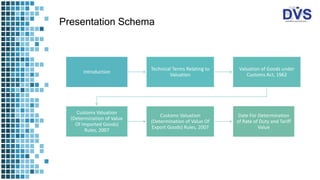

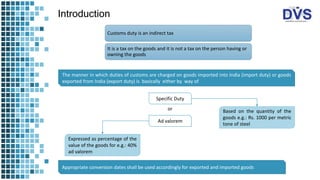

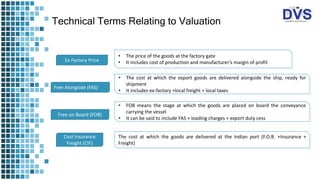

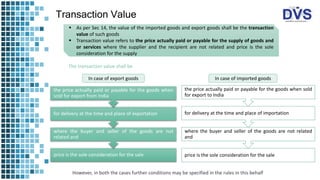

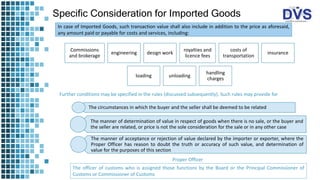

The document provides a comprehensive overview of customs valuation under India's Customs Act, 1962, including the determination of value for imported and exported goods. It details various methods for assessing transaction values, including specific rules and requirements for different scenarios, such as related parties and adjustments for shipping costs. Additionally, it outlines the conditions for accepting or rejecting declared values and establishes relevant dates for duty determination.

![Currency of Conversion Rate

The rate of exchange is notified by three agencies

Central Board of Indirect taxes and

Customs (CBIC)[Board]

Reserve Bank of India

Foreign Exchange Dealers’

Association of India

However for the purpose of customs valuation, rate of exchange

means the rate of exchange

determined by the Board

ascertained in such manner as the

Board may direct

or

The CBIC notifies the rates periodically (generally every fortnight)

There are separate rates for imported goods (selling rate) and export goods (buying rate)

A declaration by an importer of the exact nature, precise quantity and value of goods that have

landed

The legal document filed with the customs department by an exporter for allowing shipment

Bill of Entry

Bill of Export/

Shipping bill](https://image.slidesharecdn.com/valuationsundercustoms15-200217064233/85/Valuations-under-customs-12-320.jpg)