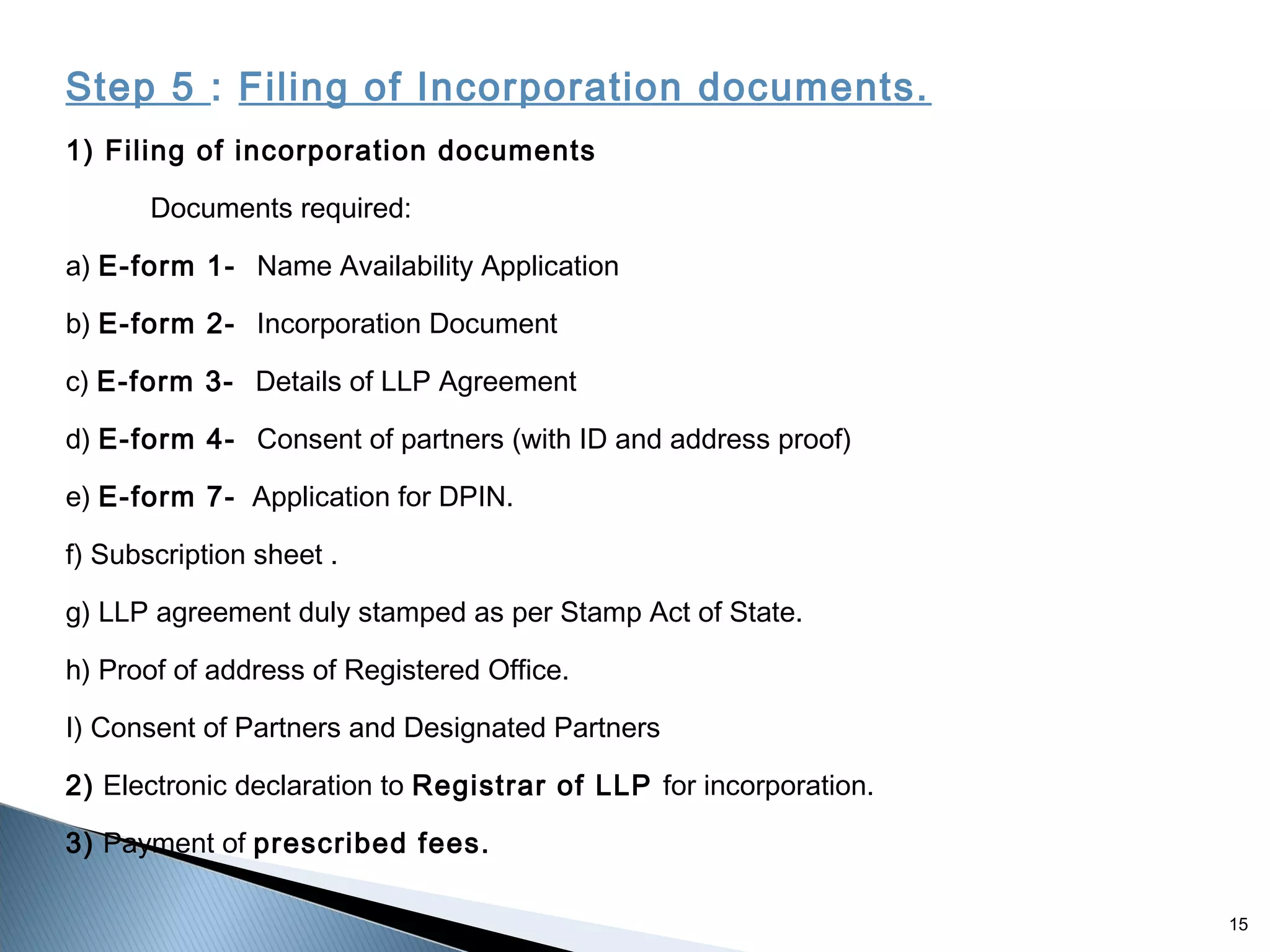

The document discusses the key aspects of a Limited Liability Partnership (LLP) under Indian law. It states that an LLP is a separate legal entity from its partners, with perpetual succession like a corporation. It must have at least 2 partners who can be individuals or bodies corporate. The key steps to form an LLP are: 1) obtaining Designated Partner Identification Numbers and digital signatures for partners, 2) reserving a name, 3) drafting an LLP agreement, and 4) filing incorporation documents online. Upon approval, the Registrar will issue a Certificate of Incorporation to establish the LLP as a separate legal entity.