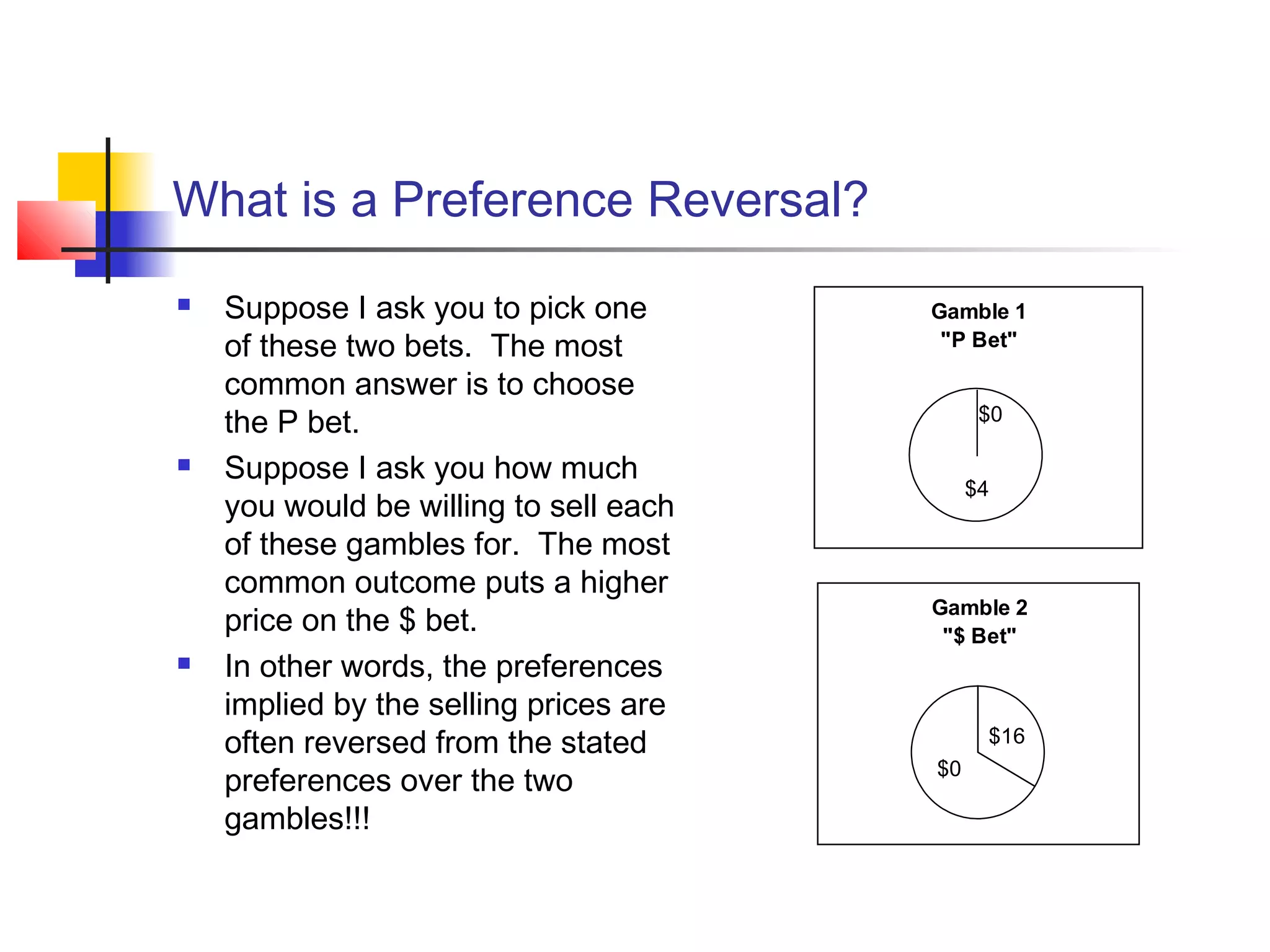

This document summarizes an experiment by Grether and Plott on preference reversals. In the experiment, subjects were asked to choose between two gambles and then state prices for the gambles. For many subjects, their stated preferences from choices and prices were reversed, violating assumptions of economic theory. Grether and Plott found preference reversals occurred even when addressing economists' concerns about incentives and language. This suggests a fundamental flaw in economic theories assuming perfectly rational choice. Later research found preference reversals reduced but not eliminated by higher stakes, awareness of consequences, or market pressures. Failures of transitivity and procedural invariance appear to explain many preference reversals.