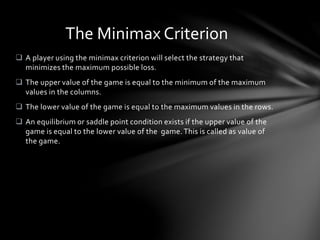

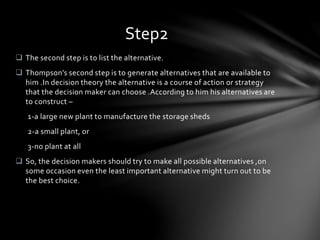

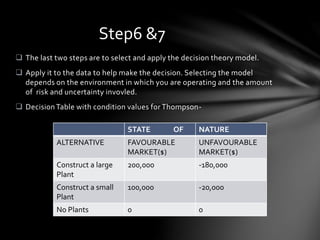

This document provides an overview of decision theory and various decision-making environments. It discusses the six steps in decision theory as applying to a case study about a lumber company expanding its product line. The types of decision-making environments covered are decisions under certainty, risk, and uncertainty. Decision-making under uncertainty further explores criteria for decisions like maximax, maximin, weighted average, equally likely, and minimax regret. Game theory and its applications to strategic decision-making between competitors are also briefly introduced.