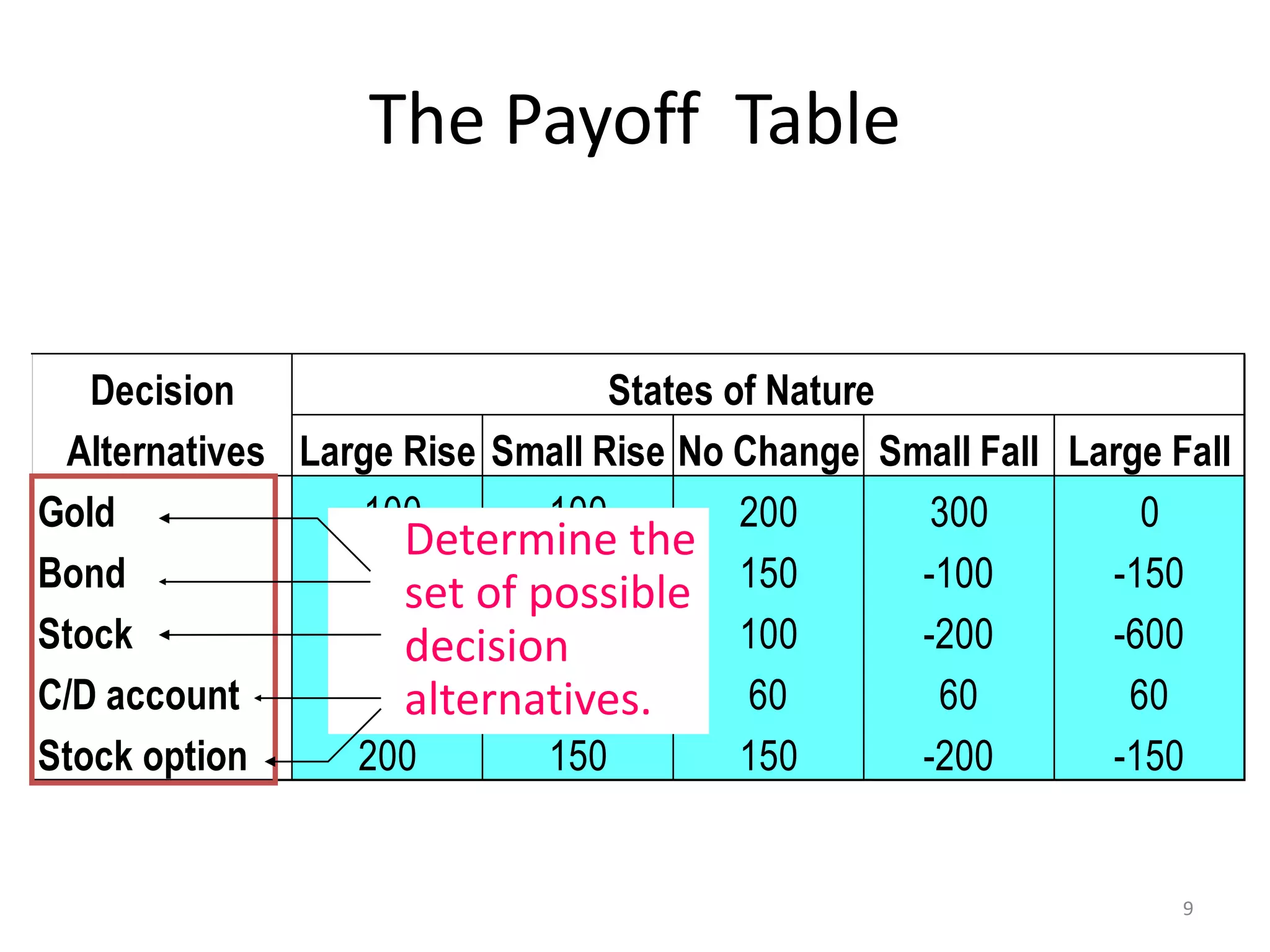

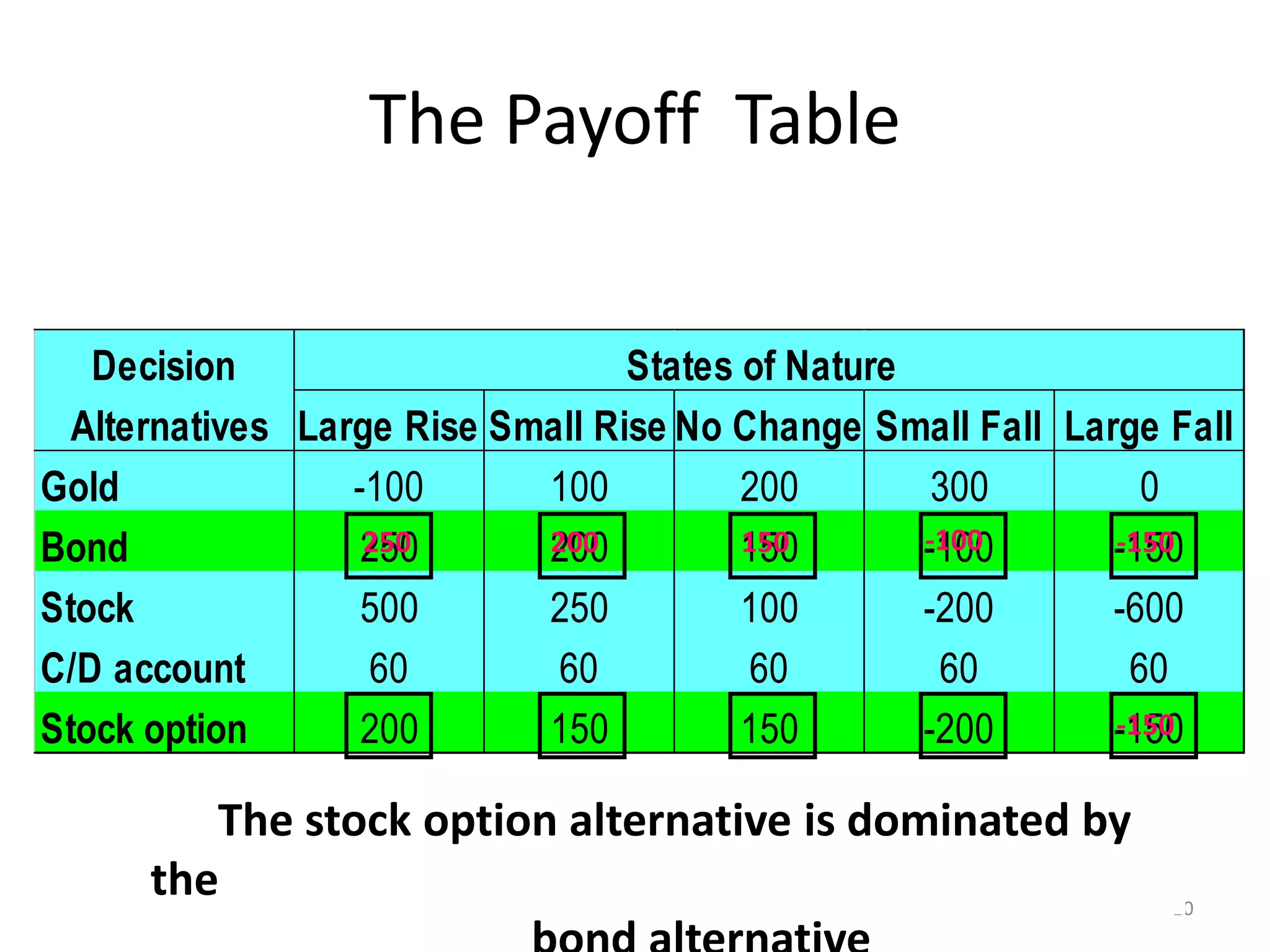

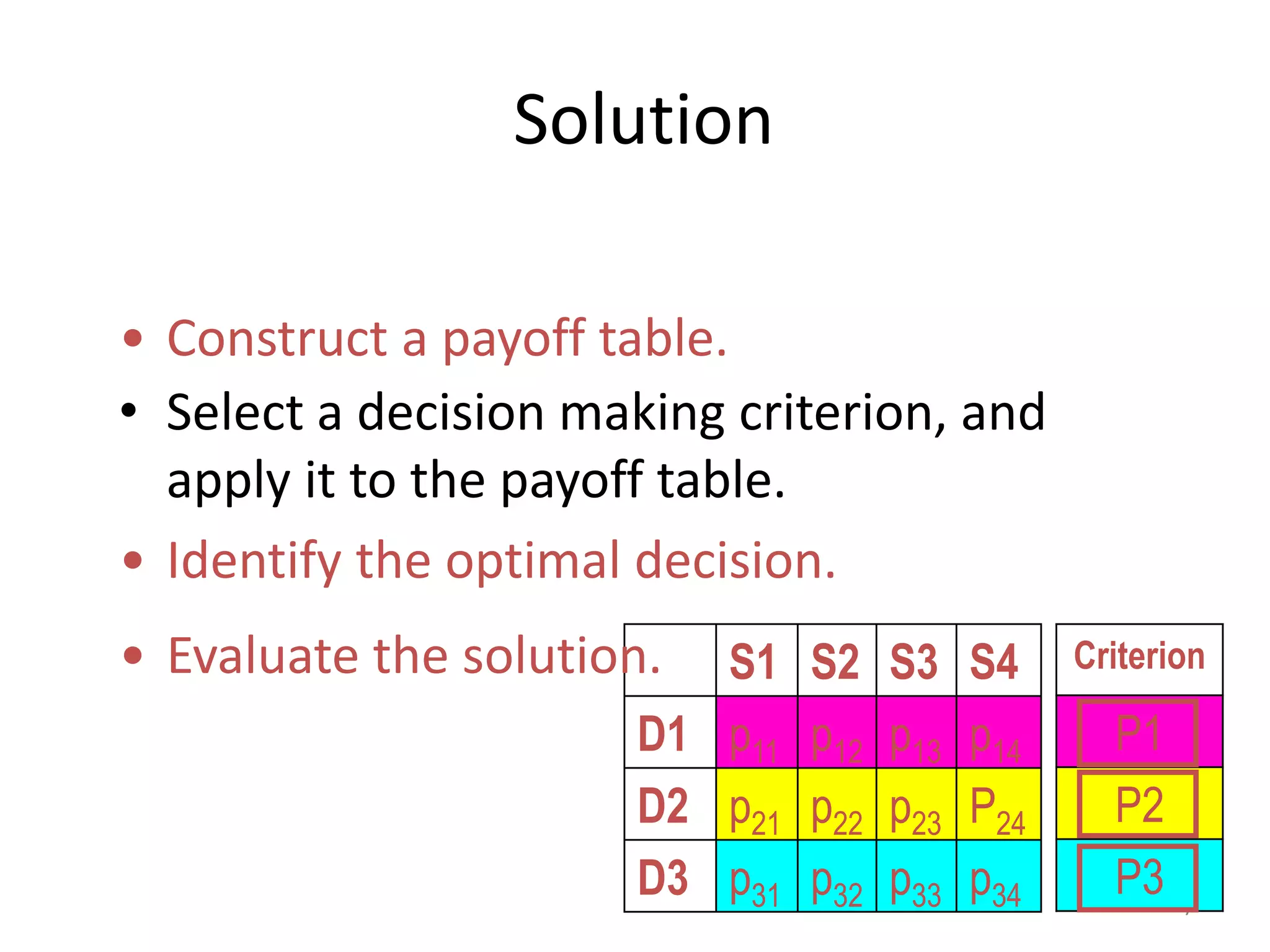

This document provides an introduction to decision analysis and various decision making criteria under conditions of certainty, risk, and uncertainty. It discusses payoff table analysis and describes key decision criteria such as expected value, maximin, maximax, and minimax regret. An example payoff table is presented for an investment decision involving five options with different returns depending on the market's behavior. The optimal decisions are identified using different criteria such as maximin, maximax, and minimax regret. Expected value criterion is also discussed for decision making under risk.

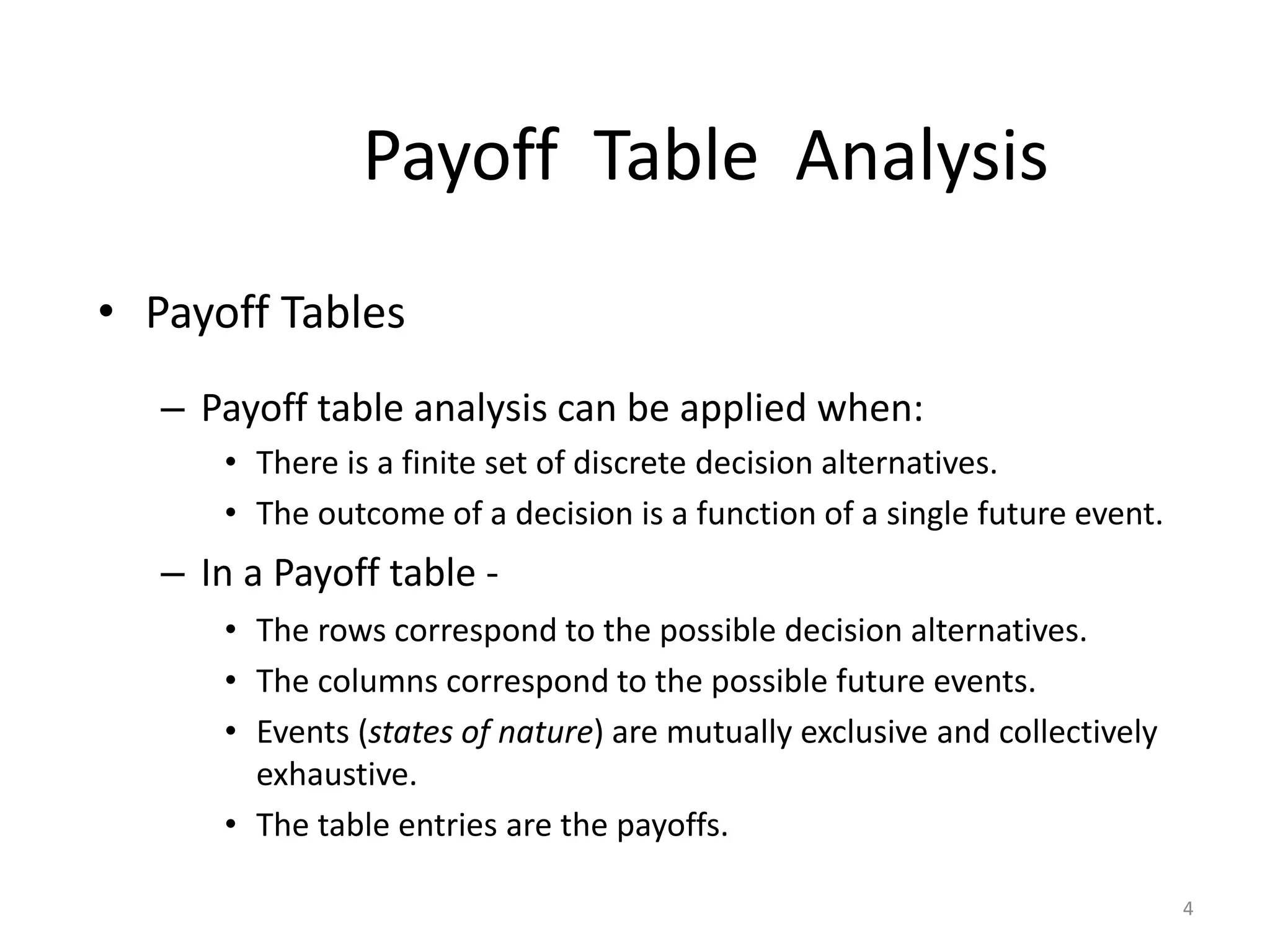

![The Payoff Table

8

The states of nature are mutually exclusive and

collectively exhaustive.

Define the states of nature.

Sensex is down mo

than 800 points

Sensex is down

[-300, -800]

Sensex

moves

within

[-300,+300]

sensex is up

[+300,+1000]

sensex is up more

than1000 points](https://image.slidesharecdn.com/decisionanalysis-190430145413/75/Decision-analysis-1-8-2048.jpg)